PepsiCo, Inc. (PEP) has shown resilience amidst a challenging market environment, with its recent earnings report highlighting a modest revenue growth. With a profit margin of 8.23% and efforts to strengthen its product portfolio, PepsiCo remains a pivotal player in the consumer staples sector. Despite facing significant headwinds, including a notable decline in quarterly earnings, the company has managed to sustain its dividend payouts, reflecting confidence in its operational strategy. This report provides an outlook for PepsiCo over the next three years as it addresses market dynamics and investor expectations.

Key Points as of July 2025

- Revenue: $91.75B

- Profit Margin: 8.23%

- Sales Growth (yoy): 1.00%

- Share Price: $143.45

- Analyst View: Cautiously optimistic

- Market Cap: $196.53B

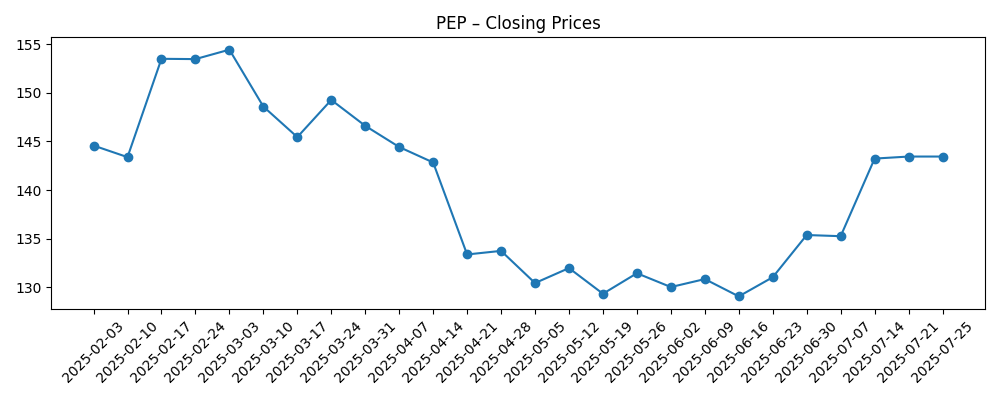

Share price evolution – last 6 months

Notable headlines

- Is PepsiCo (PEP) the Best Consumer Staples Dividend Aristocrat Right Now?

- PepsiCo Delivers The Fizz In Q2, Sweetens Outlook On Subdued Dollar Headwind

- Clearbridge Value Strategy Exited Its Position in PepsiCo (PEP)

- PepsiCo (PEP) Announced a New Limited-Edition Fashion Collection

Opinion

PepsiCo's recent earnings report has painted a complex picture for investors. Despite a decline in quarterly earnings growth of 59%, the company has managed to maintain its revenue growth and dividend payouts, which could signal management's commitment to shareholder returns. The decrease in net income raises concerns about profit sustainability, especially given the competitive landscape in the beverage and snack food sectors.

Furthermore, the uncertainty in international markets, including currency fluctuations and geopolitical tensions, poses additional risks to future performance. However, PepsiCo's diversified product offerings could mitigate some of these risks by capturing evolving consumer trends toward health-conscious and sustainable products.

Looking ahead, analysts remain cautiously optimistic about PepsiCo's stock, particularly as it attempts to strengthen brand loyalty and enhance its market presence. The recent investments in product innovation and marketing campaigns may bolster revenue growth in the coming quarters.

In summary, while there are challenges ahead, PepsiCo's robust brand equity and strategic initiatives may provide a buffer against market volatility, positioning the company for potential recovery in its stock price over the next three years.

What could happen in three years? (horizon July 2025+3)

| Scenario | Outcome |

|---|---|

| Best | Revenue grows to $110B, Profit Margin stabilizes around 10% |

| Base | Revenue reaches $100B, Profit Margin holds steady at 9% |

| Worse | Revenue declines to $85B, Profit Margin falls below 7% |

Projected scenarios are based on current trends and may vary based on market conditions.

Factors most likely to influence the share price

- Quarterly earnings reports

- Changes in consumer demand

- Competitive actions in the market

- Economic conditions impacting disposable income

- Regulatory changes affecting operations

Conclusion

In conclusion, PepsiCo faces a pivotal moment as it navigates market dynamics and pressures from competitors. The company has exhibited strong brand resilience and commitment to innovation, which could serve as significant advantages moving forward. However, the challenges posed by declining earnings and external market factors cannot be overlooked. Investors should remain vigilant, closely monitoring PepsiCo's performance as the company adapts its strategies in response to evolving consumer preferences and economic conditions. With a solid foundation and strategic initiatives, there remains potential for recovery and growth, offering a mixed outlook for both short-term and long-term investors.

This article is not investment advice. Investing in stocks carries risks, and you should conduct your own research before making any financial decisions.