CSL Limited (CSL.AX) enters August 2025 with defensive fundamentals but a risk‑off share price. The stock closed near A$215 on 28 August, close to its 52‑week low and roughly 30% below a year ago, despite trailing 12‑month revenue of A$15.56B, a 19.3% profit margin, and A$3.56B in operating cash flow. Growth is positive but modest (most recent quarterly revenue +4.9% year over year), while quarterly earnings growth rebounded strongly (+34.3% year over year). Leverage appears manageable with A$11.5B of debt against A$2.16B cash and a 2.46 current ratio. The forward dividend yield is 2.11% with a 45.5% payout ratio, and the next ex‑dividend date is 9 September 2025. Over the next three years, investor focus is likely to center on margin durability in plasma‑derived therapies, execution in seasonal vaccines, and disciplined balance‑sheet management as the company seeks to restore confidence after the recent share‑price drawdown.

Key Points as of August 2025

- Revenue – Trailing 12‑month revenue stands at A$15.56B; most recent quarterly revenue growth was +4.9% year over year.

- Profit/Margins – Profit margin 19.3%; operating margin 18.83%; EBITDA A$4.91B; operating cash flow A$3.56B; levered free cash flow A$1.88B.

- Sales/Backlog – No backlog figure provided; seasonality in vaccines and plasma‑therapy demand typically shapes near‑term visibility; gross profit A$8.08B signals pricing power.

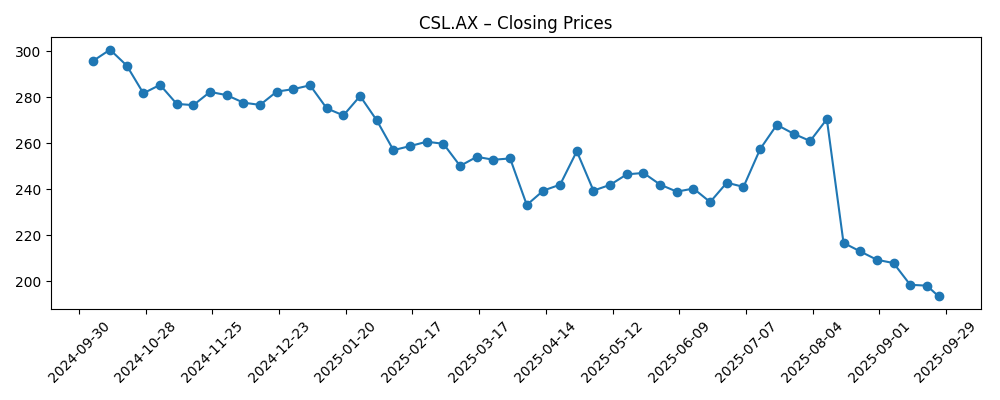

- Share price – Last close about A$215 (28 Aug 2025); 52‑week change −29.94%; 52‑week high/low A$309.89/A$208.35; below 50‑day (A$249.72) and 200‑day (A$257.69) moving averages; beta 0.33.

- Analyst view – Not provided in supplied data; sentiment appears cautious given the drawdown and higher 10‑day average volume (2.12M vs 3‑month 983.39k).

- Market cap – Approximately A$104B based on recent close and 484.21M shares outstanding.

- Balance sheet – Total debt A$11.5B vs cash A$2.16B; debt/equity 53.71%; current ratio 2.46 supports liquidity.

- Dividend – Forward dividend rate A$4.56 (2.11% yield); payout ratio 45.49%; next ex‑dividend date 9 September 2025.

Share price evolution – last 12 months

Notable headlines

Opinion

CSL’s de‑rating in 2025 reflects a swing from defensiveness to skepticism: investors are questioning how quickly growth can re‑accelerate and whether margins can expand from already healthy levels. The price sits near the 52‑week low and under both the 50‑day and 200‑day moving averages, a classic sign that the market wants more proof. Yet the fundamentals are not broken. A 19.3% profit margin, 18.83% operating margin, and 15.37% return on equity speak to a franchise with durable economics, while the low 0.33 beta underscores its historically defensive profile. In our view, that combination argues more for a timing problem than a thesis problem: the business is still producing solid cash flow, but the market is unwilling to pay up until revenue trends improve and earnings momentum looks repeatable beyond one strong quarter of year‑over‑year growth.

Growth normalization remains the swing factor. The latest +4.9% year‑over‑year revenue growth is positive but modest, and the +34.3% year‑over‑year quarterly earnings growth likely benefited from operational efficiencies and easier comps. Over the next 12–24 months, investors will look for consistent execution across plasma‑derived therapies and seasonal vaccines, where volume, mix, and pricing discipline can support incremental margin gains. With trailing revenue at A$15.56B and gross profit of A$8.08B, CSL has room to invest in collection capacity, manufacturing reliability, and product innovation without sacrificing profitability. If management demonstrates steady top‑line expansion and contains unit costs, the shares could re‑rate from depressed levels. Conversely, any wobble in volumes or pricing would likely keep the stock range‑bound until clearer proof of sustained growth emerges.

Balance‑sheet and cash‑flow resilience provide a buffer during this reset. CSL carries A$11.5B in total debt and A$2.16B in cash, but a 2.46 current ratio, A$3.56B in operating cash flow, and A$1.88B of levered free cash flow suggest capacity to fund operations, maintain dividends, and selectively invest. The forward dividend yield of 2.11% and a 45.49% payout ratio appear sustainable under a base case of stable margins. The upcoming 9 September 2025 ex‑dividend date could briefly support trading interest, particularly as 10‑day average volume has spiked above the 3‑month average. Deleveraging and disciplined capital allocation should remain priorities; given the share‑price weakness, buybacks may be less likely than continued investment in core franchises and incremental debt reduction to preserve flexibility through the cycle.

Our three‑year view is that CSL’s quality metrics and low beta can underpin market‑matching or better risk‑adjusted returns if execution stabilizes. In a best‑case path, steady demand, improved product mix, and operating leverage rebuild confidence and compress the risk premium. In a base case, modest revenue growth and stable margins keep returns adequate but unexciting, with total shareholder return anchored by the dividend. A worse case would involve regulatory, reimbursement, or cost pressures that erode profitability and force defensive actions. With the stock already down 29.94% over 12 months and trading below key moving averages, the asymmetry is improving, but durable evidence across several quarters is still required. Patient investors may find the setup attractive; traders will likely wait for technical confirmation that the downtrend has ended.

What could happen in three years? (horizon August 2025+3)

| Scenario | Operational markers | Implications for CSL shares |

|---|---|---|

| Best | Consistent top‑line growth with margin expansion from efficiency gains; stable plasma collection costs; reliable vaccine seasons. | Confidence returns, valuation re‑rates toward quality healthcare peers; dividend growth remains supported by strong cash generation. |

| Base | Steady revenue with margins holding near current levels; disciplined capex and working‑capital management; balance sheet gradually de‑levered. | Total return driven by moderate appreciation plus dividend; volatility stays below market given 0.33 beta. |

| Worse | Cost inflation or regulatory pressure compresses margins; operational hiccups or weaker demand in key franchises. | Prolonged range‑bound trading near cycle lows; management prioritizes preservation of cash and balance sheet over growth initiatives. |

Projected scenarios are based on current trends and may vary based on market conditions.

Factors most likely to influence the share price

- Execution on revenue growth and margin stability relative to the recent +4.9% revenue and +34.3% earnings growth prints.

- Plasma collection costs, supply reliability, and manufacturing efficiency affecting gross margin (A$8.08B TTM gross profit baseline).

- Seasonal vaccine performance and pricing dynamics across key markets.

- Regulatory, reimbursement, or quality‑control outcomes that could impact product availability or pricing power.

- Capital allocation and leverage trajectory given A$11.5B debt, A$2.16B cash, and dividend commitments (45.49% payout).

- Technical and liquidity factors: position vs 50‑/200‑day moving averages and trading volumes (10‑day 2.12M vs 3‑month 983.39k).

Conclusion

CSL’s three‑year setup balances quality fundamentals with a challenged share price. The company brings healthy profitability (19.3% profit margin; 18.83% operating margin), solid cash generation (A$3.56B OCF; A$1.88B FCF), and a manageable liquidity profile (2.46 current ratio) to a market that has become skeptical after a 12‑month drawdown of 29.94%. The base case is for steady revenue and margin preservation, with total return augmented by a 2.11% forward dividend yield and disciplined capital allocation. Upside requires evidence that top‑line momentum can firm without sacrificing margins, gradually re‑rating the multiple as risk perceptions ease. Downside stems from cost or regulatory shocks that would pressure profitability and constrain investment. With shares trading near the 52‑week low and below key moving averages, patient investors may find the risk‑reward improving, but confirmation through several quarters of consistent execution will be crucial to sustain a durable recovery into 2028.

This article is not investment advice. Investing in stocks carries risks and you should conduct your own research before making any financial decisions.