Alibaba enters the next three years with a sturdier financial base and a clearer strategy focus on cloud and AI. As of its most recent quarter (6/30/2025), the company reports a 14.63% profit margin and 14.13% operating margin on trailing‑twelve‑month revenue of 1T, alongside 416.41B in cash and 253.27B in total debt. Earnings momentum is improving (quarterly earnings growth yoy: 66.70%), though top‑line growth remains modest (quarterly revenue growth yoy: 1.80%). The stock has rebounded strongly, up 62.00% over the past year, closing the week of 2025‑09‑26 at 171.91 and approaching its 52‑week high of 180.16. Dividend distributions resumed (trailing annual dividend yield: 4.34%; forward yield: 0.61%) with a 12.21% payout ratio. Strategic updates include Alibaba Cloud’s planned expansion into Europe and South America and continued investments in its Qwen AI model family.

Key Points as of September 2025

- Revenue: trailing twelve‑month revenue of 1T with quarterly revenue growth (yoy) of 1.80%.

- Profit/Margins: profit margin 14.63%; operating margin 14.13%; ROE 13.45%; ROA 5.08%.

- Sales/Backlog: cloud growth flagged as robust by recent analyst commentary; no formal backlog disclosed.

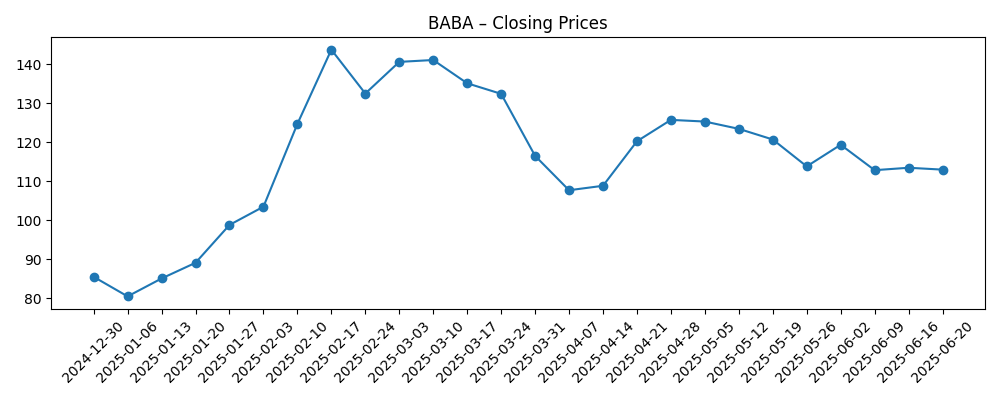

- Share price: 171.91 (week of 2025‑09‑26); 52‑week change 62.00%; 52‑week range 80.06–180.16; beta 0.10.

- Analyst view: recent Buy reaffirmation citing cloud momentum; positive sentiment evident in rising volumes (10‑day avg 24.29M vs 3‑month 17.99M).

- Market cap and capital returns: large‑cap profile; dividend yield 4.34% trailing and 0.61% forward; payout ratio 12.21%.

- Balance sheet: cash 416.41B vs debt 253.27B; current ratio 1.45; debt/equity 23.17%.

- Cash flows: operating cash flow 150.55B; levered free cash flow −30.21B (ttm) highlights investment and financing dynamics.

- Short interest: 43.98M shares short (9/15/2025); short ratio 2.01; days‑to‑cover remains low.

Share price evolution – last 12 months

Notable headlines

- Alibaba Cloud plans expansion into Europe and South America

- Qwen3‑Omni: Native Omni AI Model for Text, Image & Video

- Citi Reaffirms Buy on Alibaba (BABA) After Robust Cloud Growth

Opinion

Alibaba’s share price recovery to 171.91, versus a 52‑week low of 80.06 and a high of 180.16, reflects improving sentiment toward the company’s execution and capital discipline. The marked divergence between earnings growth (66.70% yoy) and revenue growth (1.80% yoy) signals cost discipline, mix improvement, and possibly better monetization in higher‑margin segments like cloud. Low beta (0.10) and rising liquidity (10‑day average volume above the 3‑month average) suggest broader participation without excessive volatility. The resumption of dividends, with a modest 12.21% payout ratio, provides flexibility to balance shareholder returns and reinvestment. Over the next three years, the investment case hinges on whether earnings outperformance can be sustained as revenue growth re‑accelerates, particularly in cloud and international commerce.

Cloud is the swing factor. The announced push into Europe and South America indicates confidence in the product roadmap and cost structure. Success will require compliance readiness, localized partnerships, and competitive pricing against entrenched hyperscalers. With cash of 416.41B against 253.27B of debt and operating cash flow of 150.55B, Alibaba can fund selective expansion while keeping financial risk manageable. However, levered free cash flow at −30.21B (ttm) underscores that capital intensity and financing outlays remain meaningful. Over a three‑year horizon, investors should watch for evidence of sustained international customer wins, improving utilization, and margin stability. If those appear alongside rising attach rates for AI services, the pathway to structurally higher returns on equity looks credible.

Qwen’s progress matters beyond branding. The release of Qwen3‑Omni highlights Alibaba’s intent to embed multimodal AI across commerce and cloud. Native models can reduce dependency on third‑party foundations, differentiate solutions in regulated industries, and seed an ecosystem of applications that deepen customer lock‑in. The commercial question is less about state‑of‑the‑art benchmarks and more about reliability, cost per inference, and vertical‑specific value. Over three years, tangible traction would show up in steadier revenue growth, improved gross margin mix (412.15B gross profit on a 1T revenue base provides room for incremental lift), and better operating leverage. Pairing model innovation with managed services, security, and compliance bundles could also support pricing power without sacrificing share.

Risks remain. Domestic competition, evolving regulation, and shifting access to cutting‑edge compute can pressure growth and capex plans. While the balance sheet and low debt/equity (23.17%) provide cushion, negative levered free cash flow indicates the importance of disciplined capital allocation. Any prolonged softness in consumer spending could weigh on commerce take rates, offsetting cloud gains. Conversely, clearer policy visibility, steady dividend cadence (recent dividend date 7/10/2025; ex‑date 6/12/2025), and measured international wins could compress the company’s risk premium. With the 50‑day and 200‑day moving averages at 134.08 and 118.35, respectively, technical momentum currently supports a constructive stance, but sustaining fundamentals will be decisive for multi‑year rerating.

What could happen in three years? (horizon September 2025+3)

| Scenario | Description |

|---|---|

| Best | International cloud expansion gains traction across Europe and South America, supported by Qwen‑powered services and compliance‑ready offerings. Revenue growth re‑accelerates, mid‑teens operating margins are sustained, and dividends/buybacks remain prudent. Valuation benefits from durable earnings quality and low beta characteristics. |

| Base | Cloud grows steadily but competitively; commerce stabilizes with modest improvement. Margins remain close to current levels, capital intensity normalizes, and free cash flow trends improve from recent negatives. Shareholder returns continue within a conservative payout framework. |

| Worse | Regulatory and competitive pressures slow international cloud adoption; access to advanced compute tightens. Revenue growth remains subdued, levered free cash flow stays constrained, and sentiment cools. The stock tracks fundamentals without multiple expansion. |

Projected scenarios are based on current trends and may vary based on market conditions.

Factors most likely to influence the share price

- Alibaba Cloud execution: international customer wins, utilization, and AI service attach based on Qwen.

- Regulatory environment: data sovereignty, cross‑border cloud rules, and platform governance.

- Capital allocation: trajectory of levered free cash flow, dividend cadence, and any buybacks.

- Macro and competition: China consumer activity, pricing dynamics versus hyperscalers, and merchant take‑rate trends.

- Balance sheet and liquidity: sustaining cash strength (416.41B) relative to debt (253.27B) and refinancing conditions.

Conclusion

Alibaba’s three‑year setup blends improving profitability with measured growth ambitions. The company’s 1T revenue base, 14.63% profit margin, and ample cash provide flexibility to pursue international cloud opportunities while supporting dividends under a 12.21% payout ratio. Momentum in earnings (66.70% yoy) against modest revenue growth (1.80% yoy) suggests operating discipline and a richer mix, with Qwen positioned to enhance differentiation across commerce and cloud over time. The share price has recovered meaningfully, aided by low beta and improving sentiment, but sustained fundamental progress—particularly in cloud bookings, customer retention, and AI monetization—will determine whether the rerating endures. Key watch‑items include normalization of levered free cash flow, consistent margin performance, and clear regulatory navigation in new markets. On balance, execution on cloud expansion and AI services could underpin a constructive base case, with downside buffered by the balance sheet and dividend, yet still sensitive to external policy and competitive variables.

This article is not investment advice. Investing in stocks carries risks and you should conduct your own research before making any financial decisions.