Li Auto’s setup into 2026–2028 is shaped by a cooling revenue trajectory, a broadened product roadmap, and execution on infrastructure. The stock has fallen -14.35% over the past year as investors weigh near‑term competitive discounting in China’s EV market against a longer runway from new models and self‑funded growth. Trailing revenue stands at 143.32B, underpinned by strong SUV demand earlier in 2025, while recent headlines point to a sedan launch, a plan to rapidly expand the charging network, and an unaudited Q3 update. The “what changed” is a shift from single‑segment strength to multi‑segment execution, plus investment spend that can dilute margins before scale benefits kick in. The “why” is intensifying price competition and product‑cycle churn, which typically depress near‑term growth as lineups refresh. The “so what” for investors: over the next three years, Li Auto’s ability to defend margins while ramping new platforms and charging will likely matter more than unit growth alone, in a sector where mix, software, and cost curves drive outcomes.

Key Points as of October 2025

- Revenue: trailing 12‑month revenue is 143.32B; quarterly revenue growth year over year is -4.50% (data indicates near‑term moderation).

- Profit/Margins: profit margin 5.64% and operating margin 2.86%; EBITDA 11.73B and net income (ttm) 8.08B point to positive, but thin, profitability.

- Sales/Backlog: Reuters notes a Q1 2025 delivery surge; backlog not disclosed in supplied data.

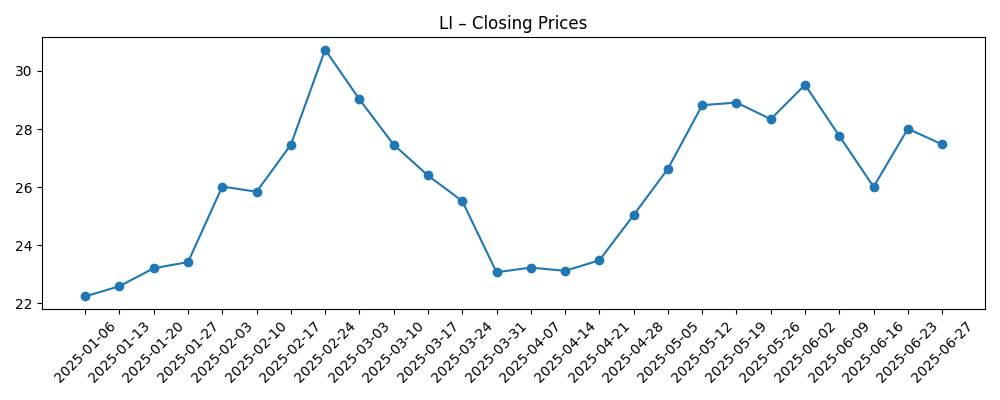

- Share price/technicals: last weekly close (Oct 10, 2025) 22.80; 52‑week range 19.10–33.12; 50‑day/200‑day moving averages 24.57/25.91; beta 1.00; 52‑week change -14.35%.

- Balance sheet: total cash 106.92B vs total debt 16.92B; current ratio 1.74; operating cash flow 14.97B and levered free cash flow 3.37B support ongoing investment.

- Ownership and sentiment: institutions hold 5.43%; short interest 5.12% of float, falling from 25.83M to 20.65M shares in the latest month.

- Analyst/Street view: Reuters reported a Q2 beat; formal consensus metrics not provided in the supplied data.

- Market cap: not disclosed in the supplied data.

- Qualitative: product mix broadening with a new sedan and an expanded charging network suggests a push beyond EREV SUVs into wider EV segments amid elevated domestic competition.

Share price evolution – last 12 months

Notable headlines

- Li Auto Inc. Reports Third Quarter 2025 Unaudited Results

- Chinese Car Maker Li Auto Beats Q2 Estimates Amid Surging Demand

- Li Auto Confirms Launch of New Electric Sedan at Beijing Auto Show

- EV Maker Li Auto Aims to Triple Charge Network by 2026

- Li Auto Sees Surge in Q1 2025 Deliveries Driven by Strong SUV Sales

Opinion

Recent figures and headlines sketch a company moving from a single‑lane highway to a multi‑lane expressway. Positive trailing profitability (profit and operating margins remain in the black) and strong cash generation provide the fuel, while the sedan introduction and a charging rollout represent new lanes for growth. The year‑over‑year decline in quarterly revenue implies that price competition and product transitions are real headwinds, even as Q2 outperformed expectations. This mix of modest profitability and cooling growth sets a balanced starting point for a three‑year view: the bar for execution is higher, but the financial runway is long.

Quality and sustainability of earnings depend on model mix, pricing discipline, and the cost curve. New vehicle ramps typically front‑load expenses, and expanding a proprietary charging network raises near‑term operating costs, which can compress margins before utilization builds. That said, the cash‑to‑debt profile is favorable, and operating cash flow remains solid, giving management room to invest without stressing the balance sheet. If the sedan achieves scale and the charging network improves user acquisition and retention, profitability can normalize as warranty, marketing, and manufacturing costs per unit decline with learning effects.

Within China’s highly competitive EV landscape—where frequent promotions and rapid model cycles are common—defensible differentiation often comes from user experience, software, and ecosystem lock‑in rather than hardware alone. Li Auto’s family‑oriented SUV heritage, now complemented by a sedan, broadens the addressable market, while an owned charging footprint can reduce dependency on third‑party networks. Execution will determine whether this translates into pricing power or simply maintains share amid aggressive peers. Supply chain stability and battery input costs remain swing factors that can amplify or offset pricing moves.

For the equity narrative and multiple, investors are likely to reward visible progress on three items: sustained, positive margin trajectory despite a broader lineup; evidence that charging investment improves conversion and repeat purchase; and confirmation that new segments do not cannibalize core models. Low institutional ownership and a moderating short interest leave room for sentiment to shift with delivery cadence and margin prints. Conversely, any prolonged price war or slower‑than‑expected ramp of the new sedan could keep the multiple anchored until growth re‑accelerates with stronger mix or software monetization.

What could happen in three years? (horizon October 2025+3)

| Scenario | Narrative |

|---|---|

| Best | New sedan scales smoothly alongside core SUVs; charging buildout enhances brand stickiness and utilization; pricing stabilizes as competitors prioritize profitability; margins expand on scale and cost reductions; the stock’s narrative shifts to durable growth with self‑funded investments. |

| Base | Mixed market with periodic promotions; deliveries grow steadily but slower than early‑2025 peaks; charging network build continues, improving user experience without materially changing demand elasticity; margins hold near current levels with modest efficiency gains. |

| Worse | Price war intensifies and new model underwhelms; inventory and marketing costs rise; policy or trade frictions complicate expansion; charging capex weighs on cash generation; margins compress and the story reverts to share defense over profitable growth. |

Projected scenarios are based on current trends and may vary based on market conditions.

Factors most likely to influence the share price

- Execution on new model ramps (sedan launch) and mix management across SUVs vs. sedans.

- Domestic pricing dynamics in China’s EV market and the cadence of promotions/discounting.

- Pace and cost of charging network rollout relative to utilization and customer acquisition.

- Supply chain stability (batteries, semiconductors) and input‑cost trends.

- Regulatory and trade policy affecting EV incentives and potential export pathways.

- Capital discipline and free cash flow versus growth investment needs.

Conclusion

Li Auto enters the next three years with a solid balance sheet, positive but slim profitability, and a strategy that leans into product breadth and infrastructure control. The near‑term growth slowdown reflects a competitive market and model transitions, but the company’s cash resources provide flexibility to invest through the cycle. The sedan launch and charging expansion are the key proof points that could reset the narrative from price‑led growth to experience‑led retention and margin resilience. The share price sits below long‑term averages as investors await clearer evidence on mix and margins. Watch next 1–2 quarters: delivery cadence and backlog conversion; pricing and promotional intensity; early reception and ramp quality of the new sedan; charging network rollout versus utilization; and gross‑to‑operating margin progression. Clear execution across these items would help resolve the current debate between cyclical pressure and structural advantage without relying on aggressive external assumptions.

This article is not investment advice. Investing in stocks carries risks and you should conduct your own research before making any financial decisions.