Taiwan Semiconductor Manufacturing Co. (TSMC; 2330.TW) is the world’s largest pure‑play semiconductor foundry, supplying advanced logic chips to fabless and integrated device makers serving smartphones, high‑performance computing/AI, auto and IoT. Key competitors include Samsung Foundry, Intel Foundry Services, GlobalFoundries and UMC, with competition centered on leading‑edge process technology and capacity availability.

Financially, TSMC reports revenue (ttm) of 3400 billion, gross profit of 1990 billion and EBITDA of 2350 billion. Profit margin stands at 42.48% and operating margin at 49.63%, with quarterly revenue growth of 38.60% year over year and quarterly earnings growth of 60.70%. Net income attributable to common is 1440 billion; diluted EPS is 55.68. Liquidity is robust with total cash of 2630 billion versus total debt of 1010 billion and a current ratio of 2.37. ROE is 34.20% and ROA is 15.96%. The forward annual dividend rate is 20 (1.54% yield) with a 30.51% payout ratio; next ex‑dividend date is 12/11/2025.

Key Points as of September 2025

- Revenue and earnings momentum: revenue (ttm) 3400 billion; net income 1440 billion; quarterly revenue growth 38.60% yoy and quarterly earnings growth 60.70% yoy.

- Margins remain industry‑leading: profit margin 42.48% and operating margin 49.63%; gross profit 1990 billion.

- Balance sheet and liquidity: total cash 2630 billion vs total debt 1010 billion; current ratio 2.37; operating cash flow 2130 billion and levered free cash flow 694.67 billion.

- Sales mix/backdrop: demand led by AI/HPC and premium smartphones; order visibility strengthened by hyperscaler and handset cycles (backlog not disclosed).

- Share price performance: 52‑week range 780.00–1,340.00; recent close at 1,340.00 with 52‑week change of 31.21%. Above 50‑day (1,176.50) and 200‑day (1,057.82) moving averages; beta 1.20.

- Trading activity: 3‑month average volume 29.49M; 10‑day average 31.98M, indicating elevated interest into recent highs.

- Analyst/investor sentiment: recent coverage frames TSMC as a key AI beneficiary and favored large‑cap semiconductor foundry.

- Ownership and scale: shares outstanding 25.93B; float 24.17B; institutions hold 42.69%.

- Regulatory watch: U.S. revocation of fast‑track export status for a China facility adds compliance friction and potential schedule risk.

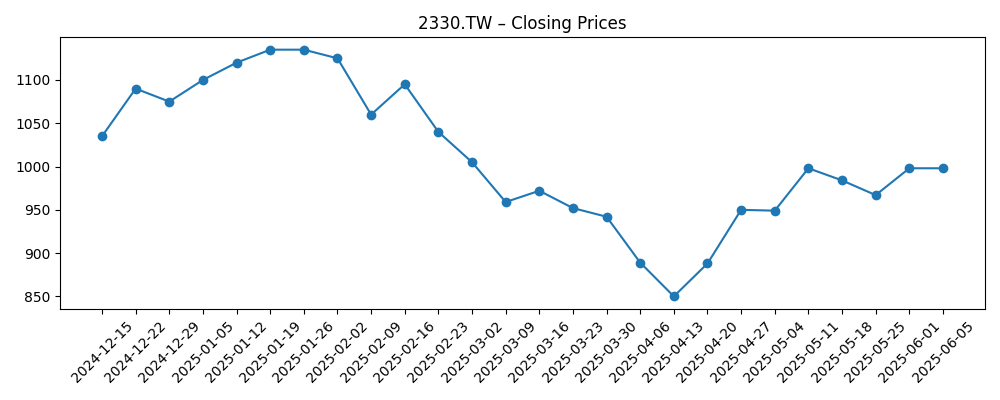

Share price evolution – last 12 months

Notable headlines

- US revokes TSMC’s fast-track export status for Chinese facility

- TSMC Stock: Wall Street’s Most Overlooked AI Play?

- Wall Street Loves Taiwan Semi. Should You Buy TSM Stock Now?

Opinion

Investors have rewarded TSMC’s return to strong growth, pushing the shares to a 52‑week high of 1,340.00 as AI‑related demand accelerates. The stock now trades well above its 50‑ and 200‑day moving averages, reflecting confidence in sustained leading‑edge utilization.

However, the U.S. revocation of fast‑track export status for a China facility is a timely reminder that regulatory risk remains. While not a demand shock, it could complicate tooling timelines and approvals, adding execution friction and potential cost or schedule slippage at the margin.

Recent bullish coverage positioning TSMC as an “overlooked” AI play highlights the foundry’s centrality to advanced processors. The company’s margin profile (49.63% operating, 42.48% net) and ample cash provide resilience to navigate near‑term policy and supply chain challenges.

Over the next three years, the investment case hinges on translating AI and premium handset cycles into consistent cash generation, while managing geopolitical and export‑control complexities. On balance, fundamentals support a constructive stance, tempered by policy headlines.

What could happen in three years? (horizon September 2025+3)

| Scenario | Main drivers | Equity implications |

|---|---|---|

| Best | AI/HPC ramps sustain high utilization at leading nodes; smartphone mix stabilizes; regulatory processes become predictable. | Consistent double‑digit growth, margin resilience, strong cash generation supports dividends and capex; sentiment remains favorable. |

| Base | AI demand normalizes; handset recovery uneven; export reviews add moderate delays but are manageable operationally. | Steady growth with periodic volatility; valuation tracks earnings progression; dividend continuity with disciplined capex. |

| Worse | Tighter export controls and geopolitical tensions disrupt schedules; slower node transitions; macro softness in electronics. | Lower utilization and pricing pressure weigh on margins; multiple compresses until policy clarity and demand recovery return. |

Projected scenarios are based on current trends and may vary based on market conditions.

Factors most likely to influence the share price

- Pace of AI/HPC chip demand from hyperscalers and leading device makers.

- Export‑control and licensing outcomes, especially affecting China‑related facilities and tooling.

- Yield, cycle time and cost performance at leading‑edge nodes versus peers.

- Global smartphone and PC unit trends and product mix shifts.

- Capital intensity, free cash flow trajectory and dividend policy execution.

Conclusion

TSMC enters the next three years with clear strengths: accelerating revenue growth (38.60% yoy in the latest quarter), industry‑leading margins and a fortress‑like liquidity position (2630 billion cash vs 1010 billion debt; current ratio 2.37). Investor sentiment is constructive, as reflected in the share price reaching 1,340.00 and trading above key moving averages. The core bull case is that AI/HPC demand and premium handset mix keep leading‑edge fabs highly utilized, underpinning cash generation and supporting dividends and disciplined capex. The principal counterweights are policy and execution risks, underscored by the revoked fast‑track export status for a China facility. While this does not alter end‑demand, it can introduce timing and compliance costs. On balance, fundamentals justify a positive medium‑term outlook, with recognition that policy headlines and macro electronics cycles can inject volatility into the path.

This article is not investment advice. Investing in stocks carries risks and you should conduct your own research before making any financial decisions.