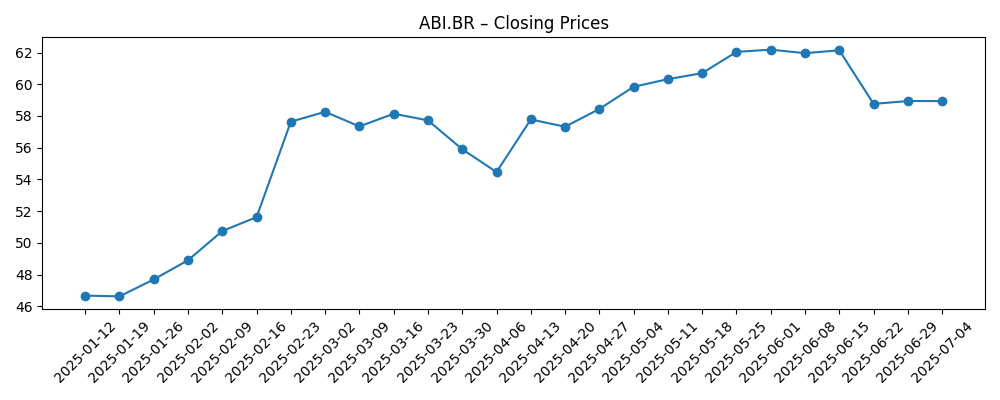

AB InBev’s Brussels-listed shares have slipped from roughly 62 in early summer to about 51 in October, giving back part of a mid-year rally. The change reflects a reset in investor appetite for consumer-staples after a strong first half, alongside currency translation headwinds and uneven beer volumes in mature markets. It also signals that, absent clearer volume traction, the story is leaning more on price/mix and cost control than on expansion. For investors, this matters because the company’s multi-year narrative hinges on premiumization—shifting consumers into higher-priced brands—while safeguarding margins through productivity and procurement. If that balance holds, cash generation can grind higher even if overall category growth is modest; if not, the valuation multiple could drift. Sector-wide, global beverages are navigating a slower pricing cycle, normalizing elasticities, and regulatory scrutiny, which puts a premium on brand strength and disciplined execution.

Key Points as of October 2025

- Revenue: Recent top-line detail not disclosed here; strategy continues to emphasize premiumization (higher-priced brands) and portfolio mix.

- Profit/Margins: Margin trajectory depends on pricing discipline and cost management; input costs (e.g., barley, aluminum) remain key swing factors; data not disclosed.

- Sales/Backlog: No backlog concept in beverages; watch depletions/shipments and market share in core geographies; volumes not disclosed.

- Share price: From a weekly close near 62.18 in early June 2025 to 51.36 by the week of Oct 10, with a late-July air pocket at 49.94 and a partial recovery into August–September.

- Analyst view: Consolidated consensus and rating details not disclosed here; tone across staples appears mixed amid debates on pricing power and elasticity.

- Market cap: Data not disclosed.

- FX and geographic mix: Significant exposure to emerging-market currencies means a stronger U.S. dollar can weigh on reported results even when local trends are stable.

- Competitive position: Global scale in brewing, distribution reach, and brand portfolios support pricing power; local challengers and craft fragmentation remain ongoing competitive pressures.

- Capital allocation: Leverage level and any portfolio actions remain watch items; specifics not disclosed.

Share price evolution – last 12 months

Notable headlines

Opinion

The share price path over the past half-year suggests a market reassessment of near-term operating momentum. After a strong run into early summer, the stock faded as investors rebalanced away from defensives and questioned the durability of elevated pricing. Currency translation likely compounded the effect: when local-currency growth meets a stronger dollar, reported results can look softer, which often pressures global consumer-staples. The late-July downdraft, followed by a steadier but subdued tape, fits a pattern of “show-me” sentiment—investors want clearer signs that price/mix gains are sticking without eroding brand equity.

Sustainability turns on three levers: pricing power, cost discipline, and volume stability. Pricing power is a function of brand strength and distribution; if consumers accept tiered offerings and premium brands, mix can carry revenue even in flat categories. Cost discipline, from procurement to logistics, can offset commodity and packaging volatility. Volume is the swing variable: modest declines in mature markets can be offset by steadier demand elsewhere, but broad-based softness would cap operating leverage. Without disclosed figures here, the quality of any beat or miss will hinge on how much of the result comes from price/mix versus true volume recovery.

Within beverages, competitive dynamics are evolving but rational: large incumbents have generally prioritized value over share chases, which supports pricing. That said, local brewers and craft offerings can nibble at share where taste and price gaps are meaningful, and regulation around alcohol marketing or excise can alter channel economics. In parallel, no/low-alcohol and flavored innovations broaden the addressable base but require sustained marketing and innovation cycles to scale profitably.

Over a three-year horizon, the equity narrative could swing on how convincingly AB InBev demonstrates pricing resilience without sacrificing volumes. If brands hold premium positions and cost inflation normalizes, investors may reward steadier free-cash-flow visibility with a firmer multiple. Conversely, if FX stays unfavorable and category demand softens, the market may emphasize balance-sheet caution and discount growth. In short, execution against premiumization and disciplined cost control, set against macro and currency tides, will shape how the multiple settles relative to global staples peers.

What could happen in three years? (horizon October 2025+3)

| Scenario | Narrative |

|---|---|

| Best | Premium brands sustain pricing with limited elasticity, cost inputs normalize, and FX headwinds ease. Modest volume stabilization in mature markets plus steady growth in select emerging markets improve operating leverage. The company converts brand strength into consistent cash generation and reduces balance-sheet risk, supporting a higher, more durable valuation multiple. |

| Base | Pricing remains positive but slows as elasticities normalize; costs are mixed with periodic commodity swings. Volumes are broadly flat, with emerging-market resilience offsetting mature-market softness. FX is a manageable headwind. The market assigns a range-bound multiple, tied to proof of execution each quarter. |

| Worse | FX turns more adverse, input costs re-accelerate, and price sensitivity rises, pressuring mix and margins. Category demand softens across key regions and promotional intensity increases. The narrative shifts toward capital preservation and risk management, compressing the multiple until clearer recovery signals emerge. |

Projected scenarios are based on current trends and may vary based on market conditions.

Factors most likely to influence the share price

- Execution on pricing and mix in core brands versus consumer price sensitivity and competitive responses.

- Foreign-exchange movements affecting translation of earnings from non-dollar markets.

- Commodity and packaging costs (e.g., grains, aluminum) and the effectiveness of hedging and procurement.

- Regulatory and tax developments affecting alcohol pricing, marketing, and route-to-market.

- Category demand trends across mature versus emerging markets, including no/low-alcohol adoption.

- Capital allocation choices and balance-sheet trajectory; any portfolio actions or M&A.

Conclusion

AB InBev’s recent share retracement underscores a market debate: how much of the story is durable pricing power and cost discipline versus cyclical and currency noise. With limited disclosed data here, the investment narrative for the next several quarters will hinge on proof points that premiumization can defend margins without eroding volumes, while FX and input costs remain manageable. Sector peers face similar normalization in pricing and elasticity, so relative brand strength and execution will be the differentiators. Watch next 1–2 quarters: price/mix realization; category volumes in mature markets; FX translation impacts; commodity and packaging cost trajectory; and any signals on balance-sheet priorities. If the company threads that needle, the multiple can stabilize; if pressure builds on any single lever, sentiment may stay in “show-me” mode until the operating cadence re-accelerates.

This article is not investment advice. Investing in stocks carries risks and you should conduct your own research before making any financial decisions.