Grupo Mexico’s U.S.-listed shares have rallied 61.70% over the past year as copper prices climbed and unit output improved, sharpening investor focus on the miner’s operating leverage. The latest quarter showed net profit up 8% amid stronger pricing and cost control, while headlines around a potential combination with Southern Copper, a board-approved buyback, and increased U.S. investment added fuel to the narrative. At the same time, a Mexican court ruling in an environmental case underscored legal and permitting risks that can affect timelines, capital allocation, and public perception. Balance‑sheet liquidity is solid and dividend discipline remains part of the pitch, but the story is now most sensitive to the path of copper and the pace of project delivery. For sector context, base‑metal producers have benefited from the electrification theme and grid investment, yet new supply from places like Africa signals a more balanced market ahead. The setup into the next three years centers on whether cyclical momentum can transition into durable free cash flow.

Key Points as of November 2025

- Revenue: trailing 12‑month revenue of 16.87B; quarterly revenue growth (yoy) 11.30% indicates demand resilience alongside higher realized prices.

- Profit/Margins: profit margin 25.80% and operating margin 46.90%; returns remain strong with ROE 20.86% and ROA 12.08%.

- Sales/Backlog: formal backlog not disclosed; top‑line momentum (11.30% yoy) and unit output at Southern Copper (per Bloomberg) serve as demand proxies.

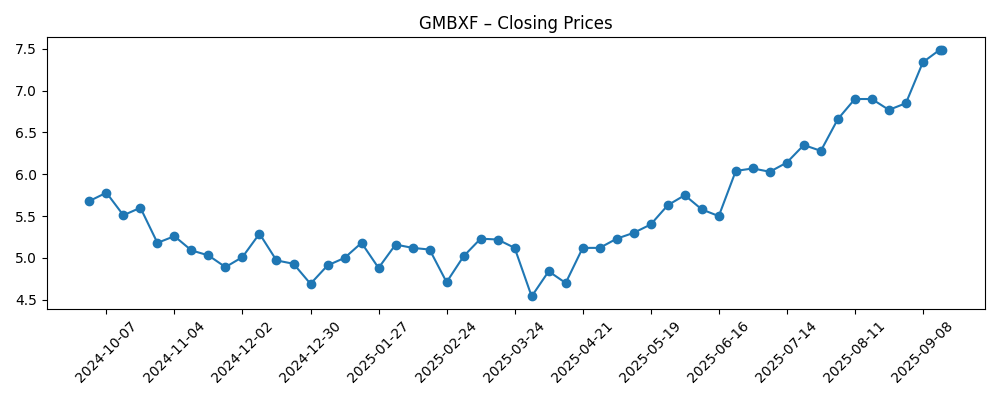

- Share price: up 61.70% over 52 weeks; near 52‑week high of 9.09 with 50‑day MA 7.71 above 200‑day 6.06; beta 1.19; recent close around 8.15.

- Analyst view: coverage generally frames GMBXF as high copper torque with capital‑return support; no consensus estimates provided in this dataset.

- Market cap: figure not stated here; 7.79B shares outstanding with 3.13B float; insider ownership 63.77% influences liquidity and governance.

- Balance sheet: total cash 8.39B vs total debt 10.18B; current ratio 5.92; debt/equity 39.64% suggests moderate leverage for a miner.

- Dividends/Capital return: forward dividend yield 3.24% (payout ratio 45.16%); ex‑dividend 9/4/2025; board‑approved buyback (FT) adds optionality.

- Qualitative: environmental lawsuit ruling in Mexico (Reuters) elevates ESG and permitting risk; company exploring renewable energy initiatives (Reuters).

Share price evolution – last 12 months

Notable headlines

- Grupo Mexico posts Q3 2025 net profit up 8% on higher copper prices [Reuters]

- Grupo Mexico's proposed merger with Southern Copper [Bloomberg]

- Grupo Mexico board approves share repurchase program [Financial Times]

- Mexican court rules against Grupo Mexico in environmental lawsuit [Reuters]

- Grupo Mexico increases investment in U.S. mining operations [Wall Street Journal]

- Grupo Mexico considers renewable energy initiatives for sustainability [Reuters]

- Southern Copper's output boosts Grupo Mexico's Q1 profits [Bloomberg]

- Zambia’s Record Copper Production Meets a Red-Hot Market [Bloomberg]

Opinion

GMBXF’s recent figures suggest the copper up‑cycle is translating into strong operating leverage. Revenue growth of 11.30% year over year, paired with a 46.90% operating margin and 25.80% net margin, points to robust unit economics. The 56.80% quarterly earnings growth (yoy) signals cost discipline and favorable price realization; however, the reported 8% net profit increase in the latest quarter implies the rate of improvement is moderating as comps stiffen and costs normalize. Cash generation (6.03B operating cash flow) supports capex and distributions, while a current ratio of 5.92 and debt/equity of 39.64% give management flexibility. In short, the quality of the beat looks price‑led with improving throughput, and the sustainability hinges on the copper tape.

Looking ahead, sustainability depends on three levers: the copper cycle, project execution, and policy. Supply is loosening at the margin (e.g., Zambia’s new output), which could cap prices even as electrification and grid spending keep demand firm. That backdrop argues for disciplined capital allocation—pacing U.S. growth projects (WSJ), advancing renewables to stabilize energy costs (Reuters), and maintaining dividend capacity (forward yield 3.24%, payout 45.16%). The balance sheet can carry investment, but cost inflation, permitting, and community relations may dictate timeline risk more than funding does.

Within the Americas mining peer set, Grupo Mexico’s scale, logistics ties, and exposure through Southern Copper offer breadth and cost advantages. A potential merger with Southern Copper (Bloomberg) could streamline governance, reduce minority leakage, and sharpen capital allocation, but it would also invite regulatory scrutiny and minority‑shareholder negotiations. A buyback authorization (FT) supports per‑share math during dips, yet high insider ownership (63.77%) and a relatively small float can amplify swings both ways. The environmental ruling in Mexico (Reuters) is a reminder that ESG outcomes directly influence permits, operating tempo, and ultimately valuation.

For the equity narrative, the stock’s 61.70% 12‑month rise and a 50‑day average above the 200‑day suggest momentum, but liquidity is modest and beta sits at 1.19—so copper volatility flows quickly into the price. If copper holds near recent ranges and projects land roughly on schedule, investors may emphasize cash returns and balance‑sheet strength; if prices slip or legal risks escalate, the focus shifts to cost takeout and optionality from capex deferrals. Over the next three years, the multiple likely tracks confidence in durable free cash flow rather than one‑off price spikes.

What could happen in three years? (horizon November 2025+3)

| Scenario | Narrative |

|---|---|

| Best | Copper demand stays firm on electrification while new supply underwhelms. Grupo Mexico executes U.S. expansions on time, advances renewable energy to tame power costs, and resolves key environmental issues. A combination with Southern Copper proceeds on workable terms, simplifying structure and lowering cost of capital. Cash flow supports steady dividends and opportunistic buybacks through the cycle. |

| Base | Copper normalizes to mid‑cycle. Operations remain stable; cost control offsets some input inflation. U.S. projects phase in, renewables lower volatility of energy costs, and legal matters are managed without outsized impacts. Corporate structure remains largely intact while buybacks and dividends continue within cash generation. |

| Worse | Copper retraces on global growth softness and faster‑than‑expected new supply. Environmental liabilities and permitting delays rise, pushing out project timelines. Merger efforts stall amid regulatory or governance friction. Management prioritizes balance‑sheet protection; capex is deferred and dividends scaled back until conditions improve. |

Projected scenarios are based on current trends and may vary based on market conditions.

Factors most likely to influence the share price

- Global copper price path and China/U.S. demand—primary driver of margins and cash generation.

- Regulatory and legal outcomes in Mexico and the U.S., including environmental rulings and permitting.

- Execution on U.S. growth projects and cost management, including renewable energy initiatives.

- Potential merger decisions with Southern Copper and associated governance/minority considerations.

- Capital allocation balance between dividends, buybacks, and capex under changing market conditions.

- FX (foreign exchange) and energy cost volatility across operating regions, plus supply‑chain logistics.

Conclusion

Grupo Mexico enters the next three years with healthy margins, ample liquidity, and clear torque to copper prices. The company’s operating profile—double‑digit revenue growth, strong operating margin, and solid cash generation—shows the cycle working in its favor, while the balance sheet provides room to fund projects and maintain distributions. Key swing factors sit outside the plant gate: copper supply additions, legal and permitting outcomes, and the shape of any Southern Copper transaction. Insider ownership concentrates control and can limit float, amplifying moves in either direction. If management converts momentum into predictable free cash flow, the narrative can shift from cyclical upside to durability. Watch next 1–2 quarters: copper price trend and demand signals; clarity on Southern Copper merger discussions; outcomes and remediation plans tied to the environmental ruling; cadence of U.S. project milestones; capital‑return pacing versus investment needs; progress on renewable energy initiatives to stabilize costs.

This article is not investment advice. Investing in stocks carries risks and you should conduct your own research before making any financial decisions.