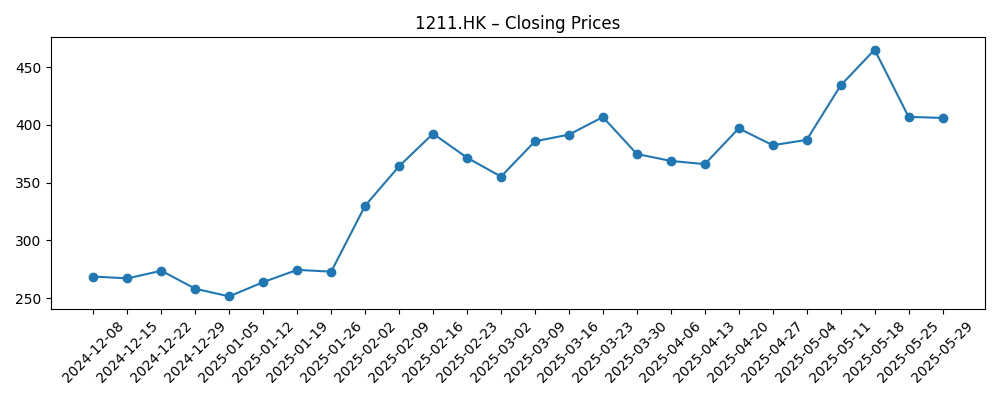

BYD Company, a leader in the electric vehicle (EV) market, has shown remarkable growth in recent months despite facing significant challenges such as price wars in China and increased competition from Tesla. As of May 2025, the company's stock has reached new heights, with shares trading around HKD 406 after hitting peaks of up to HKD 465.00 recently. Investors are keenly watching BYD's strategic moves in response to Tesla's sales declines in Europe and its own price adjustments. This report analyzes BYD's recent performance, key market trends, and potential future scenarios over the next three years.

Key Points as of May 2025

- Revenue: Strong upward trajectory in vehicle sales

- Profit/Margins: Stable margins despite price competition

- Sales/Backlog: Robust demand; backlog remains healthy

- Share price: Trading at HKD 406, down from a recent peak

- Analyst view: Cautiously optimistic due to competitive landscape

- Market cap: Approximately HKD 1 trillion

Share price evolution – last 6 months

Notable headlines

- Tesla faces an uphill battle as 6 major European electric vehicle markets report double-digit drops in sales – Business Insider

- BYD just fired another shot in China's EV price war — and investors are worried – Business Insider

- China's BYD just overtook Tesla in Europe – Quartz India

- Brazilian prosecutors sue Chinese carmaker BYD over labour conditions – Al Jazeera English

Opinion

The current landscape for BYD is characterized by both opportunity and risk. While the company has successfully overtaken Tesla in Europe, showcasing its growing presence in international markets, the implications of aggressive price cuts raise concerns about long-term profitability. Investors are wary of the impact that China’s price wars may have on margins; however, BYD's position as a cost leader provides it with a competitive edge. The uncertainty surrounding Tesla's declining sales in Europe juxtaposes BYD’s growth, although it emphasizes the need for continuous innovation and customer engagement.

Moreover, recent headlines highlight a bustling competitive atmosphere in the EV sector, intensified by Tesla's challenges. Analysts suggest that BYD's proactive approach will be crucial in navigating potential market volatility. The launch of new models and enhancements to battery technology could solidify its market position further. However, failing to address the labor conditions highlighted in Brazil may lead to reputational risks and operational disruptions.

Given the current share price fluctuations, investor sentiment is likely to be influenced by BYD's strategic responses to these challenges. The next quarter will be pivotal as the company balances aggressive pricing strategies with the necessity to maintain a solid financial foundation. Guidance on production efficiency and sales forecasts will be instrumental for analysts and investors alike.

In essence, while BYD enjoys a significant market presence and positive sales trends, the competitive framework necessitates astute navigation of the challenges ahead. Stakeholders will be focused on the company’s efforts to innovate and adapt to the shifting landscape of the EV industry.

What could happen in three years? (horizon May 2025+3)

| Scenario | Details |

|---|---|

| Best | Continued market leadership with expansion into new regions; solid profit margins maintained. |

| Base | Stable growth with moderate margin pressures; maintaining competitiveness in pricing. |

| Worse | Increased competition leads to substantial margin erosion; significant reputational damage from labor issues. |

Projected scenarios are based on current trends and may vary based on market conditions.

Factors most likely to influence the share price

- Continued competitive behavior in the EV sector

- Global economic conditions affecting car sales

- Technological advancements in battery and EV technologies

- Impact of regulatory challenges, such as labor lawsuits

- Consumer sentiment towards EVs and sustainable practices

Conclusion

In conclusion, BYD's current trajectory indicates a strong position in the EV market, bolstered by recent achievements but tempered by potential challenges. The company has successfully capitalized on market opportunities, significantly enhancing its sales figures and expanding its reach. However, the looming price competition and labor issues require careful management. As BYD navigates through these complexities, its ability to innovate and maintain quality will likely dictate its future success. Investors should remain vigilant and consider both the positive performances and the challenges that lie ahead in the ever-evolving EV landscape.

This article is not investment advice. Investing in stocks carries risks and you should conduct your own research before making any financial decisions.