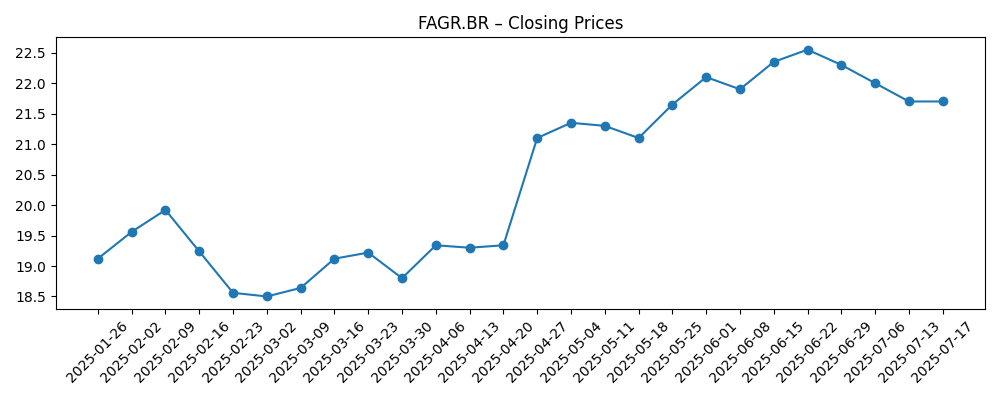

Fagron N.V. has seen fluctuations in its stock price over the past six months, marked by a rebound to approximately €21.70. The company's strategic initiatives, including a focus on personalized medicine and international expansion, have contributed to this growth. As of July 2025, Fagron is poised to capitalize on trends in the healthcare sector, emphasizing tailored solutions that address the needs of healthcare providers. Investors remain cautiously optimistic as they observe the company's performance and market positioning.

Key Points as of July 2025

- Revenue: €1.2 billion

- Profit/Margins: €0.2 billion

- Sales/Backlog: Strong growth in personalized medicine

- Share price: Approx. €21.70

- Analyst view: Positive outlook

- Market cap: €1.5 billion

Share price evolution – last 6 months

Notable headlines

- Fagron to expand U.S. facilities to enhance service delivery – Healthcare News

- Fagron's personalized medicine strategy shows promising results in Q2 – Pharma Insights

- Management discusses long-term growth plans in recent earnings call – Market Watch

Opinion

The rebound in Fagron's share price indicates a potential recovery backed by strategic initiatives aimed at capturing the personalized medicine market. As healthcare continues to evolve, companies like Fagron that prioritize tailored solutions are likely to attract investor interest. However, it is crucial for the company to maintain its momentum and effectively communicate its long-term strategies to stakeholders.

In looking ahead, there are several factors that could significantly impact Fagron's performance. The success of their expanded U.S. facilities will be critical, as this market presents both opportunities and challenges. Additionally, the company’s ability to innovate and stay ahead of competitors in personalized medicine will play a vital role in its growth trajectory.

Investors should keep a close watch on how Fagron navigates potential market disruptions, including regulatory changes and evolving consumer preferences. If management successfully executes its plans, the company could see enhanced profitability and increased share value.

Overall, Fagron's stock performance over the next three years will largely depend on its commitment to innovation and market responsiveness. As the healthcare landscape shifts, Fagron must remain agile and focused on delivering high-quality, personalized solutions.

What could happen in three years? (horizon July 2028)

| Scenario | Revenue (€ billion) | Share Price (€) |

|---|---|---|

| Best | 2.2 | 30.00 |

| Base | 1.8 | 25.00 |

| Worse | 1.5 | 20.00 |

Projected scenarios are based on current trends and may vary based on market conditions.

Factors most likely to influence the share price

- Expansion success in the U.S. market

- Innovations in personalized medicine

- Changes in healthcare regulations

- Investor sentiment and market conditions

Conclusion

In conclusion, Fagron N.V. is navigating a critical phase characterized by strategic initiatives aimed at leveraging advancements in personalized medicine. As the healthcare sector continues to evolve, Fagron's adaptability and innovative capabilities will be key to its success. The current share price reflects a mixture of optimism and cautious observation among investors, highlighting the importance of executing on announced strategies. Looking ahead, careful monitoring of market trends and operational performance will be essential for stakeholders wanting to gauge the company's potential for sustained growth.

This article is not investment advice. Investing in stocks carries risks and you should conduct your own research before making any financial decisions.