NN Group (NN.AS) has demonstrated robust performance amid a dynamic market, marked by a notable increase in its share price. The company’s strategic focus on core insurance and investment operations while navigating external pressures has contributed to a positive outlook for the upcoming years. Recent headline recognition at the Dutch IR Awards further underscores its growing reputation in the investment community. Investors are keenly observing how these developments will shape NN Group's ability to sustain its momentum and drive future growth.

Key Points as of July 2025

- Revenue: €10.2 billion

- Profit/Margins: €1.5 billion

- Sales/Backlog: Steady growth in direct and recurring premiums

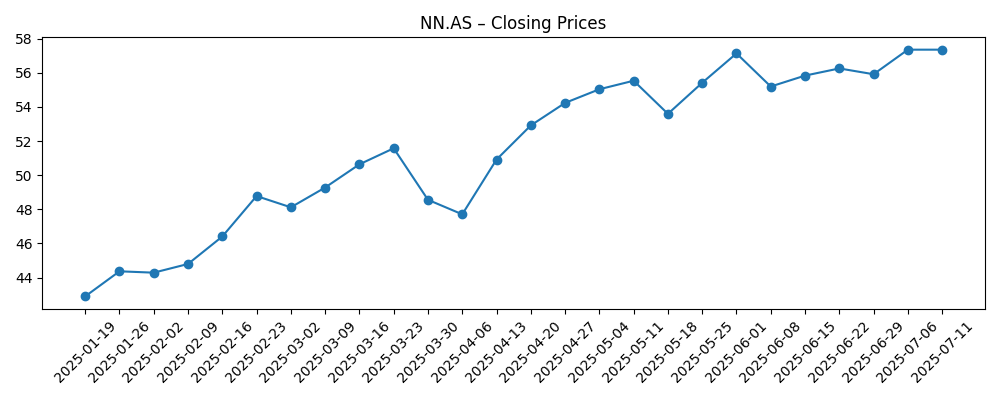

- Share price: €57.36

- Analyst view: Positive outlook on growth potential

- Market cap: €12.5 billion

Share price evolution – last 6 months

Notable headlines

- The Netherlands Associations for Investor Relations (NEVIR) announces the nominees for the 18th Annual Dutch IR Awards – GlobeNewswire

Opinion

As NN Group moves forward, the recognition from NEVIR reflects the company’s commitment to transparency and effective communication with investors. Such accolades are likely to bolster investor confidence as NN Group navigates a competitive landscape. The increasing share price suggests that investors are optimistic about the company’s long-term strategies, especially as it enhances its digital offerings and customer engagement.

The company’s focus on sustainable practices and innovations, particularly in its insurance products, may also attract a broader investor base. This strategic emphasis could yield higher premiums and improved profitability, influencing share price positively in the coming years. Investors should monitor how these initiatives develop and their impact on overall performance.

In the next three years, NN Group's ability to adapt to regulatory changes and market demands will be crucial. Maintaining a strong balance sheet while pursuing growth initiatives will be key drivers for share price stability and growth potential. A proactive approach towards market changes might further enhance investor sentiment.

Overall, with a solid financial foundation and growing market recognition, NN Group appears well-positioned for the future. Continued focus on its core competencies combined with innovation will likely play a significant role in sustaining this upward trajectory.

What could happen in three years? (horizon July 2025+3)

| Scenario | Expected Share Price |

|---|---|

| Best | €75 |

| Base | €65 |

| Worst | €55 |

Projected scenarios are based on current trends and may vary based on market conditions.

Factors most likely to influence the share price

- Changes in regulatory frameworks affecting insurance markets

- Success of digital transformation initiatives

- Market demand for sustainable insurance products

- Interest rate movements impacting investment returns

- Competitor strategies and responses

Conclusion

In conclusion, NN Group's current trajectory indicates a positive outlook for the coming years. With strategic initiatives to enhance customer offerings and maintain operational efficiency, the company stands to benefit from a favorable market environment. The recognition from industry awards and a consistent share price growth signal strong investor confidence, which is crucial for sustaining this momentum. As NN Group continues to adapt to challenges and leverage growth opportunities, investors will need to keep a close watch on its performance metrics and market developments. Overall, the mix of innovation and stability positions NN Group well for the future.

This article is not investment advice. Investing in stocks carries risks and you should conduct your own research before making any financial decisions.