JPMorgan Chase & Co. has demonstrated resilience amidst market fluctuations, with a notable commitment to increasing dividends and enhancing shareholder value. The bank's recent performance has been characterized by a high profit margin and steady cash flow, despite a decline in revenue growth. Looking ahead, investor sentiment remains cautiously optimistic as the company adapts to evolving economic conditions and continues to innovate its product offerings. With a share price reflecting significant volatility in the past months, analysts are closely monitoring JPM’s strategic decisions and market reactions as the financial landscape shifts.

Key Points as of July 2025

- Revenue: $163.64B

- Profit Margin: 34.55%

- Quarterly Revenue Growth: -10.60%

- Share Price: $298.62

- Analyst View: Cautiously optimistic

- Market Cap: Approx. $818.4B

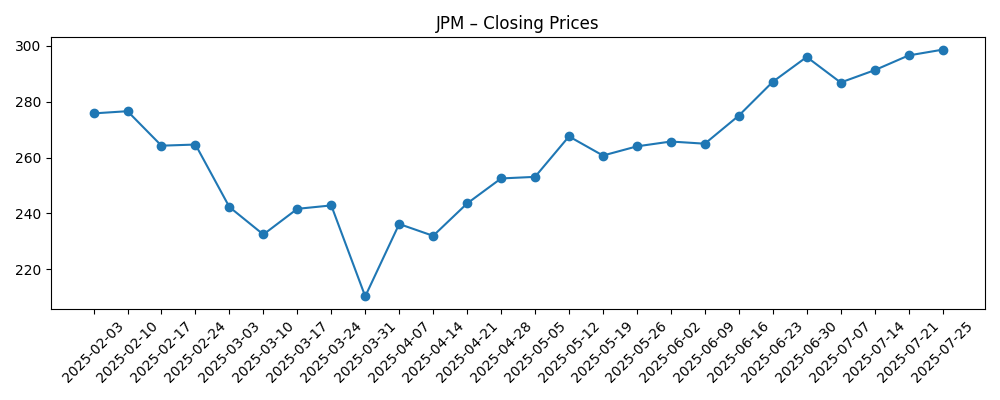

Share price evolution – last 6 months

Notable headlines

- JPMorgan Chase (JPM) Announces Plan to Increase Dividends

- JPMorgan Earnings: Consumers Are ‘Fine,’ Dimon Backs JPM Coin

- JPMorgan Chase & Co. (JPM) Is “Doing Terrifically,” Says Jim Cramer

- JPMorgan Chase & Co. (JPM): It’s The Best Of The Bunch Right Now, Says Jim Cramer

Opinion

The recent announcement from JPMorgan to increase dividends signals a strong commitment to returning value to shareholders amidst a challenging revenue environment. However, the bank's decline in quarterly revenue growth raises questions about the sustainability of this strategy in light of potential economic headwinds. Investors may need to balance the excitement over dividends with the realities of a competitive banking landscape, particularly as interest rates fluctuate and regulatory pressures mount.

With CEO Jamie Dimon’s recent comments and market positioning, it appears that JPMorgan is navigating these dynamics with caution. Dimon’s focus on innovation, such as supporting JPM Coin, reflects an understanding of the need to adapt to a rapidly changing financial ecosystem. As consumers increasingly seek digital solutions, JPMorgan’s forward-thinking initiatives may bolster its market position and attract new customers.

The stock's volatility over the past six months—a drop from a peak of $299.59—underscores the sensitivity of shares to broader market trends, such as economic uncertainty and inflation fears. Investors will be keen to see how JPMorgan manages its risk exposure while leveraging its strong capital base to explore growth opportunities.

Ultimately, JPMorgan Chase stands at a crossroads where strategic decisions made today could have lasting impacts on its market trajectory. Continued vigilance regarding market developments, coupled with strategic growth initiatives, will be critical as the bank strives to maintain its leading position in the sector.

What could happen in three years? (horizon July 2025+3)

| Scenario | Outcome |

|---|---|

| Best | Revenue growth rebounds, leading to increased market share and a higher share price. |

| Base | Stabilization in growth with steady dividends, maintaining investor confidence and market cap. |

| Worse | Continued revenue decline, prompting strategic shifts and potential divestitures. |

Projected scenarios are based on current trends and may vary based on market conditions.

Factors most likely to influence the share price

- Global economic conditions

- Regulatory changes impacting banking operations

- Consumer demand for digital banking solutions

- Interest rate fluctuations

- Competitive landscape among major banks

Conclusion

In conclusion, JPMorgan Chase is navigating a complex financial landscape marked by both challenges and opportunities. The recent emphasis on increasing dividends demonstrates a commitment to rewarding shareholders, yet the drop in quarterly revenue growth poses a critical concern. As the bank adapts to shifting market conditions and seeks out digital innovations, shareholders must remain vigilant in monitoring performance metrics and industry trends. An informed approach will be crucial as JPMorgan seeks to strengthen its market position in a competitive environment while balancing risk and growth. With strategic initiatives and a strong foundation, the outlook for JPMorgan Chase remains cautiously optimistic.

This article is not investment advice. Investing in stocks carries risks and you should conduct your own research before making any financial decisions.