Magna International enters late 2025 with a steadier share price and a clearer path to margin repair. Revenue has softened as global automakers recalibrate production and model mix, but cost control and better pricing on new programs have lifted earnings quality. Trailing twelve‑month revenue stands at 41.61B, and free cash flow has supported a dividend that yields 4.14%. The company has leaned into active safety and electrification content while keeping capital spending balanced against cash returns. For investors, the near‑term question is whether operating discipline can hold as North American and European vehicle builds wobble and Chinese competition intensifies. Auto suppliers typically live with thin margins and bargaining pressure from carmakers, so consistent cash conversion matters more than one‑off beats. Sector‑wide, the shift from internal combustion to software‑rich vehicles is uneven and capital intensive; content leaders should benefit, but timing is uncertain. Because Magna has scale, diversified customers, and a growing advanced driver‑assistance footprint, the next three years hinge on execution—converting awards into sustainable margin and cash flow.

Key Points as of October 2025

- Revenue: trailing 12‑month revenue of 41.61B; quarterly revenue growth (y/y) is -3.00%.

- Profit/Margins: profit margin 2.91%; operating margin (ttm) 4.91%; ROE 10.35% indicates improved earnings leverage.

- Cash flow & dividends: levered free cash flow 1.26B supports a forward annual dividend rate of 2.67 (yield 4.14%); payout ratio 45.07%.

- Balance sheet: total cash 1.54B; total debt 8.12B; current ratio 1.16 and debt/equity 62.90% imply moderate financial flexibility.

- Sales/Backlog: order backlog not disclosed here; integration of Veoneer’s active safety business and Asia expansion point to rising ADAS and electrification content.

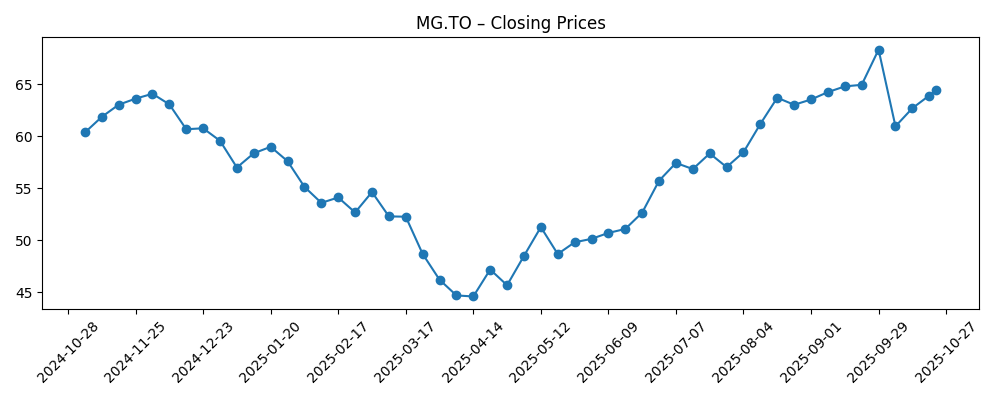

- Share price: recent weekly close 64.47; sits near 50‑day average 63.74 and above 200‑day average 55.61; 52‑week range 43.25–69.47; beta 1.68.

- Analyst view: July reporting period highlighted an earnings beat tied to Asia growth and cost control; focus remains on margin durability.

- Market cap: not disclosed in this snapshot; shares outstanding 281.78M and institutional ownership 77.06% underscore large‑cap profile.

- Short interest: 1.74% of float; short ratio 4.55—modest bearish positioning.

Share price evolution – last 12 months

Notable headlines

- Why Magna’s (MGA) Global Scale and EV Growth Support its Steady Dividend Yield

- Magna International Inc. to Announce Third Quarter 2025 Results

- Magna's Earnings Beat as Company Expands in Asia

- Magna International and Ford Motor Partnership Advances Autonomous Driving

- Magna International Inc. Completes Acquisition of Veoneer's Active Safety Business

- Magna Joins Forces with LG Electronics to Target EV Market

Opinion

Magna’s recent pattern—modest revenue slippage but faster earnings growth—suggests the company is executing on price recoveries and cost take‑outs while leaning into higher‑content programs. Quarterly revenue contracted year on year, yet quarterly earnings growth accelerated, a mix that typically points to better program economics and overhead discipline. Profitability remains thin by design for auto suppliers, but the combination of operating margin at 4.91% and positive cash conversion (levered free cash flow of 1.26B) indicates the margin base is improving. The July earnings beat, alongside expansion in Asia, supports the view that geographic diversity and product mix can offset softer build schedules in North America and Europe.

Sustainability hinges on two levers: maintaining price/cost alignment with OEMs and converting awarded programs without launch friction. The balance sheet is serviceable—total cash 1.54B versus total debt 8.12B with a current ratio of 1.16—yet it leaves limited room for error if volumes retrench. The dividend looks covered by free cash flow, with a 45.07% payout providing flexibility should macro conditions tighten. Volatility is part of the setup (beta 1.68), so execution needs to remain crisp through model changeovers and the Veoneer active safety integration to avoid swings in working capital and launch costs.

Strategically, Magna is positioned where content per vehicle is rising: electric powertrain systems, active safety/ADAS, and software‑enabled features. The Veoneer acquisition deepens the sensor, software, and systems stack, potentially improving pricing power when bundled with existing body, seating, and powertrain offerings. Partnerships—such as work with Ford on autonomous features and the collaboration with LG—help anchor technology roadmaps and de‑risk capital outlays. Against sector pressures (European restructuring, uneven EV adoption, and program delays), scale and a multi‑region footprint are differentiators that can support steadier utilization and supplier scorecard wins.

From a market narrative perspective, the path to multiple expansion depends less on headline growth and more on durable margins and cash flow. If Magna continues to show that earnings can grow faster than sales through mix and cost control, investors are likely to reward the stability of returns. Institutional ownership (77.06%) and low short interest (1.74% of float) suggest the shareholder base is patient, but it will look for proof that ADAS and electrification content translate into higher returns on capital. Near‑term share performance will track backlog conversion, launch quality, and the cadence of awards in active safety; over multiple years, credibility on free cash flow should shape the story.

What could happen in three years? (horizon October 2025+3)

| Scenario | Narrative (October 2028) |

|---|---|

| Best case | EV and ADAS take‑rates rise steadily; Magna integrates Veoneer smoothly, wins incremental awards across North America, Europe, and Asia, and passes through higher input costs. Margins widen on richer content and stable launches, cash conversion stays strong, and dividend growth is supported by disciplined capex and selective bolt‑ons. |

| Base case | Global builds remain choppy but stable; Magna offsets flat volumes with mix and productivity. Active safety and e‑powertrain contribute a larger share without execution missteps. Free cash flow comfortably funds the dividend and modest buybacks while leverage trends sideways. |

| Worse case | OEM production cuts and pricing pressure collide with launch inefficiencies, eroding already thin margins. Integration costs linger, EV adoption slows further, and working‑capital needs rise. Free cash flow tightens, forcing tougher capital allocation choices and weighing on the equity narrative. |

Projected scenarios are based on current trends and may vary based on market conditions.

Factors most likely to influence the share price

- Execution on ADAS and electrification programs post‑Veoneer integration, including launch quality and cost discipline.

- OEM production schedules and pricing negotiations across North America and Europe amid cyclical demand and labor costs.

- Input costs (energy, materials) and foreign exchange swings affecting margin pass‑through and reported results.

- Cash generation versus capital needs for R&D, tooling, and selective M&A; dividend sustainability and policy.

- Competitive dynamics from global suppliers and Chinese entrants, including potential price undercuts and technology shifts.

- Regulatory changes impacting safety content mandates and EV incentives, affecting take‑rates and program timing.

Conclusion

Magna’s setup into 2026–2028 is a classic supplier trade: thin margins but improving mix, a better cash engine, and leverage that must be managed. Revenue is under modest pressure while earnings trend better on cost and program quality, and institutional ownership provides a stable base. The equity story improves if ADAS and electrification content scale without launch friction and if pricing holds against input costs. Conversely, choppy production and slower EV adoption could compress utilization and delay awards. The dividend appears supported by free cash flow, giving management room to prioritize balance‑sheet resilience and targeted investment. Watch next 1–2 quarters: backlog conversion from active safety wins; pricing recovery versus metals and labor; integration milestones for Veoneer; working‑capital discipline through model changeovers. Over a three‑year horizon, consistent execution—not bold promises—will determine whether Magna earns a sturdier multiple and a more durable narrative.

This article is not investment advice. Investing in stocks carries risks and you should conduct your own research before making any financial decisions.