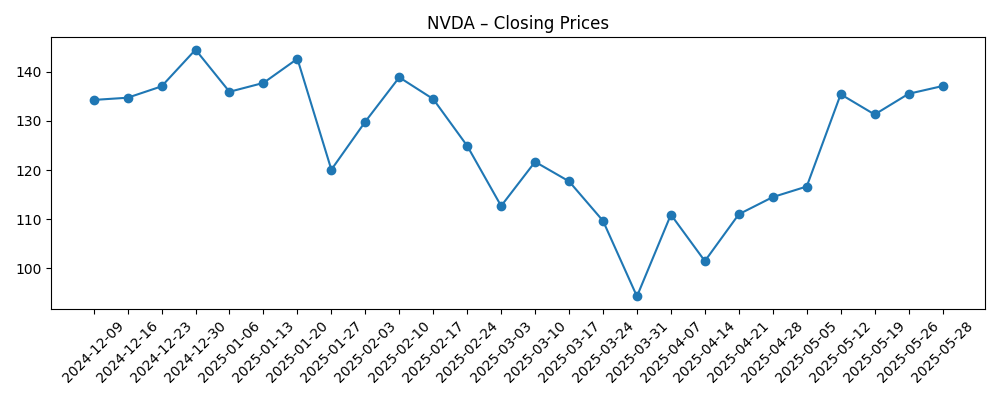

As of May 2025, NVIDIA Inc. (NVDA) sees fluctuating market conditions impacting its stock performance. After reaching a high of $144.47 in late December 2024, share prices have experienced significant volatility, dropping to as low as $94.31 in March 2025 before stabilizing around the $135 mark. Key analysts note NVIDIA's leadership in AI and gaming sectors amid increasing competition. This report explores NVIDIA's recent financial performance, critical market headlines, and potential future scenarios as the company positions itself for growth amidst technological advancements and market fluctuations.

Key Points as of May 2025

- Revenue: $26 billion in FY2024, projected growth in AI segments.

- Profit/Margins: Operating margin around 30%.

- Sales/Backlog: Increased demand for AI chips boosting backlog.

- Share price: Recent stabilization around $135.

- Analyst view: Mixed; some bullish on AI, others cautious due to competition.

- Market cap: Approximately $335 billion.

- Notable headlines from the past 6 months:

- Thunder Compute (YC S24) Is Hiring a C++ Low-Latency Systems Developer [Hacker News]

- AI Is Bigger Than NVIDIA, Analyst Says Buy Broadcom (AVGO) [Yahoo Entertainment]

- Big Tech Goes From Safest Bet to Biggest Question... [Yahoo Entertainment]

- This Nvidia Analyst Begins Coverage On A Bearish Note; Here Are Top 5 Initiations For Wednesday [Biztoc.com]

- GameStop, IonQ, And CoreWeave Are Among Top 11 Large-Cap Gainers Last Week (May 19-May 23) [Biztoc.com]

Share price evolution – last 6 months

Opinion

NVIDIA's recent stock volatility can be attributed to several factors, including broader market sentiment and shifts in competitive landscapes. The company's strong position in AI technologies is encouraged by growing demand, yet analysts express concern over potential competitors like Broadcom. As NVIDIA navigates this complex environment, how it adapts its strategy will be crucial for maintaining investor confidence.

Moreover, the contrasting views expressed in recent analyst reports highlight the uncertainty surrounding NVIDIA's future growth. Some analysts are bullish, expecting that strong demand for GPU technologies will counterbalance competitive pressures. Others suggest caution, urging investors to consider the potential risks associated with market saturation and technological advancements by rivals.

As NVIDIA works to innovate its product lines, maintaining leadership in sectors such as AI and gaming will be essential for sustaining growth. The company’s ability to attract top talent, as indicated by hiring initiatives like Thunder Compute's, demonstrates its commitment to innovation, which could play a pivotal role in shaping future performance.

What could happen in three years? (horizon May 2025+3)

| Scenario | Potential Share Price | Key Factors |

|---|---|---|

| Best | $200+ | Strong AI growth, market leadership expansion. |

| Base | $150 | Steady growth in gaming and AI sectors. |

| Worse | $100 | Increased competition, market share loss. |

Note: Projections are subject to market conditions and company performance.

Factors most likely to influence the share price

- Technological advancements in AI and gaming sectors.

- Competitive actions by other tech firms.

- Global economic conditions affecting demand.

- NVIDIA's ability to innovate and attract talent.

Conclusion

NVIDIA's future holds significant promise, yet remains fraught with challenges as competition intensifies in the technology sector. The company's recent financial performance indicates resilience, but strategic adjustments will be necessary to navigate the evolving landscape successfully. Investors should remain attentive to both NVIDIA's innovations and competitor activities while considering the macroeconomic environment impacting technology investments. Maintaining a balanced perspective between optimism and caution will be important as NVIDIA seeks to solidify its market leadership in AI and gaming.

This article is not investment advice. Investing in stocks carries risks and you should conduct your own research before making any financial decisions.