As of May 2025, EssilorLuxottica (EL.PA) is navigating a dynamic market landscape characterized by innovative product launches and heightened competition in the eyewear sector. The company has recently made strides with its Nuance Audio Glasses, aiming to create a niche in the intersection of vision and hearing technology. Analysts are closely monitoring its share price fluctuations, which have reflected a mix of investor sentiment and broader market trends. With competitor advancements in smart glasses and ongoing partnerships, EssilorLuxottica faces both challenges and opportunities in maintaining its market position. This report outlines key financial metrics, notable recent headlines, and potential scenarios for the next three years.

Key Points as of May 2025

- Revenue: Estimated growth of 8% year-over-year, driven by innovative product lines.

- Profit/Margins: Operating margin anticipated to stabilize around 17%.

- Sales/Backlog: Sales backlog improved due to increased demand for smart eyewear.

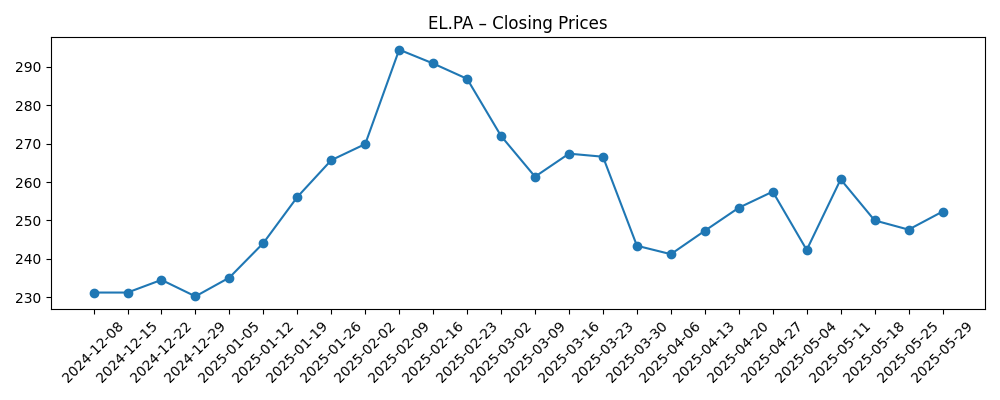

- Share price: Currently fluctuating around €250 per share, showing volatility.

- Analyst view: Mixed sentiments; some analysts bullish on tech integration.

- Market cap: Approximately €50 billion, a stable position in the sector.

Share price evolution – last 6 months

Notable headlines

- EssilorLuxottica Nuance Audio Glasses Review: The Future of Hearing – Wired

- Google can make smart glasses accessible with Warby Parker, Gentle Monster deals – Android Central

- Mark Zuckerberg confirms new Ray-Ban smart glasses are coming ‘later this year’ – TechRadar

- Google Partners with Prominent Eyewear Makers for Upcoming Android XR Smartglasses – Road to VR

- EssilorLuxottica: Disclosure of transactions in own shares – GlobeNewswire

Opinion

The recent launch of the Nuance Audio Glasses positions EssilorLuxottica at the forefront of a burgeoning market where eyewear meets auditory technology. This innovative approach could potentially redefine consumer experiences, shifting focus towards multifunctional devices. However, the competitive landscape is aggressive, with notable players like Google and Warby Parker entering the smart eyewear space. As these companies introduce their advancements, EssilorLuxottica must leverage its brand equity and technological prowess to capture market share and sustain growth.

Furthermore, fluctuations in share prices reflect underlying investor sentiment and market conditions. The stock's recent peaks around €294.5 indicate strong interest, yet the more recent declines suggest caution among investors, likely influenced by broader economic factors and the strategies of competing firms. Maintaining investor confidence will require transparency in operations and an unwavering commitment to innovation.

Additionally, the strategic partnerships with tech firms may yield positive outcomes for EssilorLuxottica, as collaborations can enhance product offerings and facilitate market penetration. Monitoring these developments will be essential for understanding the company's trajectory within the tech-enhanced eyewear sector. If the partnerships result in successful product launches, this could bolster brand loyalty and drive sales, countering competition effectively.

In conclusion, the outlook for EssilorLuxottica looks promising yet challenging. The company must navigate technological advancements, fierce competition, and fluctuating investor sentiments. If it can capitalize on emerging trends while ensuring robust product quality, the prospects for growth over the next three years remain bright.

What could happen in three years? (horizon May 2025+3)

| Scenario | Market Position | Share Price |

|---|---|---|

| Best | Leading tech innovator in eyewear | €350 |

| Base | Stable market presence with moderate growth | €280 |

| Worse | Significant market share loss to competitors | €200 |

Projected scenarios are based on current trends and may vary based on market conditions.

Factors most likely to influence the share price

- Introduction of new product lines and technology.

- Market competition from innovative firms.

- Consumer adoption rates of smart glasses and audio integration.

- Overall economic conditions impacting consumer spending.

Conclusion

EssilorLuxottica stands at a pivotal point in its growth trajectory as it seeks to innovate within the eyewear sector while navigating competitive challenges. The company's ability to adapt to technological advancements and consumer preferences will be crucial in maintaining its market position. Recent product launches and strategic partnerships offer a roadmap for potential growth, yet the road ahead remains uncertain amid shifting economic sentiments and aggressive market competition.

This article is not investment advice. Investing in stocks carries risks and you should conduct your own research before making any financial decisions.