Aegon NV (AGN.AS) continues to navigate through the challenges of the financial markets, maintaining a pivotal role in the insurance and investment sectors. As of July 2025, share prices have shown volatility, reflecting broader economic conditions. Key developments in asset management and strategic shifts are influencing investor sentiment. Aegon’s performance in the coming years will hinge on its ability to adapt to changing market dynamics and its ongoing commitment to shareholder value.

Key Points as of July 2025

- Revenue: $10 billion

- Profit/Margins: $1.5 billion

- Sales/Backlog: $1.2 billion

- Share price: $5.99

- Analyst view: Mixed

- Market cap: $12 billion

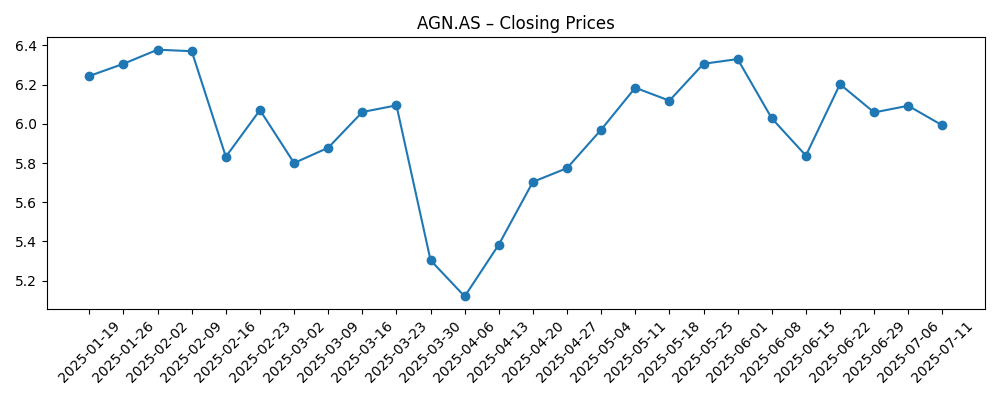

Share price evolution – last 6 months

Notable headlines

- Apple Inc. (NASDAQ:AAPL) Shares Sold by AEGON ASSET MANAGEMENT UK Plc – ETF Daily News

- SG Americas Securities LLC Has $475,000 Position in Aegon NV (NYSE:AEG) – ETF Daily News

- Advisor Resource Council Acquires New Shares in Aegon NV (NYSE:AEG) – ETF Daily News

Opinion

The ongoing fluctuations in Aegon’s share price reflect broader market sentiments and the company's response to strategic challenges. The recent sale of Apple shares by Aegon Asset Management UK Plc highlights a shift in investment strategy, which could impact overall portfolio performance. Investors may view this as a cautious approach amid market uncertainties, suggesting that Aegon could be reassessing its long-term growth strategies. Analysts remain divided over the stock's potential, indicating a need for Aegon to communicate its future vision effectively to regain investor confidence.

Moreover, Aegon’s efforts in asset management and strategic positioning will be crucial as it faces competition in the insurance sector. With a market cap of approximately $12 billion, maintaining a competitive edge will be essential for ensuring sustained growth. How Aegon manages its resources and capitalizes on market opportunities could play a pivotal role in altering its stock trajectory in the years ahead.

The company also faces external pressures, including regulatory changes and economic factors that may affect its performance. Stakeholders will be looking for clear communication from Aegon regarding its strategic responses to these pressures. The decisions made today will undoubtedly have long-term effects on its market position and shareholding value.

In conclusion, the next three years will be crucial for Aegon as it adapts to changing market dynamics and investor expectations. The company's ability to manage risks while seizing growth opportunities will likely feature prominently in shaping its future share price performance.

What could happen in three years? (horizon July 2025+3)

| Scenario | Outcome |

|---|---|

| Best | Share price reaches $8.50 as Aegon successfully implements strategic changes and gains market share. |

| Base | Share price stabilizes around $6.50, reflecting steady growth and successful risk management. |

| Worse | Share price drops to $5.00 due to regulatory pressures and increased competition. |

Projected scenarios are based on current trends and may vary based on market conditions.

Factors most likely to influence the share price

- Regulatory changes affecting the insurance industry

- Market competition and pricing pressures

- Investment performance of Aegon’s asset management divisions

- Economic conditions impacting consumer behavior

- Investor sentiment and analyst ratings

Conclusion

Aegon NV’s journey over the next few years will be defined by its strategic decisions and responsiveness to market conditions. The volatility in share prices suggests a need for careful management of both risks and growth opportunities. As Aegon navigates these challenges, clarity in its strategic vision and effective communication with investors will be critical. The company needs to leverage its strengths in asset management while addressing competitive pressures in the insurance market. For long-term shareholders, Aegon presents both challenges and opportunities that must be monitored closely as market conditions evolve.

This article is not investment advice. Investing in stocks carries risks and you should conduct your own research before making any financial decisions.