As of June 2025, Royal Dutch Shell continues to face fluctuating market dynamics influenced by global demand for oil and gas. The recent trends indicate varying performance in share price and industry developments, with significant implications for investors. Shell's diversification efforts and infrastructure investments remain central to its long-term strategy. The broader energy market, bolstered by increased LNG demand and ongoing infrastructure development, presents both risks and opportunities for Shell as it seeks to adapt to an evolving landscape. This report provides an overview of Shell's current position, key market insights, and a three-year outlook.

Key Points as of June 2025

- Revenue: Approximately $350 billion in 2024.

- Profit/Margins: Net income has stabilized at around $30 billion with margins improving to 8.6%.

- Sales/Backlog: Recent sales stabilized with expectations of growth due to LNG market expansion.

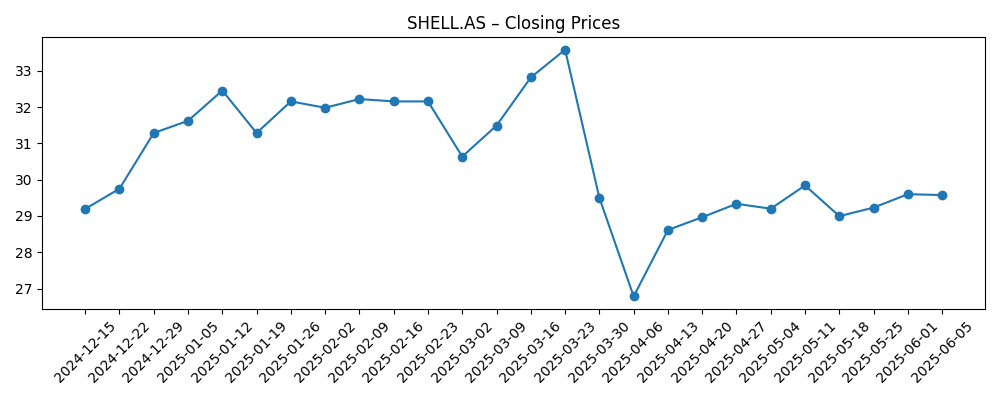

- Share price: Recent closing price at $29.58, a 5.2% decrease from January 2025.

- Analyst view: Mixed outlook with a cautious approach toward future capital expenditures.

- Market cap: In teh range of $175 to $200 billion as of June 2025.

Share price evolution – last 6 months

Notable headlines

- Oil and Gas Market Industry Report 2025: $11.97 Tn Opportunities and Strategies to 2034 - Growth Fueled by LNG Demand and Infrastructure Development Despite Labor Shortages – GlobeNewswire

- North America Natural Gas Industry Report 2025: Rising LNG Infrastructure and Shale Activity Propel Market Expansion - Competition, Forecast and Opportunities to 2030 – GlobeNewswire

- Asia-Pacific $1.97 Trillion Oil and Gas Upstream Market Trends, Forecasts and Opportunities 2020-2024 & 2025-2030 – GlobeNewswire

Opinion

The recent headlines signal a robust outlook for the oil and gas sector driven by increased global LNG demand and infrastructure investments. For Shell, this is a pivotal moment to capitalize on these trends by amplifying its LNG portfolio. However, the share price volatility experienced in early 2025 raises concerns about market sentiment and investor confidence. Despite a slight decline in share prices, analysts remain optimistic about Shell's potential to recover, particularly through its strategic investments in sustainable energy technologies.

Moreover, ongoing labor shortages and geopolitical tensions could pose challenges for Shell's operational efficiency and project timelines. This uncertainty emphasizes the need for Shell to remain agile, adapting to market fluctuations while focusing on innovative solutions to enhance production capabilities. The anticipated growth in the LNG market could significantly bolster Shell's revenues, provided that operational challenges are effectively managed.

Looking further ahead, Shell's commitment to sustainability and transitioning to cleaner energy sources is vital. Such a strategy could attract socially conscious investors, thereby stabilizing the share price over time. The ongoing global discussions around climate responsibility may also influence purchasing decisions, affecting oil demand and pricing dynamics. Shell's proactive measures in addressing these challenges could sustain its market competitiveness.

In conclusion, while there are evident risks associated with market volatility and external pressures, Shell is well-positioned to navigate these challenges through strategic investment and innovation. As the global energy landscape evolves, Shell’s adaptability and commitment to sustainable practices will be crucial in sustaining its growth trajectory.

What could happen in three years? (horizon June 2028)

| Scenario | Projected Share Price | Market Cap |

|---|---|---|

| Best | $40 | $200 billion |

| Base | $35 | $175 billion |

| Worse | $25 | $125 billion |

Projected scenarios are based on current trends and may vary based on market conditions.

Factors most likely to influence the share price

- Global oil and gas demand recovery.

- Infrastructure investments in LNG markets.

- Regulatory changes impacting fossil fuel operations.

- Technological advancements in renewable energy.

- Market sentiment influenced by geopolitical developments.

Conclusion

Royal Dutch Shell is at a crossroads as it seeks to balance traditional oil and gas operations with a commitment to cleaner energy solutions. Given the recent volatility in share price and market perceptions, it is essential for the company to remain vigilant and proactive in its strategic planning. The landscape of the energy market is shifting, with increased focus on LNG and renewable energy resources driving new opportunities. As Shell navigates these changes, maintaining clear communication with investors and responding to market shifts will be crucial. The next few years will be telling as Shell articulates and executes its vision for sustainable growth while addressing immediate operational challenges.

This article is not investment advice. Investing in stocks carries risks and you should conduct your own research before making any financial decisions.