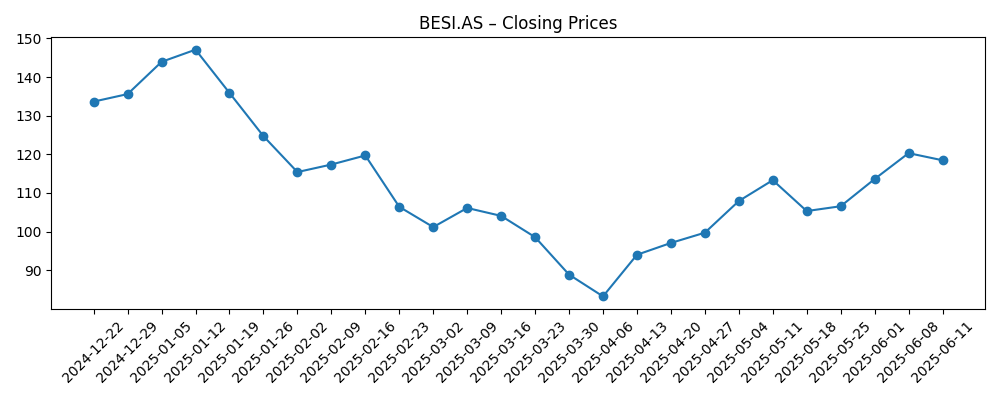

BE Semiconductor Industries N.V. (BESI.AS) has seen a decline in its stock performance over the past six months, navigating challenges such as quarterly revenue fluctuations and changing investor sentiment. Although the company reported a profit margin of 29.66% and a substantial total cash reserve, the stock's trajectory has been closely linked to broader market trends and industry competition. With a trailing annual dividend yield of 1.81% and fluctuations in earnings growth, investors are keenly watching for potential turnaround strategies and management responses to the evolving semiconductor landscape.

Key Points as of June 2025

- Revenue: $0.605B

- Profit Margin: 29.66%

- Quarterly Revenue Growth (YoY): -1.50%

- Share Price (June 11, 2025): €118.45

- Analyst View: Cautious

- Market Cap: Approximately €9.36B

Share price evolution – last 6 months

Notable headlines

Opinion

The recent decline in BE Semiconductor's stock price raises concerns about its future trajectory, particularly as the company faces stagnating quarterly revenue growth. This downturn, following a peak in late 2024, has led to increased scrutiny from analysts and investors alike. As market conditions continue to evolve, it will be crucial for the management team to address operational bottlenecks while ensuring they remain competitive within the semiconductor industry.

Furthermore, the profit margin of 29.66% signifies that there is still room for maintaining profitability despite the downturn, provided that cost-control measures are properly executed. However, the negative quarterly earnings growth compels a reevaluation of existing strategic objectives. The market's reaction will largely hinge on whether BE Semiconductor can successfully pivot to capitalize on emerging technology trends.

Looking ahead, the future stock performance will be influenced by external factors, such as changes in global demand for semiconductors and market competition. Investors should pay attention to management's ability to adapt to these changes and outline clear strategies that promote sustainable growth over the forthcoming quarters. Communication from the leadership team will be vital in restoring investor confidence.

Ultimately, while the challenges are significant, opportunities exist for BE Semiconductor Industries to regain momentum. The upcoming earnings announcements will be critical, as they will provide key insights into operational adjustments and forward-looking guidance that could positively impact the share price.

What could happen in three years? (horizon June 2025+3)

| Scenario | Projected Share Price |

|---|---|

| Best | €180 |

| Base | €130 |

| Worse | €80 |

Projected scenarios are based on current trends and may vary based on market conditions.

Factors most likely to influence the share price

- Global semiconductor demand fluctuations

- Management's strategic initiatives

- Competitors' performance and innovations

- Macroeconomic conditions impacting technology spending

Conclusion

As BE Semiconductor Industries N.V. navigates this challenging yet pivotal period, stakeholder engagement and proactive strategy implementation will be instrumental. Investors are advised to remain vigilant, not only observing quarterly performance metrics but also understanding the broader context of the semiconductor market. The company’s ability to adapt to changing dynamics in technology demand will be key to driving future growth. In one to three years, if they can capitalize on emerging trends and secure competitive advantages, there is a potential for significant recovery in share performance.

This article is not investment advice. Investing in stocks carries risks and you should conduct your own research before making any financial decisions.