As of late September 2025, Berkshire Hathaway (BRK‑B) sits near the $500 mark after a strong run into April and a summer of consolidation. The conglomerate’s breadth—insurance, rail, energy, manufacturing, services, retail, and a large equity portfolio—provides ballast, while a substantial cash position offers optionality. Recent fundamentals show solid profitability and operating efficiency alongside modest top‑line softness year over year. With no dividend and a historically cautious approach to big acquisitions, investor focus remains on book‑value compounding, underwriting discipline, and the pace of capital deployment. Over the next three years, the path of interest rates and insurance pricing cycles are likely to dominate outcomes: higher short‑term yields bolster investment income, while a softer rate environment could lift equity valuations but reduce cash returns. The stock’s below‑market beta underscores its appeal as a defensive compounder.

Key Points as of September 2025

- Revenue: Trailing‑twelve‑month revenue is $370.15B; quarterly revenue growth (yoy) is -1.20% as of the most recent quarter.

- Profit/Margins: Profit margin 17.00%; operating margin 22.43%; net income (ttm) $62.92B; diluted EPS (ttm) 29.15.

- Sales/Backlog: Mixed near‑term trends as reflected in revenue decline; operating cash flow (ttm) $27.41B and levered free cash flow (ttm) $28.27B support reinvestment.

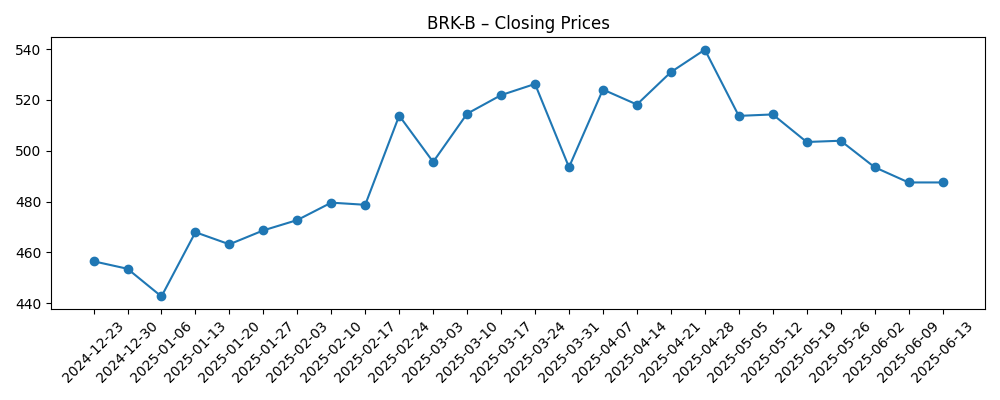

- Share price: Last weekly close ~$500.03; 52‑week high 542.07 and low 437.90; 50‑day MA 485.24 and 200‑day MA 489.76; beta (5Y) 0.78.

- Analyst view: Investors focus on per‑share book value (mrq) 464,307.84 and cautious capital deployment; no dividend (payout ratio 0.00%).

- Market cap: Berkshire remains among the largest U.S. companies by market value, supported by diversified earnings and a large equity portfolio.

- Balance sheet: Total cash (mrq) $344.09B vs. total debt $127.02B; current ratio 3.00; total debt/equity 18.95%.

- Ownership & positioning: Institutions hold 64.95%, insiders 0.38%; short interest 12.46M shares (short ratio 2.85; 0.58% of shares outstanding), down from 13.11M in mid‑August.

- Index context: 52‑week change 8.64% vs. S&P 500’s 15.29%, reflecting Berkshire’s lower‑beta profile and defensive mix.

Share price evolution – last 12 months

Notable headlines

Opinion

The recent headline highlighting how Berkshire “crushed” the S&P underscores a durable feature of the company’s design: it can perform well in uneven markets without relying on narrow bets. In 2025, shares rallied to late‑April highs near the 52‑week peak before consolidating into the $470–$505 range, roughly aligned with the 50‑ and 200‑day moving averages. That price action fits a franchise compounding earnings through underwriting profits, regulated utility returns, railroad cash generation, and investment income. With trailing operating margin of 22.43% and profit margin of 17.00%, Berkshire remains fundamentally efficient. The vast cash balance provides optionality to capture dislocations. Against a backdrop of moderating growth and policy uncertainty, Berkshire’s lower beta (0.78) appeals to investors seeking steadier compounding, though it may lag in speculative surges.

Looking forward three years, the rate path is the swing factor. Elevated short‑term yields enhance investment income on cash and insurance float, cushioning earnings in slower growth periods. If rates decline, mark‑to‑market gains on the equity portfolio could offset the drag from lower cash returns, while cheaper debt may support utility and railroad capex. Meanwhile, the insurance pricing cycle—affected by catastrophe frequency and reinsurance capacity—will shape underwriting margins. A disciplined stance on risk selection and limits should help defend profitability if catastrophe activity spikes. Across cycles, Berkshire’s ability to reprice insurance, redeploy cash, and take opportunistic stakes is central to preserving per‑share compounding.

Capital deployment is the wild card. With $344.09B in cash and equivalents at the most recent quarter and modest net leverage, Berkshire can pursue bolt‑on deals, opportunistic share repurchases, or large transactions when discounts emerge. Historically, management has been patient, preferring value over velocity. In a world where many peers face higher refinancing costs, Berkshire’s balance sheet is a strategic asset. The trade‑off is opportunity cost: idle cash earns less in a falling‑rate scenario and dilutes returns if not deployed. Still, optionality has tangible value when volatility returns. The breadth of wholly owned businesses also provides internal avenues for reinvestment without bidding wars.

Execution risks remain. Utility regulatory outcomes and wildfire liabilities could pressure returns at energy subsidiaries; the railroad must balance efficiency gains with service quality. Any broad equity drawdown would affect reported earnings via mark‑to‑market accounting, even if intrinsic value is unchanged. Conversely, benign catastrophe seasons and a firm insurance market could deliver upside to underwriting profits. The stock’s pattern—strong early‑2025 advance followed by range‑bound trading—suggests investors are assessing these cross‑currents while awaiting clearer signals on rates and capital deployment. Over a three‑year horizon, steady book‑value growth, selective acquisitions, and measured buybacks are likely to drive outcomes more than quarterly noise.

What could happen in three years? (horizon September 2025+3)

| Scenario | What it looks like | Implication for shares |

|---|---|---|

| Best | Stable to improving insurance pricing with manageable catastrophe losses; healthy investment income; constructive regulatory outcomes for energy; operational improvements at the railroad; supportive equity markets. | Outperformance versus the broad market with lower volatility; valuation supported by steady per‑share intrinsic value growth. |

| Base | Mixed macro backdrop; investment income normalizes; underwriting results remain disciplined; utilities earn allowed returns; equity portfolio tracks market. | Mid‑range compounding with returns roughly in line with the market, cushioned by defensive characteristics. |

| Worse | Higher catastrophe losses or soft insurance pricing; adverse utility rulings; rail volume softness; broad equity drawdown; rapid rate cuts reduce cash yields. | Underperformance relative to the market; slower book‑value accretion until conditions stabilize. |

Projected scenarios are based on current trends and may vary based on market conditions.

Factors most likely to influence the share price

- Interest‑rate trajectory and its impact on investment income and equity valuations.

- Insurance cycle dynamics, including catastrophe frequency/severity and reinsurance pricing.

- Regulatory and legal outcomes affecting Berkshire Hathaway Energy and the railroad.

- Capital allocation choices: pace of acquisitions, share repurchases, and internal reinvestment.

- Performance of top equity holdings and overall market sentiment toward mega‑cap value.

Conclusion

Berkshire Hathaway enters the next three years with a rare combination of scale, liquidity, and diversification. Fundamentals remain solid—strong margins, ample cash, and balanced leverage—while near‑term revenue softness and accounting volatility obscure steady underlying compounding. The stock’s late‑April peak followed by a $470–$505 trading range reflects a market waiting on clearer signals about rates, catastrophe activity, and regulatory clarity at the utilities. In a higher‑for‑longer world, investment income is a tailwind; in a lower‑rate world, equity marks and financing costs may help instead. Either way, Berkshire’s flexibility is its edge. Absent a transformative deal, returns should hinge on underwriting discipline, measured capital deployment, and incremental improvements across subsidiaries. For investors seeking durable compounding with below‑market volatility, Berkshire remains a credible core holding—though expectations should be calibrated to steady progress rather than rapid multiple expansion.

This article is not investment advice. Investing in stocks carries risks and you should conduct your own research before making any financial decisions.