Roche Holding AG (ROG.SW) finds itself navigating a complex landscape characterized by recent volatility in its stock performance. With a market cap of $207.20 billion and a diverse product portfolio, the company is focusing on maintaining growth amid challenges such as fluctuating profit margins and competitive pressures in the pharmaceutical sector. The trailing P/E ratio stands at 25.07, while the forward P/E suggests more favorable earnings potential. As we analyze Roche's trajectory, it becomes imperative to consider both its financial fundamentals and the broader market dynamics influencing its future performance.

Key Points as of July 2025

- Revenue: $62.39B

- Profit/Margins: Net Income $8.28B, Profit Margin 13.27%

- Sales/Backlog: Quarterly Revenue Growth 6.10%

- Share price: $258.5

- Analyst view: Forward P/E 13.37, PEG Ratio 0.74

- Market cap: $207.20B

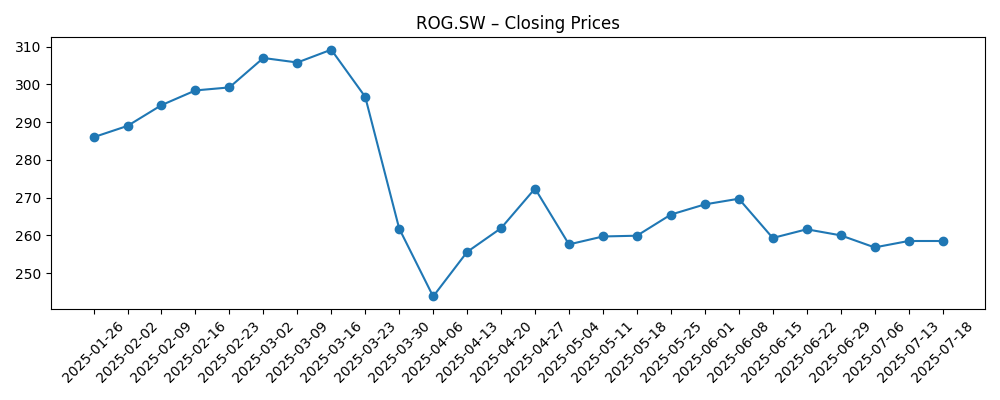

Share price evolution – last 6 months

Notable headlines

- Roche Achieves Major Milestone in Cancer Treatment Research

- Roche Faces Legal Challenges Over Patent Disputes

- Roche Reports Significant Drop in Quarterly Earnings

Opinion

Roche's recent challenges, including a significant drop in quarterly earnings, highlight the volatility inherent in the pharmaceutical sector. This downturn, emphasized by a quarterly earnings growth year-over-year of -53.70%, raises questions about the sustainability of its profit margins. However, the company's strong fundamentals, including a profit margin of 13.27%, indicate resilience that can be leveraged for recovery. Investors should consider how Roche plans to address these challenges through innovation and cost management.

The positive quarterly revenue growth of 6.10% signals that Roche may still capitalize on its strong pipeline and market demand, particularly in oncology and personalized medicine. A focus on high-growth areas could help reverse the recent stock price decline, which has seen a 52-week change of -7.71%. The current share price reflects cautious investor sentiment, yet the forward P/E of 13.37 suggests potential for upside as earnings stabilize.

Managing the legal challenges regarding patent disputes will also be critical for Roche. The outcomes could affect Roche's market position and profitability if not navigated carefully. Investors will be watching closely as the company responds to these legal pressures while continuing to innovate.

Finally, the overall market conditions, including interest rates and regulatory changes in healthcare, will remain influential in determining Roche's share price trajectory. A focus on strategic partnerships and acquisitions may provide additional avenues for growth, influencing investor confidence and market perception.

What could happen in three years? (horizon July 2028)

| Scenario | Description |

|---|---|

| Best | Stock reaches $350 as new treatments gain FDA approval, boosting revenue and market share. |

| Base | Stock rebounds to $300 with consistent revenue growth and market stability. |

| Worse | Stock declines to $220 if legal challenges worsen and earnings remain under pressure. |

Projected scenarios are based on current trends and may vary based on market conditions.

Factors most likely to influence the share price

- Regulatory approvals for new treatments

- Market competition and pricing pressures

- Legal challenges outcomes

- Innovations within product pipelines

- Global economic conditions

Conclusion

Roche's journey over the next three years appears to be fraught with both challenges and opportunities. The company’s ability to pivot in response to market pressures, navigate legal disputes, and leverage its strong product pipeline will be crucial for its success. Should Roche effectively manage these elements, it may not only stabilize its share price but also potentially achieve new growth milestones. Investors are advised to keep a close eye on Roche's strategic moves and market conditions, as these will significantly influence the stock's trajectory moving forward. In conclusion, while there are risks to consider, Roche's established presence in the pharmaceutical landscape positions it favorably for a balanced approach to growth and risk management.

This article is not investment advice. Investing in stocks carries risks and you should conduct your own research before making any financial decisions.