BE Semiconductor Industries (BESI.AS) enters a new phase of the chips cycle with a share price that has rebounded and operating discipline that is still visible. The stock has outperformed over the past year, up 44.78%, even as revenue and earnings contracted year over year as customers deferred tool purchases. The near‑term picture reflects digestion after a strong wave of spending, export‑control uncertainty, and currency swings, while the medium‑term story remains tied to advanced packaging demand for artificial‑intelligence accelerators and high‑bandwidth memory. Management kept costs tight, helping to sustain an operating margin near 25.69%, and the balance sheet offers flexibility. This matters because packaging capacity remains a bottleneck in leading‑edge compute, and when orders turn, equipment suppliers often see early re‑rating. The watch items now are order intake, pricing power on next‑gen packaging tools, and dividend policy discipline if earnings stay cyclical. Sector context: semiconductor equipment is cyclical but benefits from long‑term complexity growth as chipmakers adopt chiplets and three‑dimensional stacking.

Key Points as of November 2025

- Revenue (ttm): 0.578B; quarterly revenue growth (yoy): -15.20% (data reflects recent cyclical softness).

- Profit/Margins: Profit margin 25.61%; operating margin 25.69% – margins remain resilient through the downturn.

- Net income (ttm): 0.148B; EBITDA (ttm): 0.177B; gross profit (ttm): 0.366B.

- Sales/Backlog: Backlog data not disclosed; order visibility remains tied to advanced packaging investment cycles.

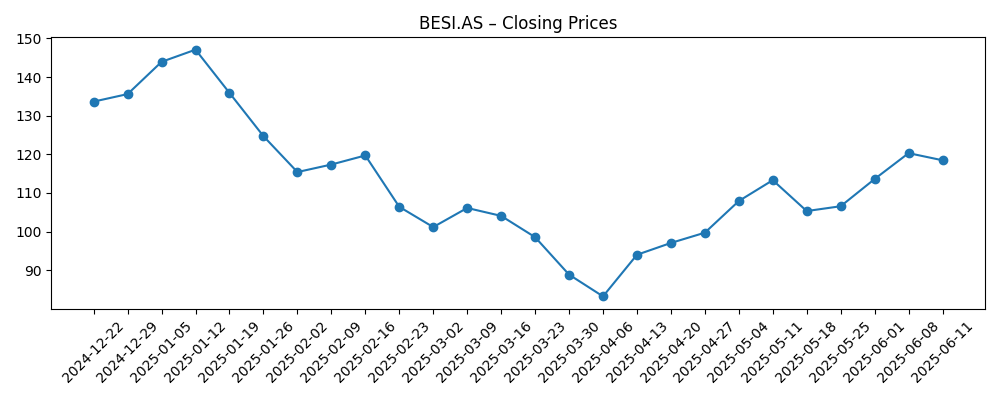

- Share price: Last close 145.80; 52‑week range 79.62–152.75; 50‑day MA 129.30 vs 200‑day MA 116.35.

- Analyst view: Street consensus and target prices not disclosed.

- Market cap: data not disclosed; shares outstanding reported at 78.91M; liquidity robust (current ratio 5.75).

- Balance sheet: Cash (mrq) 518.56M; debt (mrq) 537.85M – similar magnitudes, indicating balanced financing.

- Dividend: Forward dividend rate 2.18 (yield 1.48%); payout ratio 116.58% flags sensitivity to earnings swings.

- Qualitative: Positioned in die attach and advanced packaging; FX (foreign exchange) and export rules remain key swing factors.

Share price evolution – last 12 months

Notable headlines

Opinion

Recent figures depict a business managing the downcycle with discipline. Revenue fell on a year‑over‑year basis while earnings compress more sharply, typical for equipment names when customers pause orders and factory absorption declines. Yet margins in the mid‑20s suggest tight cost control and favorable mix, likely supported by higher‑value packaging tools. Cash and debt are broadly comparable, which preserves optionality to invest through the cycle and maintain dividends, though it reduces room for aggressive buybacks if orders were to slip again. In short, results show pressure on the top line, but the margin floor looks intact.

The quality of any beat or miss from here hinges on order timing rather than execution alone. Advanced packaging demand is tied to artificial‑intelligence accelerators and high‑bandwidth memory roadmaps; those programs can create lumpiness as customers phase capacity. When orders flow, revenue conversion can be rapid given historically strong working capital and a high current ratio. Conversely, if customers stretch lead times or reprioritize nodes, quarterly earnings can whipsaw given operating leverage. That asymmetry will likely define the next few quarters.

Within the industry, packaging remains a bottleneck as chipmakers adopt chiplets and stacking to improve compute density. This supports a medium‑term narrative in which suppliers with competitive positions in advanced die bonding participate early in customers’ capex cycles. Pricing power can hold if tool differentiation remains clear and qualification lists stay tight; if competitors narrow the gap, discounting pressure could chip away at margins. Export controls and licensing regimes also shape where growth can be realized, influencing regional mix and service revenues.

Valuation for semicap names typically expands ahead of shipments once investors believe the order trough is past. If order books rebuild on AI and memory packaging projects, the market can reward visibility with a higher multiple; if the cycle slips, multiples compress quickly given beta above 1. In that sense, the story will pivot from defensive margin stewardship to growth credibility: can the company turn backlog and pipeline into sustained revenue without sacrificing profitability or returns on capital? Dividend signaling will also influence the narrative given the elevated payout ratio.

What could happen in three years? (horizon November 2028)

| Best case | AI and high‑bandwidth memory expansions drive a multi‑year packaging upcycle. Orders accelerate for advanced die bonding, enabling operating margins to remain robust and cash generation to fund disciplined dividends and selective capacity additions. Export frictions ease at the margin, improving regional mix. |

| Base case | Orders recover in waves as customers balance AI programs with broader compute and automotive demand. Revenue normalizes with mid‑cycle margins supported by cost control. Dividend policy stays prudent, with flexibility to adjust as earnings rebuild. FX and regulatory noise continues but remains manageable. |

| Worst case | AI‑related tooling proves lumpier and shorter than expected; export restrictions tighten and competition intensifies, pressuring pricing. Orders stagnate, utilization falls, and margins drift lower, prompting a reset in dividend policy and a focus on protecting the balance sheet. |

Projected scenarios are based on current trends and may vary based on market conditions.

Factors most likely to influence the share price

- Order inflection in advanced packaging (AI accelerators and memory) and visibility on backlog conversion.

- Export‑control developments and customer localization, which can shift regional mix and service revenue.

- Pricing power versus competitors on next‑generation die bonding tools and any product qualification wins/losses.

- FX movements (EUR/USD) that affect reported margins and the value of overseas orders.

- Dividend policy adjustments given the current payout ratio and earnings trajectory.

- Supply chain lead times and ability to deliver during demand spikes without excess inventory.

Conclusion

BESI stands at a familiar semicap junction: soft year‑over‑year revenue and earnings, resilient margins, and a stock that has already priced in a measure of recovery. The investment case hinges on whether advanced packaging orders re‑accelerate as AI compute and high‑bandwidth memory remain priorities, offsetting export frictions and currency noise. Strong liquidity and mid‑20s margins argue the franchise can bridge the trough, but an elevated payout ratio reduces room for error if earnings stay subdued. The equity narrative over the next stretch will move from downside protection to proof of operating leverage on the next upturn. Watch next 1–2 quarters: order intake and book‑to‑bill language; pricing on new packaging platforms; and dividend stance versus cash generation. If visibility improves, the multiple can follow; if not, volatility typical of equipment names is likely to persist.

This article is not investment advice. Investing in stocks carries risks and you should conduct your own research before making any financial decisions.