Amazon enters September 2025 with accelerating fundamentals and a stock approaching prior highs. Over the last 12 months, trailing revenue reached $670.04B, with quarterly revenue growth of 13.30% year over year and quarterly earnings growth of 34.70%. Profitability continues to firm, reflected in a 10.54% profit margin and 11.43% operating margin, supported by $121.14B in operating cash flow and $31.02B in levered free cash flow. Shares have risen 31.35% over the past year versus 18.19% for the S&P 500, trading near a 52‑week high of $242.52 and above the 50‑ and 200‑day moving averages. Against this backdrop, investors are watching AWS, the grocery push highlighted by Evercore, Project Kuiper’s first airline customer, and commentary around AI GPU investments—key drivers that could shape Amazon’s three‑year trajectory.

Key Points as of September 2025

- Revenue: Trailing twelve months revenue of $670.04B; revenue per share $63.37; gross profit $332.38B.

- Profit/Margins: Profit margin 10.54%; operating margin 11.43%; ROE 24.77%; EBITDA $133.83B; net income attributable to common $70.62B.

- Sales/Backlog: Quarterly revenue growth (yoy) 13.30%; operating cash flow $121.14B; levered free cash flow $31.02B.

- Share price: Recent close $238.24 (2025-09-09); 52‑week range $161.38–$242.52; 50‑day MA $225.89; 200‑day MA $213.37; beta 1.31.

- Analyst view: Recent notes emphasize diversification, AWS/ads strength, grocery expansion and Prime stickiness, and scrutiny of AI GPU investment returns.

- Market cap: Not provided in snapshot; shares outstanding 10.66B, float 9.64B; insider ownership 8.44%, institutions 66.35%.

- Balance sheet: Cash $93.18B; total debt $159.57B; current ratio 1.02; total debt/equity 47.81%.

- Trading & short interest: Avg volume (3M) 41.62M; (10D) 32.8M; shares short 75.68M vs. 62.8M prior; short ratio 1.64; short % of float 0.79%.

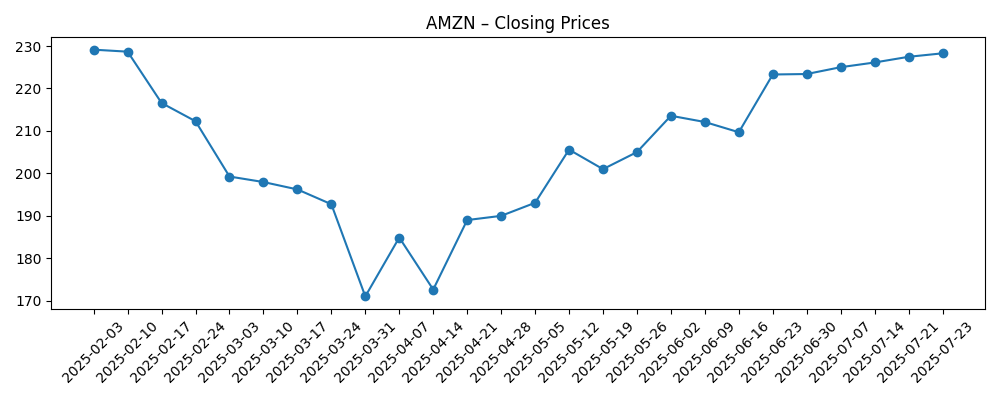

Share price evolution – last 12 months

Notable headlines

- Evercore Highlights Amazon (AMZN) Grocery Strategy and Prime Stickiness

- Amazon.com Inc. (AMZN) Focused on Growing Grocery Business

- JetBlue To Be The First Airline To Implement Amazon.com (AMZN)’s Project Kuiper Satellite Technology

- Amazon.com, Inc. (AMZN)’s Figuring Out The Returns Of AI GPU Investment, Says Jim Cramer

- Why Amazon’s (AMZN) Diversification Strategy Keeps It on Wall Street’s Radar

- Amazon.com, Inc. (AMZN): A Bull Case Theory

- Jim Cramer Nailed Amazon.com, Inc. (AMZN)’s Stock Back In August 2024

- Amazon (NASDAQ: AMZN) Stock Price Prediction for 2025: Where Will It Be in 1 Year

- Amazon (NASDAQ: AMZN) Stock Price Prediction in 2030: Bull, Bear, & Baseline Forecasts (Aug 22)

Opinion

Amazon’s three-year setup starts with earnings power. The company’s 10.54% profit margin and 11.43% operating margin reflect a structurally healthier mix tilted toward AWS and advertising, with retail efficiency gains helping. Operating cash flow of $121.14B and levered free cash flow of $31.02B offer headroom to fund growth vectors while absorbing cycles in capex. Debt of $159.57B versus cash of $93.18B and a current ratio of 1.02 keep leverage in focus, but a 24.77% ROE signals productive deployment. The share price recovery from the March 2025 trough near the 52‑week low of $161.38 to a recent $238.24, alongside a 31.35% 52‑week gain versus 18.19% for the S&P 500, suggests confidence in margin durability. The next leg likely hinges on AWS growth sustainability, ad wallet resilience, and how management sequences investments without diluting returns.

Grocery is a multi-year execution story that can deepen Prime engagement and add higher-frequency baskets, as Evercore’s note on grocery strategy and Prime stickiness underscores. The headlines spotlight a renewed push in owned stores, delivery, and partnerships. While grocery margins are thinner than cloud or ads, store density and last‑mile leverage can reduce fulfillment costs for the broader retail network, indirectly supporting margins. Success metrics to watch include same‑store productivity, delivery economics, and retention uplift within Prime cohorts. With revenue per share at $63.37 and gross profit of $332.38B, even modest mix shifts toward higher‑margin categories can be meaningful over time. The risk is capital intensity outpacing unit economics in slower macro pockets; however, Amazon’s scale and data advantages may allow more precise, localized expansion to mitigate that risk.

Project Kuiper’s first airline customer in JetBlue is strategically significant as a proof point for enterprise connectivity and a wedge into mobility use cases. Near term, Kuiper is more option value than earnings driver, but the commercial signal expands the potential partner set beyond consumer broadband. The operational challenge is twofold: manufacturing cadence and regulatory/commercial ramp, both of which require disciplined capital allocation. With beta at 1.31, investors may demand clearer milestones to underwrite Kuiper’s path to materiality. Productization into logistics, IoT, and retail connectivity could also reinforce Amazon’s core businesses. Execution risk remains, yet establishing lighthouse deployments in aviation can shorten sales cycles elsewhere and create data network effects that compound with AWS, especially if integrated offerings reduce customer switching costs.

Finally, the debate around AI GPU investment returns—featured in recent commentary—matters because it touches AWS competitiveness and capex efficiency. If management can translate GPU commitments into durable AI services revenue and higher utilization, margins could hold or improve despite heavier infrastructure spend. The stock’s journey—declining toward $171.00 by late March before recovering above the 50‑ and 200‑day moving averages—illustrates sensitivity to perceived AI monetization and macro demand. Short interest remains modest at 0.79% of float, though shares short rose to 75.68M from 62.8M, highlighting active positioning into highs. From here, sustaining double‑digit revenue growth (recently 13.30% yoy) while defending returns will likely determine whether the shares consolidate below the 52‑week high of $242.52 or break out on evidence of AI‑led operating leverage.

What could happen in three years? (horizon September 2025+3)

| Scenario | Operating narrative | Strategic levers | Stock setup |

|---|---|---|---|

| Best | AWS sustains strong growth and monetizes AI services effectively; retail mix shifts toward higher‑margin ads and third‑party services; grocery achieves scale efficiencies. | Disciplined capex, faster AI product cycles, Kuiper wins beyond aviation, tighter last‑mile costs. | Multiple expansion as margins hold or improve; sentiment supported by consistent free cash flow delivery. |

| Base | AWS grows solidly; retail margins improve gradually; grocery contribution is steady but not transformative; AI spend aligns with revenue ramp. | Selective capex, pricing/packaging refinements in AWS and ads, measured Kuiper rollout. | Range‑bound valuation near recent averages; performance tracks earnings growth with occasional volatility (beta characteristics). |

| Worse | AI monetization lags infrastructure spend; retail growth slows; grocery underperforms; Kuiper delayed. | Capex deferrals, cost controls, portfolio prioritization, potential restructuring of underperforming initiatives. | De‑rating as margins compress; shares more sensitive to macro and competitive headlines. |

Projected scenarios are based on current trends and may vary based on market conditions.

Factors most likely to influence the share price

- Trajectory of AWS growth and AI services monetization relative to infrastructure investments.

- Retail margin mix from advertising, third‑party services, and efficiency gains across fulfillment and logistics.

- Execution in grocery (store productivity, delivery economics) and its effect on Prime engagement.

- Project Kuiper milestones, commercial wins, and capital intensity versus returns.

- Regulatory actions affecting marketplace practices, data use, or acquisitions.

- Macro sensitivity of consumer demand and enterprise IT budgets; volatility consistent with a beta of 1.31.

Conclusion

Amazon’s investment case over the next three years hinges on compounding cash flows from AWS and advertising while narrowing the cost-to-serve curve in retail. The current fundamentals—$670.04B in trailing revenue, improving margins, robust operating cash flow, and positive share momentum versus the broader market—provide a solid base. Strategic headlines around grocery and Prime stickiness suggest deeper engagement opportunities, while Kuiper’s first airline customer marks early validation of a longer‑dated platform. The central swing factor is AI: translating compute commitments into sticky, high‑margin services that reinforce AWS leadership. Balance sheet capacity is meaningful, though leverage and capital intensity require discipline to preserve returns. If Amazon sustains double‑digit top‑line growth with stable or improving margins, the stock can compound alongside earnings; if AI payback and retail efficiency disappoint, valuation could compress. Monitoring AWS demand signals, ad spend resilience, and capex cadence will be critical checkpoints.

This article is not investment advice. Investing in stocks carries risks and you should conduct your own research before making any financial decisions.