As Procter & Gamble (NYSE: PG) progresses into July 2025, the company faces various market dynamics and challenges. A mix of macroeconomic variables, evolving consumer preferences, and competitive pressures will shape PG's trajectory in the coming years. Despite recent fluctuations in stock price, PG maintains solid fundamentals with a strong profit margin and consistent dividends. The outlook remains cautiously optimistic, contingent upon the company's ability to adapt to changing market conditions and enhance its product offerings.

Key Points as of July 2025

- Revenue: $83.93B

- Profit Margin: 18.46%

- Quarterly Revenue Growth: -2.10%

- Share price: $156.61

- Analyst view: Mixed to positive

- Market cap: Approximately $366.67B

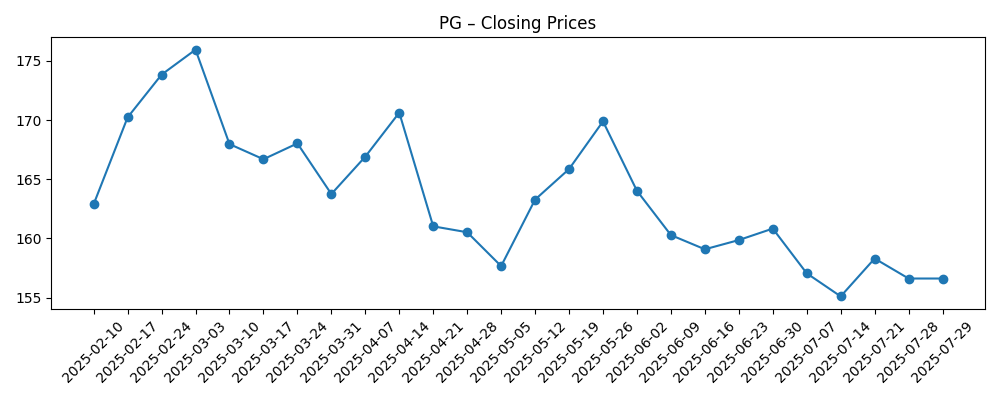

Share price evolution – last 6 months

Notable headlines

- Procter & Gamble: Buy PG Stock Ahead of Its Upcoming Earnings?

- Relative Strength Alert For Procter & Gamble

Opinion

The recent decline in Procter & Gamble's stock price, particularly noted in the weekly closing prices, raises questions about market confidence in the brand. However, the company continues to show resilience through its robust profit margins and a steady dividend policy. As the market evolves, P&G's approach to adapting its product lines and enhancing consumer engagement will be vital. If the company can pivot effectively and capitalize on emerging trends, it may recover and even extend its market share.

Furthermore, the upcoming earnings report could provide insight into P&G's operational efficiency and strategic direction. Analysts are closely watching how the company responds to competition and shifts in consumer behavior post-pandemic. Holding steadfast to its core values while innovating could set P&G apart from competitors who are aggressively pushing new products.

The imminent dividend announcement signals P&G's commitment to returning value to shareholders, yet investors should weigh this against the backdrop of revenue growth challenges. The upcoming financial landscape could either validate the current stock price or result in further decline if expectations are not met.

Ultimately, the critical question remains: can Procter & Gamble leverage its legacy while evolving to meet the future? Success in the next three years may hinge on how well they navigate this balance.

What could happen in three years? (horizon July 2025+3)

| Scenario | Outcome |

|---|---|

| Best | Stock price increases to $200, strong revenue growth due to innovation. |

| Base | Stock stabilizes around $170, modest revenue growth. |

| Worse | Stock drops to $130, ongoing sales decline due to competitive pressures. |

Projected scenarios are based on current trends and may vary based on market conditions.

Factors most likely to influence the share price

- Overall market conditions and consumer spending trends

- Product innovation and response to competitors

- Operational efficiency and cost management

- Dividend announcements and financial performance

Conclusion

In conclusion, Procter & Gamble's future performance is uncertain but presents multiple avenues for growth. The company's ability to innovate while maintaining its foundations will play a significant role in shareholder satisfaction. Factors such as external economic conditions and competitive strategies will also critically determine the stock’s trajectory. Investors remain hopeful for a turnaround, but they would benefit from ongoing research and vigilance regarding market trends. Overall, if P&G can adapt and leverage its strengths, it may navigate successfully through the coming years, potentially rewarding shareholders in return.

This article is not investment advice. Investing in stocks carries risks and you should conduct your own research before making any financial decisions.