ASML Holding enters late 2025 with industry-leading profitability and a unique position in advanced lithography, but investors are weighing a more uneven demand picture into 2026. Trailing‑twelve‑month revenue stands at 32.16B with robust operating and net margins, while quarterly revenue and earnings grew 23.2% and 45.1% year over year, respectively. The share price has underperformed over the past year and now trades near the mid‑600s, below long‑term moving averages, as the market debates order timing, China exposure, and the pace of High‑NA EUV adoption. Balance‑sheet flexibility and a rising dividend provide support, and recent research highlights both caution and upside, reflecting a wide dispersion of views. Over the next three years, the stock path is likely to hinge on leading‑edge foundry roadmaps, export controls, and whether AI‑driven capital spending offsets cyclical digestion.

Key Points as of September 2025

- Revenue: TTM revenue of 32.16B; quarterly revenue growth (YoY) at 23.20% highlights solid end‑market demand.

- Profit/Margins: Gross profit (TTM) 16.89B; operating margin 34.64%; profit margin 29.27%; EBITDA 12.09B; ROE 58.24% underscores moat strength.

- Sales/Backlog: Earnings growth (YoY) 45.10%; visibility tied to EUV and High‑NA ramps, with 2026 demand signals mixed per recent coverage.

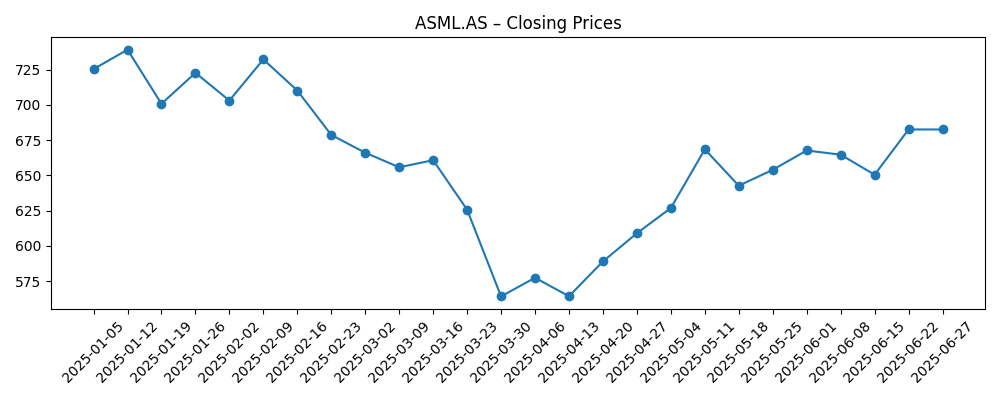

- Share price: Last weekly close near 625.30; 52‑week range 508.40–804.60; 52‑week change −16.19% vs S&P 500 at 16.22%; 50/200‑day MAs at 643.30/659.58.

- Balance sheet: Cash 7.25B vs debt 3.7B; current ratio 1.43; debt/equity 21.00% supports investment in capacity and R&D.

- Analyst view: Mixed sentiment—recent downgrade to Hold and media caution, yet a cited consensus target of $923.80 implies upside.

- Market cap: Approximately $246B based on 393.2M shares outstanding and the latest close.

- Dividends: Forward annual dividend rate 6.48 (1.05% yield); payout ratio 26.60%; ex‑dividend date 7/28/2025.

Share price evolution – last 12 months

Notable headlines

- Is ASML’s (ASML) Growth Story Still Intact Despite 2026 Uncertainty?

- Freedom Broker Downgrades ASML Holding N.V. (ASML) to ‘Hold’ Following Q2 Results

- Multiple Catalysts Prompted Artisan Value Fund to Add ASML (ASML) to Its Portfolio

- Jim Cramer on ASML: “I’m Concerned About the Stock”

- Brokerages Set ASML Holding N.V. (NASDAQ:ASML) Target Price at $923.80

Opinion

ASML’s near‑term narrative revolves around whether 2026 becomes a digestion year after two strong up‑cycles. On one side, TTM revenue of 32.16B, 23.2% quarterly revenue growth, and 45.1% quarterly earnings growth confirm that leading‑edge logic and AI‑related demand remain powerful. On the other, management coverage and recent broker commentary point to mixed order visibility into 2026 as customers balance capacity adds with utilization. In our view, the crux is not if EUV/High‑NA are adopted—they are essential to roadmaps—but how steep the interim slope is. A softer 2026 would most likely reflect timing, not technology risk. That makes the story unusually sensitive to news flow on tool readiness, customer fab starts, and export policy, rather than to the structural value of ASML’s monopoly‑like position at the bleeding edge.

Margins and returns provide an important buffer. With a 34.64% operating margin, 29.27% net margin, and 58.24% ROE, ASML has room to absorb mix shifts or short‑term pricing friction while continuing to invest. Cash of 7.25B against 3.7B of debt and a 1.43 current ratio suggest balance‑sheet flexibility to sustain R&D, service capacity, and selective capacity expansion. The long‑cycle installed base and service revenue tend to smooth downturns relative to pure shipment cycles. Risks center on shipment phasing, high‑value tool acceptance, and regulatory limits on certain geographies. Still, given the scarcity value of EUV/High‑NA capability, any slowdown that preserves project milestones likely delays rather than destroys demand.

From a market standpoint, the stock’s 52‑week change of −16.19% and a last close near 625 suggest investors have already discounted some 2026 risk. Shares sit below the 50‑day and 200‑day moving averages (643.30 and 659.58), keeping technicals cautious. Sentiment is split: a downgrade to Hold and high‑profile concerns argue for patience, while a published $923.80 target showcases perceived longer‑term upside. We expect volatility around quarterly bookings and any headlines on export controls. For patient holders, an improving order cadence or early evidence of High‑NA productivity could be the inflection to re‑rate the multiple. Conversely, pushouts or a weaker memory rebound could extend the consolidation phase.

Capital returns and durability matter in a three‑year frame. The forward dividend rate of 6.48 (1.05% yield) with a 26.60% payout ratio leaves room for increases if cash generation stays aligned with the 12.09B TTM EBITDA and 11.18B operating cash flow backdrop. While buybacks are not guaranteed, balance‑sheet capacity allows optionality. Strategically, expanding the installed base, protecting tool lead‑times, and ensuring supply resilience will influence pricing power. If leading foundries proceed with 2‑nm and beyond, and High‑NA demonstrates throughput gains at scale, ASML’s earnings power should compound. Should macro or regulation curtail demand, the moat and service mix may mitigate downside but not eliminate it. In short, the next leg of the story hinges on timing of node transitions rather than the necessity of those transitions.

What could happen in three years? (horizon September 2025+3)

| Scenario | Three‑year view |

|---|---|

| Best | AI/data‑center and leading‑edge logic spend accelerate; High‑NA EUV is validated at multiple top customers, expanding the installed base. Margins hold near current levels, services scale, and sentiment improves. Shares revisit prior highs and potentially re‑rate on stronger visibility. |

| Base | 2026 is a digestion year with uneven orders; foundry and memory spending normalize thereafter. Margins remain resilient, backlog visibility gradually improves, and the stock tracks fundamentals, oscillating around long‑term moving averages as confidence rebuilds. |

| Worse | Export restrictions tighten and a deeper cyclical downturn hits orders; customers delay node transitions. Utilization stays subdued, pricing mix softens, and shares underperform broader indices, risking a retest of the 52‑week low (508.40) before stabilization. |

Projected scenarios are based on current trends and may vary based on market conditions.

Factors most likely to influence the share price

- Order cadence and visibility for EUV/High‑NA tools across leading foundries and memory makers.

- Export control and licensing developments affecting shipments to specific geographies.

- Customer capex timing, utilization rates, and the slope of 2‑nm and below node transitions.

- Supply‑chain execution, tool lead‑times, and acceptance milestones for high‑value systems.

- Competitive dynamics and substitution risk at mature nodes versus continued moat at the leading edge.

- Capital return policy, including dividend sustainability and any potential buybacks.

Conclusion

ASML’s investment case into 2028 rests on whether structural demand from AI, high‑performance computing, and next‑gen mobile offsets the cyclical digestion flagged for 2026. The company’s metrics—32.16B TTM revenue, 34.64% operating margin, 29.27% net margin, and 58.24% ROE—indicate a franchise capable of withstanding timing bumps while compounding value through its installed base and service economics. Shares have already de‑rated relative to the market, reflecting uncertainty and export‑policy noise. Against that backdrop, balanced expectations seem prudent: a base case of choppy but constructive fundamentals, a favorable case if High‑NA ramps smoothly across multiple customers, and a downside case if restrictions and a deeper cycle hit orders. With cash exceeding debt and a growing dividend, ASML retains optionality. For long‑term investors, execution on High‑NA and clearer 2026 order patterns are the pivotal catalysts to watch.

This article is not investment advice. Investing in stocks carries risks and you should conduct your own research before making any financial decisions.