Exxon Mobil enters September 2025 with shares near $112.14 and a defensive profile underpinned by integrated operations, steady cash generation, and a commitment to dividends. Trailing 12-month revenue is $329.82 billion with a 9.40% profit margin and 11.73% operating margin, though quarterly revenue and earnings declined year over year (−12.30% and −23.40%, respectively). Operating cash flow of $54.3 billion and levered free cash flow of $20.75 billion support a forward dividend yield of 3.52% with a 55.68% payout ratio. The stock trades close to its 50- and 200-day moving averages (110.42 and 109.67) and carries a 0.55 beta. Recent coverage cites a $125.00 consensus price target, implying potential upside versus the latest close. Against this mixed backdrop, our three-year outlook weighs cash flow durability, capital returns, and macro sensitivity to chart plausible paths for the shares.

Key Points as of September 2025

- Revenue: $329.82B (ttm); quarterly revenue growth −12.30% year over year; revenue per share $75.05.

- Profit/Margins: Profit margin 9.40%; operating margin 11.73%; ROE 11.83%; ROA 5.28%.

- Cash flow & balance sheet: Operating cash flow $54.3B (ttm); levered FCF $20.75B; total debt $38.99B; debt/equity 14.44%; current ratio 1.25; total cash $14.35B.

- Share price: Last close (9/11/2025) $112.14; 50-day MA 110.42; 200-day MA 109.67; 52-week range 97.80–126.34; 52-week change 1.14%; beta 0.55.

- Dividend: Forward annual rate $3.96 (yield 3.52%); payout ratio 55.68%; last dividend date 9/10/2025; ex-dividend 8/15/2025; trailing yield 3.48%; 5-year average yield 4.43.

- Sales/Backlog: Backlog not disclosed in this snapshot; quarterly earnings growth −23.40% year over year.

- Analyst view: Reported $125.00 consensus target (ETF Daily News); short interest 47.2M shares (short ratio 3.03; 1.23% of float); institutions hold 66.58%.

- Market cap: Not provided in this snapshot; Exxon Mobil remains a mega-cap integrated energy company; shares outstanding 4.26B.

- Liquidity/trading: Average volume 16.49M (3-month) and 15M (10-day); float 4.25B; insider ownership 0.07%.

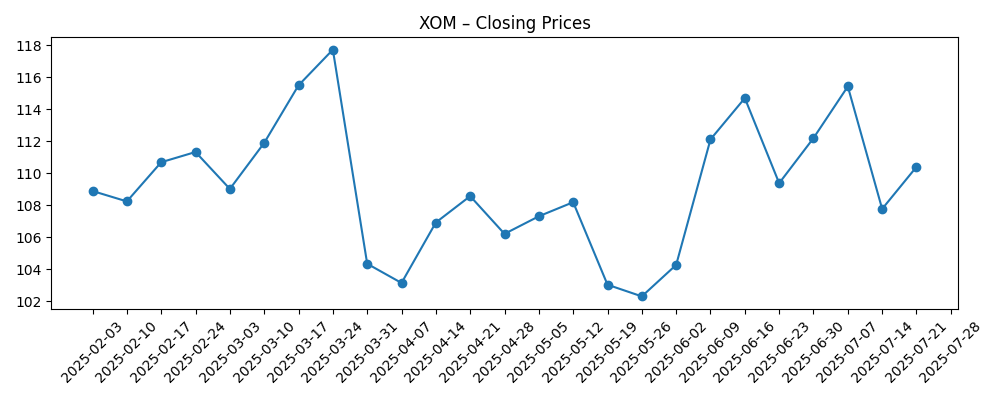

Share price evolution – last 12 months

Notable headlines

- How Is Exxon Mobil's Stock Performance Compared to Other Oil & Gas Integrated Stocks? [Barchart.com]

- Exxon Mobil Corporation (XOM): A Bull Case Theory [Yahoo Entertainment]

- Exxon Mobil Corporation (NYSE:XOM) Receives $125.00 Consensus Price Target from Brokerages [ETF Daily News]

- How to Buy XOM for a 3% Discount, or Achieve a 15% Annual Return [Barchart.com]

- Exxon Mobil (NYSE:XOM) Trading Down 1% After Insider Selling [ETF Daily News]

- Exxon weighs Russia comeback in talks with Rosneft [Biztoc.com]

- Exxon, Rosneft said to have weighed return to Russia [Biztoc.com]

Opinion

The headline $125.00 consensus target puts a marker on sentiment: investors see upside from the $112.14 recent close, but not a runaway re-rating. Technically, Exxon Mobil is trading near its 50- and 200-day moving averages, suggesting the market is still calibrating macro inputs rather than repricing company-specific risk. The 52-week range of 97.80–126.34 frames a fairly tight corridor for a cyclical stock; coupled with a 0.55 beta, it underlines XOM’s role as a lower-volatility energy exposure. In our view, the multi-year call hinges on how quickly revenue and earnings growth stabilize after the recent −12.30%/−23.40% year-over-year declines. If product cracks and upstream realizations firm while cost discipline holds, modest multiple expansion toward the consensus view is plausible within an 18–36 month window.

Income investors remain central to the story. A forward dividend yield of 3.52% and a 55.68% payout ratio look manageable against $54.3B in operating cash flow and $20.75B in levered free cash flow (ttm). With debt at $38.99B and debt/equity at 14.44%, leverage appears conservative, providing room to sustain dividends through commodity cycles and potentially resume opportunistic buybacks when conditions allow. That said, the five-year average dividend yield of 4.43% reminds us that entry yields can back up if macro weakens. Over three years, we expect dividend growth in low–single digits to be the baseline, with total returns driven as much by cycle-aware timing as by income compounding.

Reports suggesting Exxon weighed a return to Russia via talks with Rosneft would, if pursued, introduce significant geopolitical, legal, and reputational risk. While such discussions may not translate into action, the mere consideration highlights how value in large integrated models often intersects with geopolitics. We would expect any concrete steps to face regulatory scrutiny and potential investor pushback, and we would incorporate a higher risk premium into the equity if re-entry into sanctioned jurisdictions became a live option. In the absence of that path, the strategic priority likely remains brownfield debottlenecking and selective upstream and downstream investments aimed at improving unit costs and returns, which would support margins even if headline revenues remain sensitive to prices.

The insider-selling headline that coincided with a 1% dip does not, on its own, change the thesis; short interest sits at 47.2M shares (1.23% of float) and the short ratio is 3.03—hardly signs of pronounced bearish positioning. Institutional ownership of 66.58% suggests a stable base that may add on weakness, particularly if the stock revisits the lower end of its 52-week range. Near term, we watch whether XOM can hold above the 50- and 200-day moving averages; sustained closes above both would strengthen the case for a drift toward the $125.00 consensus over the next few quarters. Conversely, slippage below the moving averages alongside weaker spreads would likely keep shares range-bound and put more of the burden on dividend yield to carry total returns.

What could happen in three years? (horizon September 2025+3)

| Scenario | Operating environment | Financial/returns | Implication for shares (to September 2028) |

|---|---|---|---|

| Best | Oil demand holds firm and supply remains disciplined; refining and chemicals margins stay healthy; execution remains strong. | Revenue and margins expand; free cash flow trends higher; dividend growth in low–mid single digits; opportunistic buybacks. | Shares re-rate toward the upper end of their recent performance band; total return outpaces the broader market. |

| Base | Mixed commodity tape with periodic softness; steady operations offset by normal cost inflation. | Revenue stable to modestly higher; margins flat to slightly up; dividend growth in low–single digits; buybacks used tactically. | Shares track sideways to modestly higher, gravitating toward consensus targets as cash returns anchor valuation. |

| Worse | Global growth slows and commodity prices weaken; project delays and softer downstream spreads. | Revenue pressure and margin compression; free cash flow tightens; dividend growth pauses but base payout maintained. | Shares retreat toward the lower end of the recent range; total return lags until cycle turns. |

Projected scenarios are based on current trends and may vary based on market conditions.

Factors most likely to influence the share price

- Commodity prices and refining/chemical spreads, which directly drive revenue, margins, and cash flow.

- Capital allocation discipline (dividends, buybacks, and capex) relative to free cash flow and payout ratio sustainability.

- Regulatory and geopolitical developments, including any potential Russia-related decisions and broader sanctions risk.

- Operational execution and cost control across upstream, downstream, and chemicals during a flattening growth backdrop.

- Market technicals and positioning: adherence to key moving averages, short interest trends, and institutional flows.

Conclusion

Exxon Mobil’s three-year setup balances dependable cash generation with cyclical sensitivity. The numbers outline a sturdy base: $329.82B in trailing revenue, a 9.40% profit margin, conservative leverage, and meaningful cash flow that supports a 3.52% forward yield with a mid-50s payout ratio. Yet the near-term data also flag caution, with year-over-year declines in revenue and earnings. In our base case, operational execution and disciplined spending keep margins resilient, allowing modest dividend growth and tactical buybacks to underpin returns while the share price gradually gravitates toward the $125.00 consensus. Upside exists if product cracks and realizations improve, whereas a softer macro could keep shares anchored near the lower end of the recent range. For investors seeking lower-beta energy exposure and consistent income, XOM remains a credible core holding—provided expectations reflect the cycle and the pace of normalization.

This article is not investment advice. Investing in stocks carries risks and you should conduct your own research before making any financial decisions.