Tencent’s three-year setup has brightened after a powerful equity rebound and steadier operating delivery. Over the past year, the share price outperformed, up 49.43%, while profitability remained resilient with a profit margin of 29.54%. The near-term story is about execution: keeping games, advertising and fintech growing without sacrificing discipline, and translating traffic leadership into cash returns. Partnerships in premium content and studios, alongside ongoing investment in technology, suggest a focus on quality revenue rather than volume alone. Legal friction around intellectual property underscores the need for strong governance but is unlikely to alter the core trajectory unless it broadens. For China’s internet sector, the mix is improving as macro stabilizes and regulation normalizes in practice even if policy risk persists. For investors, the change matters because improving growth with high margins can sustain a re-rating, provided cash generation stays healthy and external risks—regulatory, competitive and legal—remain contained.

Key Points as of October 2025

- Revenue – TTM revenue stands at 704.16B with quarterly revenue growth (yoy) of 14.50%; revenue per share is 76.94.

- Profit/Margins – Profit margin 29.54% and operating margin 32.58%; EBITDA 245.76B and net income 208B indicate healthy economics.

- Sales/Backlog – Backlog data not disclosed; near-term sales depend on new game approvals, live-ops performance, advertising recovery and fintech payment volumes.

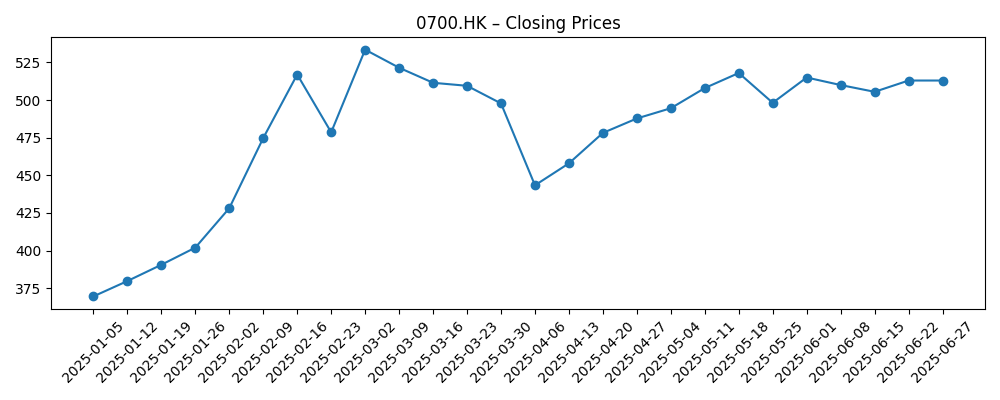

- Share price – Last weekly close 651.5; 52-week change 49.43%, high 683.0, low 364.8; 50-day MA 614.29; 200-day MA 512.487; beta 0.57; avg volume (3M) 18.89M.

- Analyst view – Street consensus and targets not provided here; focus remains on sustaining double-digit growth across games, ads and fintech while defending margins.

- Market cap – Not disclosed in the supplied data; Tencent remains among the largest Hong Kong–listed internet platforms by scale.

- Balance sheet & cash flows – Total cash 380.44B vs total debt 412.49B; current ratio 1.25; operating cash flow 283.33B; levered free cash flow 120.25B.

- Capital returns – Forward dividend rate 4.5 (yield 0.69%); trailing dividend 4.23; payout ratio 18.60%; last ex-dividend date 5/16/2025.

- Qualitative – Regulation of games/fintech remains the main swing factor; partnerships and international content help diversify, while IP litigation introduces headline risk.

Share price evolution – last 12 months

Notable headlines

- Tencent accuse Sony of trying "to fence off a well-trodden corner of popular culture" with their Horizon copyright lawsuit

- Tencent Attacks Sony Lawsuit Over Game Accused Of Copying Horizon

- Tencent responds to Sony lawsuit against "slavish" Horizon clone, stating its claims of originality are "startling"

- Ubisoft and Tencent form new subsidiary, Vantage Studios, to lead development for the Assassin’s Creed, Far Cry, Rainbow Six franchises

Opinion

Tencent’s current profile blends renewed growth with disciplined execution. Reported quarterly revenue growth of 14.50% year on year and earnings growth of 16.80%, alongside a 32.58% operating margin, point to attractive unit economics at scale. The key driver appears to be a balanced mix of games, advertising and fintech services, coupled with cost control that lets incremental revenue fall through to profit. With TTM revenue at 704.16B and gross profit of 385.04B, the company has room to invest in content, cloud and safety systems without destabilizing margins. The quality question is whether this pace is fueled by sustainable engagement and monetization or by easy comps and temporary cost saves; the next few quarters should clarify as new content cycles and ad demand normalize.

Cash generation supports the story. Operating cash flow of 283.33B and levered free cash flow of 120.25B provide flexibility for content partnerships and infrastructure while funding dividends (payout ratio 18.60%). Liquidity looks manageable with 380.44B in cash versus 412.49B in debt and a current ratio of 1.25. On the market side, momentum is constructive: shares sit above the 50-day and 200-day moving averages, with a 52-week change of 49.43% and beta at 0.57, signaling lower volatility than many tech peers. The upshot is a platform that can self-fund growth and absorb shocks—provided capital allocation stays disciplined and legal/regulatory surprises are contained.

Industry dynamics will shape the slope of the curve. China’s games and fintech rules continue to evolve, making approval cadence and compliance costs key variables. Against that, the Ubisoft partnership to form Vantage Studios suggests Tencent is deepening access to global franchises—helpful for pipeline diversity and overseas reach. IP litigation tied to Sony’s Horizon underscores the importance of robust content vetting; it is a reputational and execution risk more than a near-term P&L swing based on publicly available information. Meanwhile, broader trends—advertisers seeking performance, players favoring live services, and domestic platforms investing in AI-enhanced experiences—could support engagement and ad yield if executed prudently.

The narrative over the next three years may hinge less on headline growth and more on its composition. If games, ads and fintech contribute in a balanced way and margins hold near historical levels, investors could keep assigning a platform premium. Conversely, if regulation tightens, game approvals slow or competition from domestic platforms intensifies, the market may reapply a risk discount even with solid cash flow. Strategic partnerships and measured international expansion can partially offset country-specific risk, while steady dividends and potential incremental returns could anchor sentiment. In short, the multiple will likely track confidence in durable, policy-compliant growth rather than any single product cycle.

What could happen in three years? (horizon October 2025+3)

| Scenario | Narrative |

|---|---|

| Best | Game approvals and live-ops cadence remain supportive; international partnerships (e.g., Ubisoft collaboration) broaden the pipeline; ads and fintech scale with improved targeting and compliance. Margins stay resilient as operating leverage offsets content and trust & safety spend. Confidence in durable growth narrows the China risk discount. |

| Base | Growth normalizes at solid double digits with periodic regulatory checks; a balanced mix of flagship titles, mid-core updates and social ads supports steady cash generation. Fintech grows in line with consumption, and dividends remain a modest, consistent component of returns. The valuation range-bound, tracking execution and macro headlines. |

| Worse | Approval pace slows and new titles underperform; advertising softens on macro and competitive pressure; additional compliance burdens raise costs. Legal disputes broaden or linger, sapping management bandwidth. Investors reapply a heavier policy discount, compressing the multiple despite ongoing cash flow. |

Projected scenarios are based on current trends and may vary based on market conditions.

Factors most likely to influence the share price

- Regulatory actions affecting games approvals, fintech operations and data governance in China.

- Game pipeline execution and live-ops performance, including outcomes of major partnerships.

- Advertising demand and monetization trends across social and short-form formats.

- Capital allocation discipline (content investment, potential buybacks/dividends) versus leverage and liquidity.

- Macro conditions in China—consumer spending, employment and sentiment—impacting payments and ads.

- IP litigation outcomes and broader competitive dynamics with domestic platforms.

Conclusion

Tencent enters the next three years with a sturdier foundation: double-digit top-line growth, high margins and ample cash generation. The market has begun to reflect that with a strong price recovery, but the durability of the move will be tested by the mix of growth (games, ads, fintech), regulatory posture and the pace of new content approvals. Partnerships that extend premium IP and international reach could mitigate country risk, while steady dividends help frame capital returns without constraining investment. The most credible path forward is execution-led—delivering consistent engagement and monetization while keeping compliance costs in check and resolving IP disputes efficiently. Watch next 1–2 quarters: new-title approvals and reception; social advertising demand; fintech take rates and credit exposure; operating margin discipline; cash conversion; signals from regulators on game time/monetization mechanics.

This article is not investment advice. Investing in stocks carries risks and you should conduct your own research before making any financial decisions.