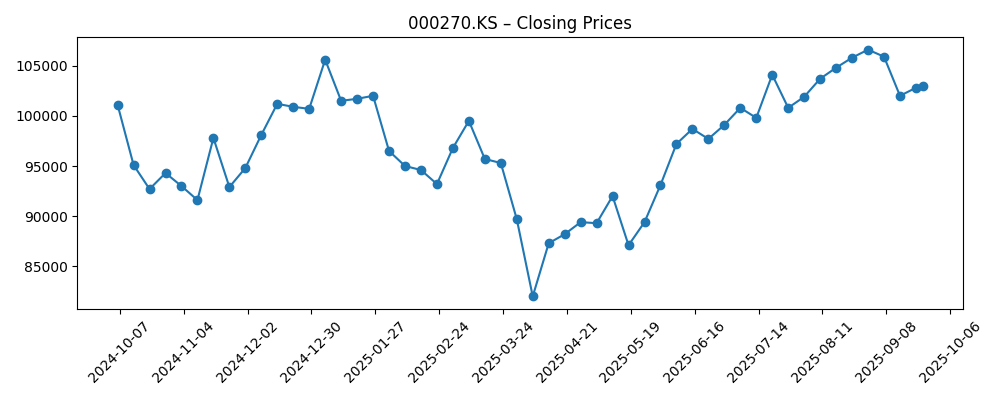

Kia Corporation enters the next three years with improving top-line momentum, solid liquidity, and a share price that has recovered from April’s trough. Over the last six months, the stock rebounded from lows near ₩82,000 to about ₩103,000, while the 52‑week range sits at ₩81,300–₩113,200. Trailing‑12‑month revenue is ₩111.04T with a 7.81% profit margin and 9.42% operating margin, supported by ₩23.75T in gross profit and ₩13.96T in EBITDA. The balance sheet shows ₩20.2T in cash versus ₩2.62T in debt (current ratio 1.50), underpinning a forward annual dividend of ₩6,500 per share (6.32% yield; 29.40% payout). Recent headlines point to robust August auto sales but a murky outlook for fall, putting emphasis on Kia’s EV/hybrid mix, pricing discipline, and currency management. With beta at 0.76, volatility remains comparatively contained.

Key Points as of September 2025

- Revenue (ttm): ₩111.04T; Quarterly revenue growth (yoy): 6.50%.

- Profitability: Profit margin 7.81%; Operating margin (ttm) 9.42%; EBITDA ₩13.96T; Net income ₩8.67T.

- Liquidity & leverage: Cash (mrq) ₩20.2T; Debt ₩2.62T; Current ratio 1.50 – a clear net-cash profile.

- Share price: ~₩103,000 (late Sep); 52‑week ₩81,300–₩113,200; 50‑day MA ₩103,524; 200‑day MA ₩97,473.5; Beta 0.76.

- Dividend: Forward annual ₩6,500 (yield 6.32%); payout ratio 29.40%; ex‑dividend date was 18 Mar 2025.

- Ownership: Insiders 38.91%; Institutions 30.34%; Float 235.51M shares; Avg vol (3m) ~942k; (10d) ~1.05M.

- Sales backdrop: August U.S. auto sales were strong, but fall outlook flagged as uncertain in recent coverage.

- Implied market value: Roughly ₩40T based on ~₩103k/share and 389.82M shares outstanding.

Share price evolution – last 12 months

Notable headlines

- Ford, Kia, Hyundai sales charge higher in August, shaking off tariffs and fueled by EVs (Yahoo)

- Auto sales charged higher in August, but a murky fall outlook weighs on automakers (Yahoo)

Opinion

The near-term narrative for Kia blends encouraging demand signals with caution about the next quarter. August sales strength and EV momentum are supportive, and Kia’s balanced lineup across ICE, hybrid, and EV models provides optionality if consumer preferences shift. That said, media commentary highlights a murky fall outlook, suggesting incentives and pricing discipline will matter more than usual. With operating margin at 9.42% and profit margin at 7.81%, Kia has room to absorb targeted promotion without breaking the P&L, but aggressive discounting industrywide could compress margins. The company’s 0.76 beta and a share price now above the 200‑day average imply improving sentiment, yet the stock remains below its 52‑week high. Into 2026, sustained volume growth and mix improvement are likely prerequisites for a durable rerating.

Margins and cash flow anchor the equity story. Trailing EBITDA of ₩13.96T and operating cash flow of ₩11.92T, coupled with ₩20.2T in cash against ₩2.62T in debt, position Kia to fund capex, software and electrification initiatives, and maintain its dividend. The forward yield of 6.32% with a 29.40% payout ratio looks serviceable given current profitability, creating a buffer if growth moderates. Currency swings are a wild card: a stronger won can pressure export margins, while a softer won supports them. Input costs, especially for batteries, also bear watching. If Kia can hold operating margins near current levels while nurturing EV/hybrid scale economies, free cash flow could remain healthy enough to support both investment and shareholder returns.

Market tone may oscillate with headlines on tariffs, EV adoption, and macro demand, but Kia’s lower volatility profile could help investors stay the course. The stock’s rebound from April lows toward the 50‑day average reflects stabilizing expectations, while volumes near 1.0M shares per day suggest liquidity is adequate for larger holders. Ownership is balanced between insiders (38.91%) and institutions (30.34%), which can dampen extreme swings. Near-term catalysts include monthly deliveries, pricing/incentive updates, and commentary on supply chains. Over three years, the company’s ability to convert product launches into sustained share gains in key markets will likely outweigh quarter-to-quarter noise.

Risks remain. Headlines already flag uncertainty into the fall, and the auto cycle is sensitive to rates and employment trends. Competitive intensity—especially in EVs—could pressure mix and pricing, while any recall or warranty spikes could weigh on margins. Still, Kia’s liquidity and net-cash posture provide flexibility that many automakers lack. If execution stays tight—containing incentives, optimizing capacity, and pacing capex with demand—the equity case tilts constructive. Conversely, if discounting broadens and EV demand lags targets, the stock could revisit the lower end of its 52‑week range. For patient investors, the dividend may compensate for interim volatility as the EV transition plays out.

What could happen in three years? (horizon September 2028)

| Scenario | Narrative | Implications |

|---|---|---|

| Best | EV/hybrid launches scale efficiently; global demand holds; pricing remains rational; supply chains stable. | Margins supported by mix; steady free cash flow funds capex and dividends; shares trend toward prior highs with potential multiple expansion. |

| Base | Moderate unit growth; stable pricing; EV adoption continues but uneven across regions; costs manageable. | Earnings and cash flow track in a tight band; dividend maintained; stock returns align with cash generation and market averages. |

| Worse | Macro slows; intense price competition in EVs; currency and input costs move unfavorably; one‑off quality costs emerge. | Margin compression; reduced investment pace; sentiment weakens and shares gravitate toward the lower end of the recent range. |

Projected scenarios are based on current trends and may vary based on market conditions.

Factors most likely to influence the share price

- Global demand and pricing power across ICE, hybrid, and EV segments.

- Battery costs, supply-chain stability, and availability of critical components.

- Currency movements (KRW) versus key export markets and related hedging efficacy.

- Tariffs, incentives, and regulatory changes affecting import/export and EV adoption.

- Product quality, recalls, and warranty trends impacting brand and margins.

- Competitive actions in core markets, including discounting and inventory dynamics.

Conclusion

Kia’s investment case into 2028 rests on steady execution amid a choppy auto backdrop. The company brings a resilient financial base—₩111.04T in ttm revenue, solid margins, and a clear net‑cash position—to an industry transition that rewards flexibility. The forward dividend yield of 6.32% with a 29.40% payout ratio can cushion investors, while ownership and a 0.76 beta temper volatility. Still, recent coverage highlights uncertainty into fall, underscoring the importance of pricing discipline and cost control as EV competition intensifies. If Kia converts a robust product pipeline into sustained share gains and preserves margin quality, the stock could grind higher and challenge prior peaks over a three‑year horizon. If macro or competitive pressures bite, returns may default to dividends and modest multiple mean‑reversion. On balance, risk‑reward appears reasonable for long‑term holders comfortable with auto‑cycle swings.

This article is not investment advice. Investing in stocks carries risks and you should conduct your own research before making any financial decisions.