Using August 2025 as the starting point, Coca‑Cola (KO) enters the next three years with classic defensive traits and a few moving parts. The shares recently closed at 68.83, down 4.47% over 52 weeks versus a 15.91% gain for the S&P 500, leaving valuation support to its 2.96% forward dividend yield and low 0.44 beta. The company’s fundamentals remain sturdy: trailing‑twelve‑month revenue of 47.06B, profit margin of 25.89%, EBITDA of 15.79B and return on equity of 42.37%. Balance‑sheet flexibility is mixed, with 14.3B in cash against 50.21B of debt and a current ratio of 1.21. Near‑term headlines point to portfolio optionality (a reported exploration of a Costa Coffee sale) and marketing digitization (use of AI avatars in campaigns). This note outlines key drivers, potential scenarios to 2028, and risks that could sway KO’s steady, dividend‑anchored equity story.

Key Points as of August 2025

- Revenue: TTM 47.06B; quarterly revenue growth (yoy) 1.40%.

- Profitability: Profit margin 25.89%; operating margin 34.66%; gross profit 28.91B; ROE 42.37%; ROA 8.94%.

- Cash & leverage: Cash 14.3B; debt 50.21B; debt/equity 166.37%; current ratio 1.21.

- Share price: Last close 68.83; 52‑week change −4.47% vs S&P 500 +15.91%; 52‑week range 60.62–74.38.

- Trend & volatility: 50‑day MA 69.75; 200‑day MA 68.08; beta 0.44.

- Earnings power: Net income (TTM) 12.18B; EBITDA 15.79B; diluted EPS (TTM) 2.82; quarterly earnings growth (yoy) 58.00%.

- Dividend: Forward rate 2.04; forward yield 2.96%; payout ratio 70.57%; ex‑div 9/15/2025; pay date 10/1/2025.

- Ownership & liquidity: Shares outstanding 4.3B; float 3.87B; insiders 9.88%; institutions 65.58%; avg 3‑mo volume 15.28M.

- Short interest: 35.27M shares short; short ratio 2.53; 0.83% of float.

- Market cap (approx.): ~296B based on 68.83 share price and 4.3B shares.

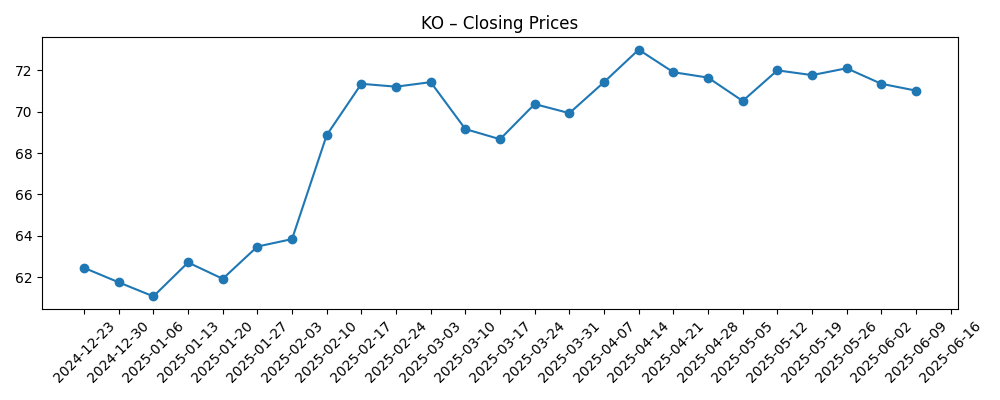

Share price evolution – last 12 months

Notable headlines

- Coca-Cola (KO) Eyes Costa Coffee Sale despite Billions in Potential Losses

- Coca-Cola, Amazon, Google, And Nvidia Have Used This Startup's AI Avatars — Inside Jeff Lu's $40M Rise To America's Fastest-Growing Company

Opinion

Coca‑Cola’s share price has been range‑bound in 2025, hovering largely between the high‑60s and low‑70s, with a recent 68.83 close and a 52‑week decline of 4.47% against a rising S&P 500. For income‑oriented investors, the 2.96% forward yield and a 0.44 beta provide ballast. The technical set‑up is neutral: the 50‑day moving average at 69.75 sits modestly above the 200‑day at 68.08, consistent with a market that is neither capitulating nor bidding the stock aggressively. In fundamentals, TTM revenue of 47.06B and a 25.89% profit margin underscore defensiveness even as near‑term revenue growth is 1.40% year over year. The investment debate for the next three years centers on whether Coca‑Cola can pair steady margins with improved top‑line momentum through innovation, price/mix, and disciplined capital allocation.

A key strategic swing factor is portfolio shaping. Reporting suggests Coca‑Cola may be evaluating a Costa Coffee exit despite potential losses. If pursued, such a move could simplify the portfolio, refocus management bandwidth on core sparkling and non‑sparkling brands, and—depending on deal terms—gradually improve balance‑sheet flexibility. The near‑term cost would likely be headline noise and possible non‑cash charges, with knock‑on effects for reported earnings. Over a multi‑year horizon, shedding lower‑synergy assets can enhance return on invested capital if proceeds are used to reduce debt (50.21B) or reinvest in higher‑margin categories. Conversely, if no transaction materializes, investors still gain clarity: the exercise itself signals management’s willingness to reassess capital deployment amid a payout ratio of 70.57% and a dividend cadence highly valued by KO’s shareholder base.

Marketing digitization is another thread to watch. Reports that Coca‑Cola has leveraged AI avatars in campaigns illustrate how the company experiments to keep brand salience high across global markets. For a system with 28.91B in gross profit and notable pricing power, small percentage lifts in engagement can matter—especially when organic volume growth is uneven and quarterly revenue growth sits at 1.40% year over year. The 58.00% quarterly earnings growth (yoy) highlights operating leverage and cost control, but durability will hinge on whether digital tools translate into sustained price/mix and innovation wins across hydration, sports, tea, and zero‑sugar offerings. Execution risk exists, yet the scale and distribution reach of KO provide a fertile testbed for data‑driven marketing that could compound brand equity without materially raising risk.

From a risk‑reward stance, KO’s balance between stability and optionality remains intact. Cash of 14.3B against 50.21B of debt and a 1.21 current ratio argue for measured capital returns, not stretch. The dividend—forward yield 2.96%—is a core part of the thesis, but the 70.57% payout ratio means buybacks and M&A must compete with deleveraging for priority. With a beta of 0.44 and a 52‑week range of 60.62–74.38, the stock offers low volatility while investors await clearer catalysts. Over three years, outcomes likely hinge on portfolio actions (e.g., any Costa decision), the pace of digital commercialization, and the beverage demand mix. If top‑line growth gradually improves while margins hold, KO can compound modestly; if not, the dividend and brand strength should still underpin total return that skews toward income.

What could happen in three years? (horizon August 2025+3)

| Scenario | Preview of 2028 |

|---|---|

| Best case | Portfolio streamlining (potential Costa outcome or similar) clarifies focus; digital marketing lifts price/mix; margins remain resilient; balance sheet improves through gradual deleveraging; dividend grows steadily and total return benefits from multiple stability plus improved organic growth. |

| Base case | Core brands sustain share; revenue growth remains modest but positive; operating discipline keeps margins healthy; dividend remains the primary return driver; valuation tracks earnings with limited multiple expansion amid low beta and defensive positioning. |

| Worse case | No portfolio action and uneven category demand; FX and input costs pressure margins; a write‑down or strategic misstep dents sentiment; dividend growth slows to preserve liquidity; shares lag broader indices within a 60–70 style trading band. |

Projected scenarios are based on current trends and may vary based on market conditions.

Factors most likely to influence the share price

- Strategic portfolio moves (e.g., any decision regarding Costa Coffee) and associated financial charges or proceeds.

- Pricing power and mix across key brands versus volume trends, reflected in revenue growth and margins.

- Input costs and FX swings affecting gross profit and operating margin resilience.

- Capital allocation balance among dividends, buybacks, and deleveraging given 50.21B total debt and a 70.57% payout ratio.

- Effectiveness of digital marketing initiatives (e.g., AI‑enabled campaigns) in sustaining brand engagement.

- Relative performance versus defensives and the broader market, considering low beta (0.44) and income appeal.

Conclusion

Coca‑Cola’s investment case into 2028 leans on durability: high margins (25.89% profit margin; 34.66% operating margin), global brands, and a dividend investors can underwrite (forward yield 2.96%). The counterbalance is modest near‑term revenue growth (1.40% yoy) and a leveraged balance sheet (50.21B debt) that argues for measured capital returns. Two developments could shape the next leg: portfolio optimization—illustrated by reports about Costa Coffee—and the scaling of data‑driven marketing, where early experiments such as AI avatars point to new engagement levers. If management threads the needle—protecting margins, nudging top‑line growth, and trimming leverage—KO’s low‑beta characteristics should compound steady total returns. If execution or macro headwinds intervene, the dividend and brand strength still provide downside buffering. On balance, KO looks positioned for incremental, not explosive, gains over three years, with clear watch‑items for investors seeking stability with select catalysts.

This article is not investment advice. Investing in stocks carries risks and you should conduct your own research before making any financial decisions.