Petrobras enters the next three years with a split narrative: strong operating economics versus policy and governance overhangs. The company’s revenue base remains large at 85.53B (ttm), yet investors have repriced the stock amid concerns about Brazil’s fuel-price policy, capital allocation, and the durability of outsized distributions. The forward dividend yield of 15.72% underscores the appeal of cash returns, but also the market’s skepticism about sustainability through a full oil-price cycle. The past year brought softer top-line trends as global oil prices normalized and domestic pricing remained politically sensitive, while sector peers leaned on discipline and shareholder returns. For energy investors, Petrobras offers leverage to deepwater barrels and a sizable refining footprint, but the state’s strategic priorities can change payout cadence and reinvestment choices. Because the investment case hinges on governance stability and commodity conditions, the next few quarters will set the tone: if cash generation tracks capital needs and dividends remain predictable, the equity could re-rate; if policy uncertainty persists, the discount likely endures.

Key Points as of November 2025

- Revenue: 85.53B (ttm); quarterly revenue growth year over year is negative (−10.10%).

- Profit/Margins: Operating margin 31.58%; profit margin 15.19%; ROE 18.48% and ROA 7.84% indicate solid asset productivity.

- Cash Flow: Operating cash flow 35B (ttm); levered free cash flow 15.17B supports dividends and investment needs.

- Balance Sheet: Total debt 68.06B vs. cash 9.5B; current ratio 0.76 highlights short-term liquidity tightness that requires disciplined treasury management.

- Dividends: Forward yield 15.72% with a 90.48% payout ratio; last ex-dividend date 8/25/2025 and next dividend date 12/30/2025.

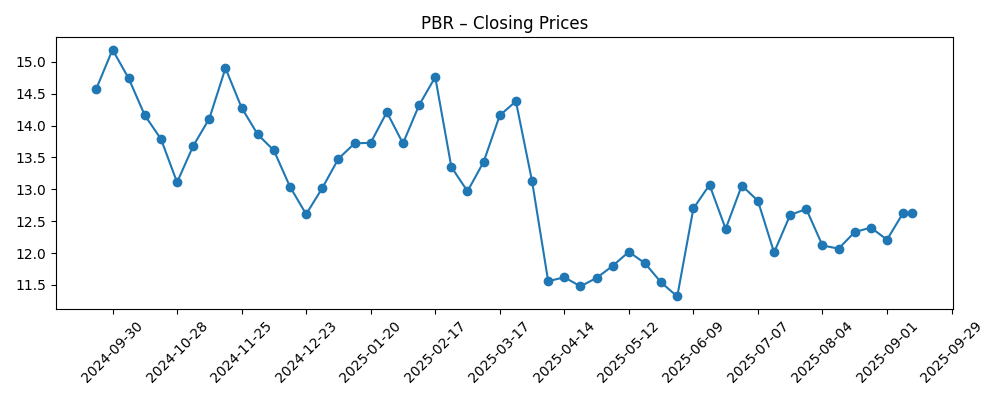

- Share price: 52‑week change −11.68%; 52‑week high/low 15.10/11.03; 50‑day MA 12.29 vs. 200‑day MA 12.64; beta 0.29 signals low market correlation.

- Analyst view: External consensus not provided here; positioning looks cautious with short interest modest at 1.60% of float and a short ratio of 1.22.

- Market cap: Not disclosed in the provided data.

- Sales/Backlog/Reserves: Production, reserves, and order/backlog metrics not disclosed in this dataset.

- Qualitative: State influence on fuel pricing and dividends, FX (foreign exchange) swings, and energy-transition policy remain central to the investment case.

Share price evolution – last 12 months

Notable headlines

Opinion

Recent figures suggest a company still generating robust economics despite a softer top line. Revenue (ttm) of 85.53B sits alongside a 31.58% operating margin and 15.19% net margin, implying healthy upstream and refining contributions even as year‑over‑year revenue contracted. That contraction most likely reflects a more normal oil-price setup and domestically sensitive fuel pricing, which can compress realized margins. Cash generation remains a strength: 35B in operating cash flow and 15.17B in levered free cash flow, against a sizable but manageable debt load, suggests the core assets are throwing off cash in average conditions. Because Petrobras’s beta is low, the equity tends to move more on company‑specific policy and payout signals than on broad market swings.

The dividend yield is eye‑catching, but the 90.48% payout ratio signals limited buffer if oil weakens or if investment requirements rise. Coverage from free cash flow looks adequate today; however, the current ratio at 0.76 highlights the importance of cautious liquidity management and access to funding. Quality of earnings appears supported by strong EBITDA (33.19B) and gross profit (41.65B), but the sustainability test will be whether management can balance dividends, debt, and capex without leaning on incremental leverage if macro conditions soften. In short, the numbers depict a profitable, cash‑generative operator whose distribution policy remains the swing factor.

Looking across the industry, global oil balances, OPEC+ discipline, and refining margins will shape Petrobras’s realized economics. The company’s pre‑salt position offers structural cost advantages and scale, but state ownership keeps domestic fuel pricing and dividend decisions within a political frame. That can affect pricing power and utilization across refining, and it can also change the timing of growth investments versus shareholder returns. FX volatility—through BRL/USD—adds another layer to dollar‑reported results and to the debt affordability narrative.

Given these cross‑currents, the medium‑term multiple will hinge on policy predictability and evidence that free cash flow can consistently cover both reinvestment and distributions. A steadier framework for domestic pricing would likely compress the governance discount and anchor the dividend narrative; inconsistent signals could sustain a higher risk premium. If the sector continues to prioritize capital discipline and if Petrobras adheres to a transparent payout framework, the equity story can pivot from event‑driven to cash‑flow‑compounding. Absent that, investors may continue to demand a high yield to underwrite policy and FX risk.

What could happen in three years? (horizon November 2028)

| Scenario | Narrative |

|---|---|

| Best | Oil prices hold at supportive levels while Brazil maintains a market‑linked fuel pricing approach. Petrobras executes efficiently on upstream projects and refinery optimization, keeps leverage stable, and formalizes a predictable dividend framework. The governance discount narrows as cash returns prove durable through a normal cycle. |

| Base | Oil averages around mid‑cycle conditions. Policy remains mixed—periods of alignment with market pricing interspersed with occasional interventions. Cash generation funds maintenance and selective growth with room for dividends, though payouts vary with macro and FX. Equity valuation tracks the sector with a modest governance discount. |

| Worse | A weaker oil tape combines with heavier domestic price controls and rising investment demands. Free cash flow tightens, dividends become more variable, and refinancing or asset sales enter the discussion. The stock trades primarily on policy risk and macro headlines rather than fundamentals. |

Projected scenarios are based on current trends and may vary based on market conditions.

Factors most likely to influence the share price

- Brent oil price path and refining margins affecting realized revenues and cash generation.

- Brazilian fuel‑pricing policy and dividend governance, including any changes to payout rules.

- Execution on upstream and refining projects, operational reliability, and safety performance.

- Balance‑sheet flexibility: debt trajectory, liquidity management (current ratio), and refinancing access.

- FX volatility (BRL/USD) impacting dollar‑reported earnings and debt service costs.

- Portfolio moves (asset sales, partnerships, or M&A) and any shifts in state influence or regulation.

Conclusion

Petrobras combines scale and profitability with policy‑sensitive cash returns. The data show a large revenue base and strong margins, backed by 35B in operating cash flow and 15.17B in levered free cash flow (ttm). Yet the stock’s 52‑week underperformance and a very high payout ratio (90.48%) reflect investor caution about the durability of distributions under varying oil prices and domestic pricing choices. Low beta suggests the equity will react more to company‑specific policy and dividend signals than to broader markets. If management can maintain a transparent, rules‑based payout while funding necessary investment and managing 68.06B of debt prudently, the governance discount could narrow over time. Conversely, heavier intervention or a weaker macro backdrop would likely keep the yield high and the multiple constrained. Watch next 1–2 quarters: dividend policy clarity; domestic fuel‑pricing framework; free‑cash‑flow coverage after capex; debt and liquidity trajectory; FX impacts on reported results.

This article is not investment advice. Investing in stocks carries risks and you should conduct your own research before making any financial decisions.