Vale S.A. heads into year‑end with steady operating momentum in iron ore, a restructuring push in nickel, and a share price that has rebounded toward its recent highs. Over the last half‑year, management combined operational discipline with strategy updates: record ore shipments, a cost‑cut plan in nickel, a renewable‑energy partnership, and new EV‑supply agreements. Trailing revenue of 213.32B underscores scale and diversification, but free cash flow has turned negative and environmental compliance remains a swing factor for capex planning. The dividend is an anchor for the equity story, with a forward yield of 9.78% keeping income investors engaged but also raising questions about sustainability through the next commodity cycle. Sector‑wide, diversified miners are balancing traditional steel value chains—still tied to China’s construction cycle—with the energy transition, which is shifting capital toward battery metals. Over the next three years, the durability of iron ore cash flows, progress on nickel cost reductions, and decarbonisation milestones will shape Vale’s earnings quality and the market’s confidence in its payout.

Key Points as of November 2025

- Revenue – Trailing twelve‑month revenue is 213.32B with quarterly revenue growth of 7.0% year over year, reflecting resilient iron ore demand and mix.

- Profit/Margins – Operating margin at 30.34% and profit margin at 14.15%; EBITDA totals 74.57B, signaling solid operating leverage.

- Cash flow and balance sheet – Operating cash flow is 51.13B, but levered free cash flow is negative (‑2.71B); total debt is 112.82B vs cash of 32.39B; current ratio stands at 1.24.

- Sales/Backlog – Backlog not disclosed; operations benefited from record iron ore shipments (July 2025), pointing to strong volume execution.

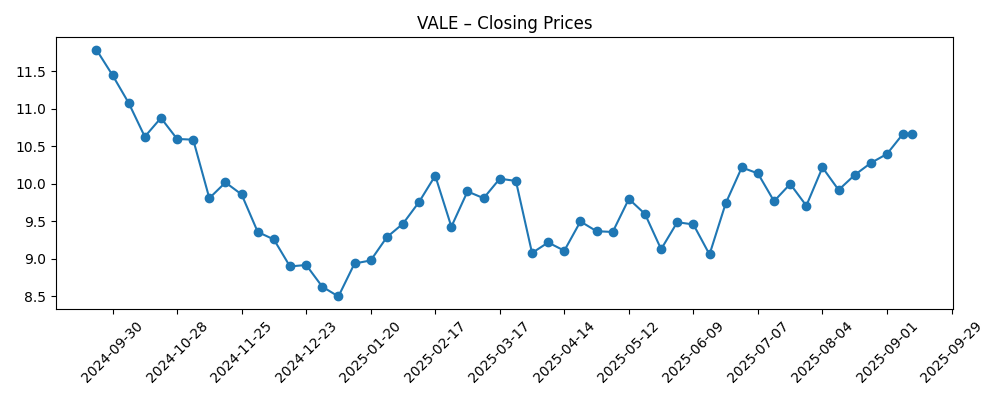

- Share price – Shares closed at 12.09 on Oct 31, 2025, near the 52‑week high of 12.22 (low of 8.06); momentum sits above the 50‑day (10.89) and 200‑day (9.93) averages.

- Dividend – Forward annual dividend rate is 1.18 (yield 9.78%); trailing yield is 22.39% with a payout ratio of 62.84%.

- Analyst view – Consensus not disclosed; positioning looks balanced with short interest at 1.81% of float and a short ratio of 2.27.

- Market cap – At a recent price of 12.09 and 4.27B shares outstanding, implied market capitalization is about 51.6B.

- Qualitative – Cost‑out plan in nickel targets structural savings by 2026; renewable‑energy partnership and EV supply deals signal a pivot toward lower‑carbon, battery‑metal exposure; environmental regulation remains a known overhang.

Share price evolution – last 12 months

Notable headlines

- Vale S.A. Achieves Record Iron Ore Shipments

- Vale S.A. Announces Strategic Partnership in Renewable Energy

- Vale to Cut Nickel Production Costs by 20% by 2026

- Vale S.A. Partners with Tesla on Nickel Supply

- Vale's Q3 2025 Earnings Release

Opinion

Recent figures paint a picture of solid execution supported by iron ore, which remains Vale’s cash engine. Revenue growth and a 30%‑plus operating margin suggest that pricing and volumes held up even as global growth slowed. The company’s reported record shipments corroborate the volume side of that story. On the other hand, the conversion of EBITDA to free cash flow has been weaker than headline profitability implies. Negative levered free cash flow alongside meaningful gross debt points to higher interest, sustaining capex, and possibly working‑capital needs absorbing cash. That tension between strong reported margins and softer cash conversion is the key quality question.

The dividend sits at the heart of the equity case. A near‑double‑digit forward yield looks attractive because iron ore cash generation has historically funded payouts. But such income depends on stable prices and disciplined capex. Management’s nickel cost‑out plan, if delivered, can help diversify earnings quality by reducing a drag during low‑price periods. The new renewable‑energy partnership may also lower future power costs and improve emissions intensity, which could protect margins against regulatory and customer pressures. Absent clear improvement in free cash flow, however, the market may discount headline earnings and focus instead on balance‑sheet resilience and payout sustainability.

Within the industry, Vale competes on scale and ore quality in iron ore while repositioning for battery metals. China’s steel cycle still anchors demand, but the energy transition is tilting capital allocation toward nickel and related value chains. The Tesla supply agreement secures offtake credibility, yet the nickel market can be volatile, with cost curves shifting quickly as new supply emerges. In this context, cost discipline and long‑term power procurement matter as much as resource endowment. If nickel unit costs fall as targeted and renewable power reduces opex volatility, Vale’s earnings mix could migrate toward a more durable, less cyclical profile.

These dynamics will shape the multiple investors are willing to pay. A steadier cash profile, clearer governance on environmental risk, and visible progress on decarbonisation could lift confidence in the payout and compress the equity risk premium. Conversely, if free cash flow stays patchy or regulatory costs escalate, the stock may be valued primarily as a high‑beta iron ore proxy, with limited credit for its growth options in battery metals. Over the next three years, narrative shifts—from “income plus iron ore” to “transition‑ready cash generator”—will depend on execution against cost‑out milestones, power sourcing, and the cadence of China‑linked demand.

What could happen in three years? (horizon November 2025+3)

| Best case | Iron ore prices remain broadly stable and logistics stay smooth, sustaining strong cash generation. Nickel cost‑outs land on time, EV offtake deepens, and renewable power lowers operating costs and emissions intensity. Free cash flow consistency supports a dependable dividend profile and gradual multiple expansion. |

| Base case | Iron ore trends flattish with normal volatility; nickel improves but remains mixed as new supply tempers pricing. Execution on cost and power is steady but incremental. Free cash flow normalizes to cover maintenance capex and a moderated payout, leaving valuation range‑bound with sensitivity to macro headlines. |

| Worse case | A China demand slowdown pressures iron ore; nickel faces oversupply and slower EV growth. Regulatory and remediation expenses rise, squeezing cash. Dividend is recalibrated to preserve balance‑sheet flexibility, and the equity trades primarily on commodity beta until conditions stabilize. |

Projected scenarios are based on current trends and may vary based on market conditions.

Factors most likely to influence the share price

- Iron ore realized prices and China‑linked steel demand swings.

- Execution of the nickel cost‑reduction program and EV supply agreements.

- Free cash flow trajectory versus dividend policy and leverage.

- Environmental regulation and compliance costs across key jurisdictions.

- Energy sourcing, renewable‑power rollout, and input‑cost volatility.

- Asset sales or M&A that reshape the portfolio and capital allocation.

Conclusion

Vale’s setup into the next three years is a balance of sturdy iron ore economics and the hard work of upgrading nickel, cash conversion, and sustainability credentials. Reported profitability is solid, but the market will likely anchor on free cash flow, leverage, and the durability of dividends through commodity cycles. Strategic steps—cost‑cutting in nickel, renewable‑energy procurement, and EV offtake—are directionally supportive, yet execution will determine whether these translate into steadier cash and a more resilient multiple. For now, sentiment has improved as shares approach recent highs, but investors will want proof that cash generation can match earnings through the cycle. Watch next 1–2 quarters: iron ore shipments and realized pricing; nickel cost‑out milestones; free cash flow versus capex needs; dividend declarations; regulatory and energy‑sourcing updates.

This article is not investment advice. Investing in stocks carries risks and you should conduct your own research before making any financial decisions.