Bank of America Corporation (BAC) has experienced fluctuating stock performance and market sentiment in 2025. With a current profit margin of 28.51% and revenue reaching $98.46 billion for the trailing twelve months, BAC is navigating a competitive landscape. Recent headlines reflect both skepticism and optimism about its stock prospects, as notable analysts express mixed views. It remains crucial for investors to monitor ongoing developments, including earnings growth and market positioning, as they may significantly impact the company's trajectory over the next three years.

Key Points as of August 2025

- Revenue: $98.46B

- Profit Margin: 28.51%

- Quarterly Revenue Growth: 4.20%

- Share price: $47.27

- Analyst view: Mixed opinions from major analysts

- Market cap: Approximately $351.64B

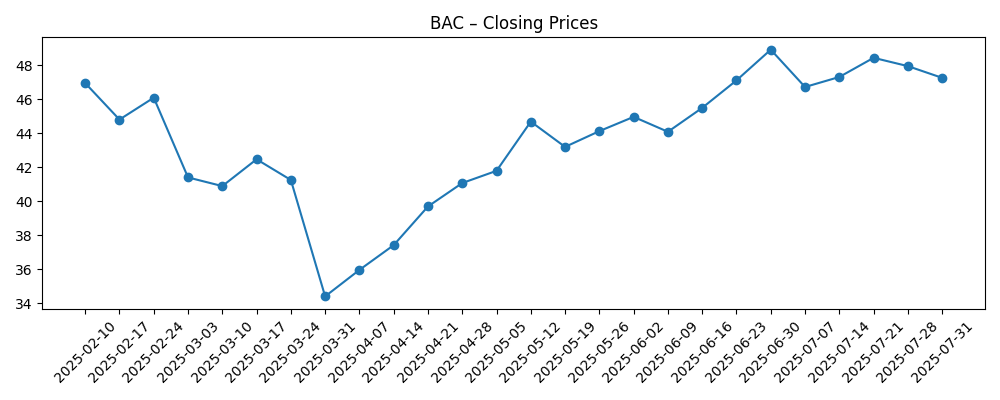

Share price evolution – last 6 months

Notable headlines

- Jim Cramer Calls Bank of America “The Weakest” in the Group

- Truist Increases PT on Bank of America to $53, Maintains Buy Rating On the Stock

- Jim Cramer Says “Don’t Wait” on Bank of America

- Bank of America Commits Over $3.5M to LA Wildfire Recovery

- Jim Cramer on Bank of America: “I Don’t Know If Buffett Or The Number Two Sold”

- Jim Cramer on Bank of America: “I Can’t Get Excited About It”

- Bank Of America Vs. JPMorgan: The Best Bank Stock To Buy For Q3 2025

Opinion

The recent fluctuations in Bank of America’s stock price illustrate the challenges facing the financial sector amid economic uncertainties. Analysts have voiced concerns, citing potential weaknesses in the company's growth strategy compared to rivals. Despite this, some analysts maintain optimistic price targets, suggesting that the market may still have room for recovery. Moving forward, it will be essential for BAC to capitalize on its existing strengths while addressing perceived vulnerabilities in its offerings.

Jim Cramer's recent commentary highlights the struggle to generate enthusiasm for BAC, especially as the investment community begins to weigh newer fintech entrants against traditional banking powerhouses. This sentiment, coupled with cautious outlooks from analysts, could weigh heavily on investor psychology and affect stock price performance. However, focused initiatives and strategic investments could help BofA regain some market confidence.

The volatility seen in BAC's stock this year correlates with broader market trends, which have been influenced by interest rate changes and economic forecasts. As the market adjusts, it is crucial for BAC to implement adaptive strategies and continue to focus on customer service excellence, especially amid rising competition.

Overall, the economic landscape will play a pivotal role in BAC’s performance over the next three years. If the bank can effectively manage both operational efficiency and market dynamics, it may see a positive trajectory, offsetting current skepticism.

What could happen in three years? (horizon August 2025+3)

| Scenario | Outcome |

|---|---|

| Best | Achieves robust revenue growth, improving sentiment leads to a share price of $65 |

| Base | Steady growth with improved operational efficiency, resulting in a share price of $55 |

| Worse | Continued competitive pressures and stagnation, leading to a share price of $40 |

Projected scenarios are based on current trends and may vary based on market conditions.

Factors most likely to influence the share price

- Economic recovery and interest rate changes

- Competition from fintech and other banks

- Management effectiveness in executing growth strategies

- Regulatory changes impacting profitability

Conclusion

In summary, Bank of America stands at a crossroads where it must navigate market volatility and adapt to evolving industry dynamics. While the recent headlines reveal mixed analyst sentiments, the company has fundamental strengths such as a solid profit margin and impressive revenue figures. Addressing current challenges through strategic initiatives could bolster investor confidence and drive future growth. Over the next three years, BAC's ability to deliver sustained performance will likely hinge on its responsiveness to economic fluctuations and competition. Investors should keep a close eye on upcoming financial disclosures and market movements for more insight.

This article is not investment advice. Investing in stocks carries risks and you should conduct your own research before making any financial decisions.