GSK PLC is navigating a complex landscape as it aims to enhance its market position through strategic initiatives. The company, which has faced fluctuations in its share price and profitability, is focusing on bolstering its revenue growth and improving operational efficiency. As of July 2025, GSK's latest financial metrics indicate a profit margin of 10% and an operating margin of 30.79%. Investors are keenly observing how management's strategic decisions will unfold in the upcoming months, especially amidst ongoing industry headwinds and changing market dynamics.

Key Points as of July 2025

- Revenue: $31.53B

- Profit Margin: 10%

- Quarterly Revenue Growth (yoy): 2.10%

- Share Price: £1348.0

- Analyst View: Cautiously optimistic

- Market Cap: $54.60B

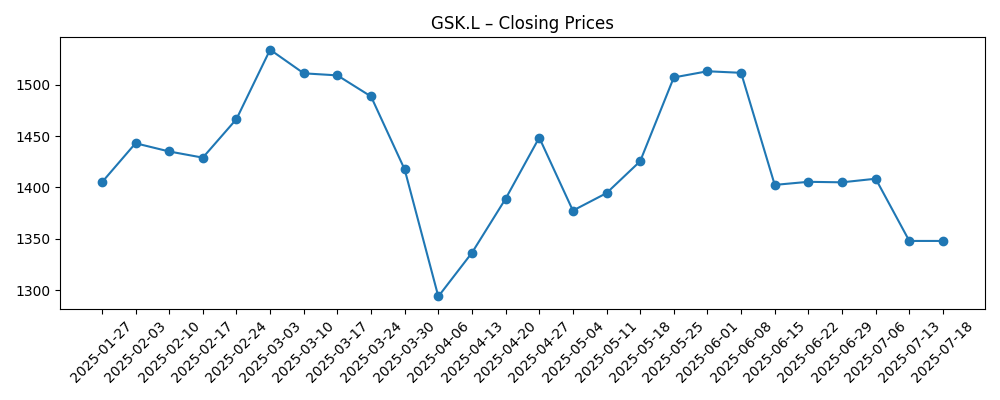

Share price evolution – last 6 months

Notable headlines

- GSK Reports Strong Quarterly Growth Amidst Industry Headwinds

- GSK Initiates Strategic Review to Focus on Core Drug Development

Opinion

The recent performance of GSK shares indicates a sentiment shift among investors, largely fueled by a 55.30% growth in quarterly earnings year-over-year. However, the stock has struggled significantly over the past year, with a 52-week decline of 11.58%. Analysts are cautiously optimistic as the company implements measures to stabilize its growth trajectory. If GSK can successfully navigate its strategic pivots and deliver on earnings expectations, it may see a positively influenced share price moving forward.

As GSK refines its operational approach and brings innovation to its product pipeline, the company is positioning itself for a potential rebound. A solid performance in upcoming quarters could help regain investor confidence and support the share price. GSK's focus on core areas of drug development may also present opportunities for new revenue streams, setting the stage for future growth.

Moreover, the company’s current debt levels warrant close monitoring. With total debt at $18.43B, its debt-to-equity ratio is high at 134.99%. Any significant changes in market conditions or interest rates could impact GSK’s profitability. Therefore, investors need to carefully assess GSK's financial health as it attempts to balance growth initiatives with debt management.

Finally, the market's response to GSK's strategic moves will likely be reflected in its share price performance over the next three years. If GSK can deliver consistent metrics and demonstrate resilience against market fluctuations, it could see a turnaround that might be reflected positively in its valuation.

What could happen in three years? (horizon July 2025+3)

| Scenario | Share Price (£) | Revenue Growth |

|---|---|---|

| Best | £1800 | 5% CAGR |

| Base | £1500 | 3% CAGR |

| Worse | £1200 | 0% CAGR |

Projected scenarios are based on current trends and may vary based on market conditions.

Factors most likely to influence the share price

- Success of new product launches

- Changes in debt levels and interest rates

- Market competition and regulatory developments

- Strategic partnerships and acquisitions

Conclusion

In summary, GSK PLC faces a pivotal moment as it endeavors to navigate a challenging market landscape while striving for growth. The notable increase in quarterly earnings presents a silver lining, yet the persistent decline in share price highlights risks that must be addressed. GSK's ability to execute its strategic initiatives effectively will be crucial in influencing investor confidence and market perception. As the company continues to adapt to evolving market conditions and investor expectations, the next three years will be critical in shaping its trajectory and overall valuation.

This article is not investment advice. Investing in stocks carries risks and you should conduct your own research before making any financial decisions.