Amazon.com, Inc. (AMZN) continues to demonstrate growth potential as it navigates a competitive retail landscape and expands its market presence. With increasing revenue and a strong profit margin, the company remains a focal point for investors. Recent headlines reflecting its resilience and market strategy highlight an optimistic outlook for Amazon's future. Despite challenges from competitors and changing market dynamics, analysts maintain a bullish stance on Amazon's stock due to its solid fundamentals and growth prospects.

Key Points as of July 2025

- Revenue: $650.31B

- Profit Margin: 10.14%

- Quarterly Revenue Growth (yoy): 8.60%

- Current Share Price: $228.29

- Analyst View: Mostly bullish

- Market Cap: Approximately $2.43T

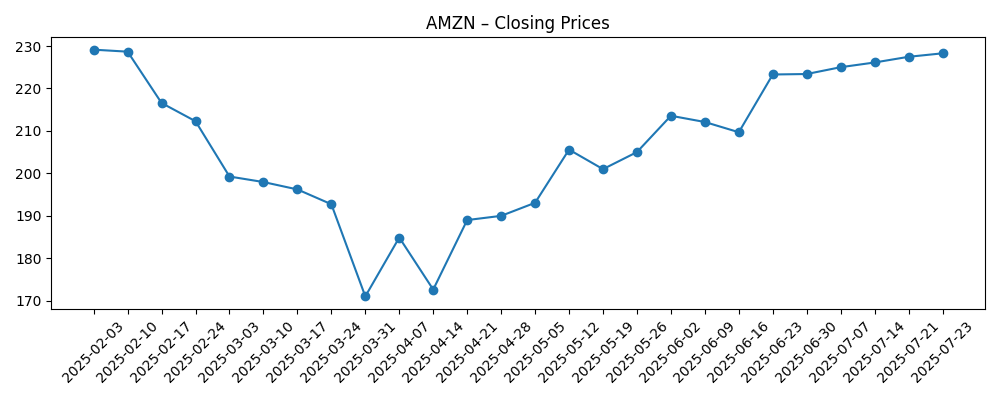

Share price evolution – last 6 months

Notable headlines

- Are You a Growth Investor? This 1 Stock Could Be the Perfect Pick

- Walmart ramps up e-commerce to rival Amazon's Prime Day event

- Amazon.com, Inc. (AMZN): A Bull Case Theory

- Amazon.com, Inc. (AMZN) Is Dominating Retail, Says Jim Cramer

- Bezos Sells Millions in Amazon.com, Inc. (AMZN) Under Trading Plan

- Cantor Fitzgerald Stays Bullish on Amazon (AMZN), Lifts Target to $260

Opinion

As of July 2025, Amazon finds itself at a pivotal crossroads. The recent bullish outlook from analysts, combined with the impressive revenue and profit margins, paints a favorable picture for the company. The competitive landscape, particularly with rivals like Walmart intensifying their e-commerce efforts, adds pressure. However, Amazon's historical adaptability and focus on customer experience may provide it the edge needed to sustain its growth trajectory. The market's response to Amazon's strategic maneuvers will be crucial in determining investor sentiment moving forward.

Recent headlines suggest a growing recognition of Amazon's resilience in the retail sector. The implications of growth stories, including e-commerce expansion and new service offerings, could bolster investor confidence. The company's ability to effectively communicate these advancements will be key in maintaining its stock performance. As companies increasingly rely on digital transformation, Amazon's established infrastructure and logistics capabilities could serve it well amid growing competition.

With analysts simultaneously raising price targets, the market appears to support a positive future for AMZN. Investor interest will likely continue to build if Amazon can deliver on its growth promises. The strategic focus on diversifying revenue streams through AWS and retail innovations suggests a well-rounded business model, aligning with investor expectations in a rapidly evolving market.

Ultimately, monitoring how Amazon responds to market pressures and competitive threats will be critical. Should it continue on this upward trajectory, driven by enhanced operational efficiencies and customer-centric innovations, the stock may see significant gains. Conversely, any misstep or failure to adapt could pose challenges, reminding investors of the volatility associated with growth stocks.

What could happen in three years? (horizon July 2025+3)

| Scenario | Price Target |

|---|---|

| Best | $300 |

| Base | $250 |

| Worse | $180 |

Projected scenarios are based on current trends and may vary based on market conditions.

Factors most likely to influence the share price

- Competitive pressure from other retailers.

- Investment in technology and infrastructure.

- Consumer spending trends.

- Regulatory risks related to antitrust findings.

- Global economic conditions impacting e-commerce.

Conclusion

In conclusion, Amazon.com, Inc. is poised for potential growth amidst a challenging market environment. With effective management strategies and a focus on innovation, AMZN is likely to continue to capture market share across its diverse business segments. The recent price adjustments from analysts signal a strong belief in Amazon's future. Ongoing developments within the retail landscape will be instrumental in shaping investor sentiment and expectations. Keeping a close eye on Amazon's response to competitive threats and its ability to innovate will be crucial for stakeholders as they navigate the complexities of the marketplace.

This article is not investment advice. Investing in stocks carries risks and you should conduct your own research before making any financial decisions.