BMW (BMW.DE) enters the next three years balancing EV rollout and profitability. Trailing-twelve-month revenue is 136.51B with a 4.20% profit margin and 7.70% operating margin; quarterly revenue growth is -8.20% year over year and quarterly earnings growth -33.00%. Shares are up 10.04% over 52 weeks, below the S&P 500’s 16.33%, after peaking near the 52-week high of 91.72 in August and easing to 82.78 (Sep 24). The company maintains a 5.14% forward dividend yield on a 4.3 payout and a 46.34% payout ratio. Headlines center on the “Neue Klasse” iX3 EV, a driver-assistance partnership with Qualcomm, and policy risks such as India’s proposed taxes on luxury EVs. We assess scenarios and catalysts into September 2028.

Key Points as of September 2025

- Revenue (ttm): 136.51B; Gross profit (ttm): 18.54B; EBITDA: 14.75B.

- Profit/Margins: Profit margin 4.20%; Operating margin (ttm) 7.70%; ROE 6.44%; ROA 2.19%.

- Sales/Backlog: No backlog disclosed here; quarterly revenue growth (yoy) -8.20% and quarterly earnings growth (yoy) -33.00% highlight a softer demand/mix backdrop.

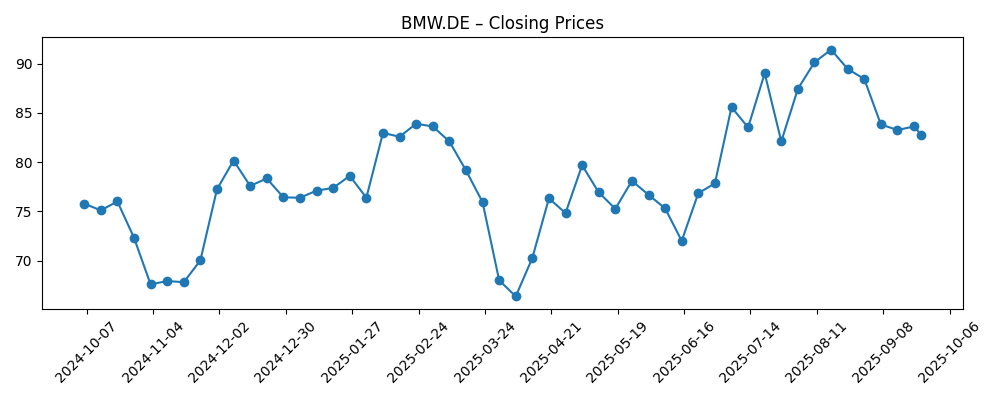

- Share price: 52-week range 62.96–91.72; recent close 82.78 (Sep 24, 2025); 50-day MA 86.49; 200-day MA 79.80; Beta 0.92.

- Dividend: Forward annual dividend rate 4.3; forward yield 5.14%; payout ratio 46.34%; last ex-dividend date 5/15/2025.

- Balance sheet: Total cash (mrq) 15.46B; total debt (mrq) 106.34B; current ratio 1.15; debt/equity 113.19%.

- Ownership: Shares outstanding 559.37M; float 388.28M; insiders hold 50.18%; institutions hold 23.59%.

- Analyst view: Focus likely to remain on EV execution, margin resilience, and capital returns; ratings vary across firms.

- Market cap: Not provided here; implied by shares outstanding and recent price.

Share price evolution – last 12 months

Notable headlines

- BMW’s iX3 is a ‘new class’ of EV that packs a lot of range and computing power

- Qualcomm, BMW launch automated driving system to better compete in growing market

- BMW Says EVs Can Still Be the Ultimate Driving Machine

- India tax panel calls for steep levies on luxury EVs in blow for Tesla, BMW

Opinion

The Neue Klasse iX3 reveals BMW’s intent to fuse efficiency, computing power, and brand DNA in its next EV wave. If execution matches the promise, this platform can rationalize BMW’s product complexity and lift unit economics over time. The near-term challenge is bridging today’s margins with tomorrow’s scale: current operating margin sits at 7.70% while quarterly growth rates are negative, reflecting a mixed demand and mix environment. A compelling iX3 can defend pricing in core segments and reduce reliance on incentives, stabilizing profitability. Over three years, we think platform reuse and vertical software integration could be the key levers. Success would likely show up first in steadier gross profit and a narrowing gap between operating and net margins, before translating into sustained multiple support.

The Qualcomm collaboration on automated driving underscores a pragmatic route to software-defined vehicles. BMW gains access to compute and perception stacks that shorten time-to-market versus building everything in-house, while retaining tuning that preserves the “Ultimate Driving Machine” character. Commercial success depends on reliability, regulatory acceptance, and customer willingness to pay for advanced driver-assistance features. While we avoid quantifying optionality, enhanced driver-assist could support attachment rates that cushion margins during the EV transition. Importantly, robust ADAS may widen BMW’s appeal in China and Europe, where regulatory frameworks increasingly value safety tech. If BMW can launch feature roadmaps with disciplined cost control, investors may reward the stock with better resilience through macro cycles.

Policy risk remains a wild card. India’s consideration of steep levies on luxury EVs would raise total ownership costs and could slow premium EV adoption in a market viewed as strategically important over the long run. While BMW’s global footprint provides diversification, such measures would complicate regional scale-up and delay margin breakeven for specific EV lines targeted at emerging markets. Beyond India, investors should watch for evolving incentives, tariffs, and local-content rules in the EU, U.S., and China. A patchwork of rules can fragment supply chains and add working-capital friction, particularly with a current ratio at 1.15 and significant gross debt. The strategic answer is manufacturing flexibility and supplier redundancy—priorities that may weigh on near-term free cash flow but de-risk the out-years.

Shares have been volatile: the stock rallied into mid–late August (peaking near the 52-week high of 91.72) before cooling to 82.78 by Sep 24. It remains above the 200-day moving average (79.80) but below the 50-day (86.49), a neutral technical stance. The 5.14% forward dividend yield offers carry while investors wait for clearer EV-mix inflection and margin stabilization. Relative underperformance versus the S&P 500 over 52 weeks (10.04% vs. 16.33%) suggests sentiment is cautious but not broken. Into 2026–2028, watch for operating leverage from Neue Klasse launches, cadence of ADAS updates, and regional policy clarity. If these line up, retesting prior highs is plausible; if execution wobbles, the 200-day area could serve as a barometer of confidence.

What could happen in three years? (horizon September 2025+3)

| Scenario | Operations | Strategy | Share price context |

|---|---|---|---|

| Best | Neue Klasse ramps smoothly; mix shifts to higher-margin EVs; operating efficiency improves from current levels. | Qualcomm-enabled ADAS sees strong take-up; software/services enhance loyalty and pricing power; disciplined capex. | Confidence returns; stock retests the 52-week high region (91.72) and sustains above key averages. |

| Base | EV adoption progresses steadily; margins hold near current run-rate with incremental improvement as scale builds. | Phased feature rollouts; selective regional adjustments to policy shifts; dividend maintained with prudent payout. | Shares oscillate around longer-term trend, with the 200-day MA (79.80) acting as a pivot. |

| Worse | Launch delays or cost overruns; demand softness persists; margins compress amid pricing pressure and input costs. | Slower software execution; regulatory setbacks in key markets; higher financing costs strain cash generation. | Sentiment deteriorates; stock revisits lower end of the 52-week range (62.96) before stabilizing. |

Projected scenarios are based on current trends and may vary based on market conditions.

Factors most likely to influence the share price

- Neue Klasse execution: launch timing, cost discipline, and consumer reception of the iX3 and follow-ons.

- Margins and cash flow: trajectory from current 7.70% operating margin and 4.20% profit margin amid EV mix shift.

- Regulation: incentives/tariffs in EU, U.S., China, and potential luxury EV levies in India.

- ADAS/software progress: effectiveness of the Qualcomm partnership and feature monetization without eroding brand character.

- Macro and FX: demand in premium segments, financing costs, and currency impacts on earnings translation.

- Capital returns and balance sheet: dividend sustainability (5.14% forward yield) versus investment needs and leverage.

Conclusion

BMW’s three-year setup is a balance of credible product-cycle catalysts and near-term earnings pressure. The numbers frame the task: 136.51B in revenue, 7.70% operating margin, and negative quarterly growth rates point to a transition period as the mix tilts toward EVs. The Neue Klasse iX3 and the Qualcomm-assisted driving system address competitiveness in technology and efficiency, while the dividend (5.14% forward yield; 46.34% payout ratio) provides income support. Technically, shares sit between moving averages—above the 200-day (79.80) but below the 50-day (86.49)—after a summer rally toward the 91.72 high. Policy developments, notably in India, add uncertainty but are manageable with flexible manufacturing and prudent capital allocation. Base case: steady EV ramp, stable margins, and range-bound trading. Upside requires clean launches and software traction; downside stems from cost overruns and policy setbacks.

This article is not investment advice. Investing in stocks carries risks and you should conduct your own research before making any financial decisions.