As of June 2025, TSMC (2330.TW) continues to grapple with significant price fluctuations and evolving market dynamics. The semiconductor giant is under pressure from rising AI demand amid geopolitical concerns, particularly regarding tariffs. Recent headlines reveal TSMC's response to rumors about expanding its fabrication capabilities in the UAE, highlighting the company's focus on maintaining stability and growth despite external challenges. This note explores TSMC's recent performance, key metrics, and the potential scenarios for the next three years, factoring in market trends and corporate strategies.

Key Points as of June 2025

- Revenue: Steady growth due to AI demand

- Profit/Margins: Margins under pressure from tariffs

- Sales/Backlog: Strong AI-related backlog

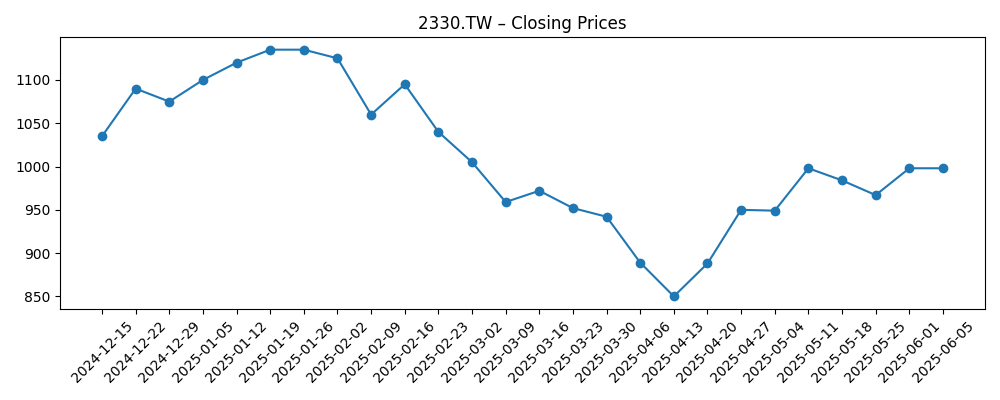

- Share price: Currently at 998.0

- Analyst view: Mixed outlook amid volatility

- Market cap: Significant but fluctuating

Share price evolution – last 6 months

Notable headlines

- TSMC quashes UAE fab rumors, but says AI demand remains fierce in the face of tariff pressures – Tom's Hardware UK

- Sam Altman wants OpenAI to be the Microsoft of AI, with a subscription-based operating system built on ChatGPT – Windows Central

Opinion

The past six months have been pivotal for TSMC, primarily due to the increasing demand for AI-related semiconductors. This surge is expected to continue, potentially boosting revenues significantly. However, the pressures from tariffs may pose a risk to profit margins, affecting investor sentiment and the share price. The decision to quash rumors concerning the UAE fab demonstrates TSMC's strategic focus on existing operations rather than expansive ventures, which could be wise in such volatile markets.

Moreover, the company's ability to navigate geopolitical tensions and maintain strong customer relations will be crucial. As AI technologies become more integral to various sectors, TSMC could leverage its position as a leader in chip manufacturing to capitalize on this trend. Nevertheless, investors should remain cautious, as fluctuations in share price and capacity constraints may remain a theme in the near term.

With TSMC's current share price holding slightly below previous highs, it will be interesting to see how the company addresses both internal efficiencies and external pressures. The mixed analyst outlook reflects a balance between optimism regarding AI demand and caution due to geopolitical factors. Considering these dynamics, TSMC's strategic decisions will be critical in shaping its next chapter.

In conclusion, while the outlook is cautiously optimistic for TSMC, the company must navigate multiple challenges that could influence its stock performance over the coming years. Continuous innovation and strategic maneuvering within the semiconductor landscape will be vital for maintaining and potentially enhancing its market position.

What could happen in three years? (horizon June 2025+3)

| Scenario | Share Price (approx.) |

|---|---|

| Best | 1450 |

| Base | 1100 |

| Worse | 800 |

Projected scenarios are based on current trends and may vary based on market conditions.

Factors most likely to influence the share price

- Demand for AI-related semiconductors

- Geopolitical tensions and tariffs

- Operational efficiency improvements

- Market competition

- Technological advancements

Conclusion

In summary, TSMC's stock is at a critical juncture. The interplay of AI demand, tariff pressures, and operational decisions will shape the company's future. Investors should closely monitor how TSMC responds to these challenges, as its ability to innovate while managing costs will fundamentally influence its market position. While current price levels suggest some stabilization, the volatility seen in the past few months indicates that market sentiment can shift rapidly. A strategic focus on AI and maintaining competitive advantages will be essential as TSMC aims for sustainable growth amidst a landscape marked by uncertainty.

This article is not investment advice. Investing in stocks carries risks and you should conduct your own research before making any financial decisions.