Walmart Inc. (WMT) is navigating a competitive retail landscape as it ramps up its e-commerce efforts to rival major players like Amazon. After a mixed performance in recent quarters, analysts are closely monitoring the company's strategies to enhance profitability and market share. With a current market cap of approximately $731 billion and a stock price hovering around $97.47, Walmart's ability to adapt to consumer trends and economic conditions will significantly influence its performance going forward. Investors are keen to see how upcoming strategies will bolster revenue amidst rising operational costs and market pressures.

Key Points as of July 2025

- Revenue: $685.09B

- Profit Margin: 2.75%

- Quarterly Revenue Growth (yoy): 2.50%

- Share price: $97.47

- Analyst view: Mixed

- Market cap: $731B

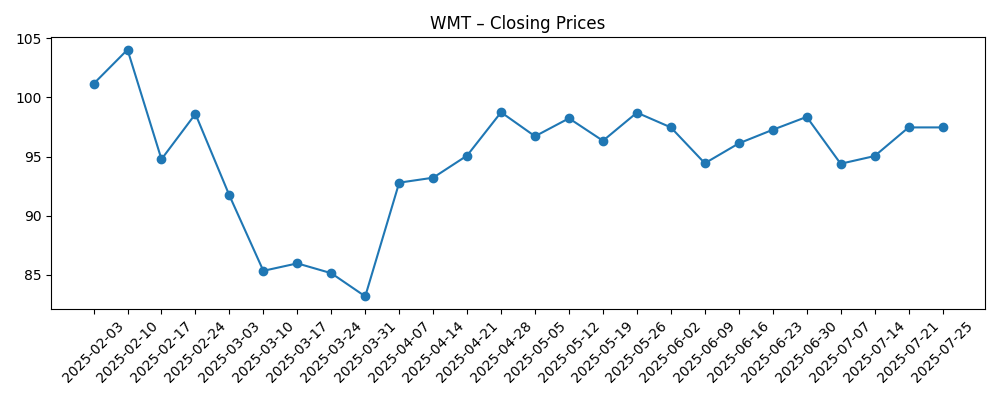

Share price evolution – last 6 months

Notable headlines

- Walmart ramps up e-commerce to rival Amazon's Prime Day event

- “I Do Think It’s Time To Buy Walmart,” Says Jim Cramer

- Mizuho Raises Walmart (WMT) Price Target, Maintains Outperform Rating

- Analyst Calls Walmart (WMT) the ‘Nvidia of Retail’

- Walmart (WMT) Recalls 850,000 Water Bottles Over Safety Risk

Opinion

The recent push from Walmart to enhance its e-commerce offerings is a vital strategy as the retail landscape shifts dramatically due to changing consumer behaviors. As online shopping continues to gain traction, the competition will only intensify, especially with players like Amazon maintaining a strong foothold in the market. This strategy may help mitigate risks associated with declining in-store sales, which have been exacerbated by inflation and changing economic conditions. However, the challenge remains in executing these strategies effectively amid rising operational costs.

Moreover, despite a dip in quarterly earnings growth, Walmart's solid market position offers potential for recovery. Analysts suggest that the company's focus on omnichannel retailing is not only timely but essential for future success. However, they are cautious, noting that Walmart must balance cost management with aggressive investment in technology and fulfillment to remain competitive.

The stock performance of Walmart reflects market sentiment about these strategic initiatives. Recently, the stock price fluctuations indicate investor uncertainty, leading to cautious trading activity. The headlines linking prominent analysts to positive ratings may provide a buffer, but sustained performance will depend on how well Walmart navigates the ongoing challenges of the retail environment.

Looking ahead, Walmart's ability to grow its revenue while maintaining profitability is crucial. The retail giant's efforts to recalibrate its business model to leverage both physical and digital sales channels will ultimately determine if the company can achieve its long-term objectives in a post-pandemic world.

What could happen in three years? (horizon July 2025+3)

| Scenario | Projected Revenue | Share Price |

|---|---|---|

| Best | $800B | $120 |

| Base | $740B | $100 |

| Worse | $680B | $80 |

Projected scenarios are based on current trends and may vary based on market conditions.

Factors most likely to influence the share price

- Changes in consumer spending habits

- Inflation and economic conditions

- Competition from online retailers

- Operational efficiency and cost management

- Growth in e-commerce capabilities

Conclusion

In conclusion, Walmart Inc. is at a critical juncture as it seeks to solidify its position in a rapidly evolving retail environment. With a strong emphasis on enhancing its e-commerce platform, the company has the potential to capture market share and drive revenue growth. However, significant challenges remain, including rising operational costs and fierce competition. Analysts' mixed views emphasize the need for cautious optimism. As the retail giant navigates through these turbulent waters, its ability to adapt to market demands and consumer preferences will ultimately dictate its success over the next three years. Investors should closely monitor Walmart’s actions regarding e-commerce and operational efficiency, as these factors will be crucial in shaping the company's future performance.

This article is not investment advice. Investing in stocks carries risks and you should conduct your own research before making any financial decisions.