HSBC Holdings’ three-year set-up pivots on a strategic swing toward Hong Kong: the bank has proposed to buy out Hang Seng Bank at a premium, prompting a short‑term share pullback even as the broader 12‑month trend has been strong. Under the hood, revenue fell 11% year over year and earnings are normalizing as the interest‑rate cycle peaks; that helps explain management’s renewed focus on fee income, wealth, and digital, which are less rate‑sensitive. For investors, the key is whether the Hang Seng transaction concentrates risk in Greater China or deepens HSBC’s moat in its strongest profit pools. The forward dividend yield of 5.03% offers income support while capital is redeployed, but the payout must be balanced against integration costs and any credit normalization. Sector‑wide, global banks face easing rates, tougher capital and conduct standards, and uneven growth in China and the UK. Over 2026–2028, the stock narrative will hinge on capital discipline, credit costs, and proof that Asia‑led growth can offset margin compression.

Key Points as of October 2025

- Revenue (ttm): 56.21B; quarterly revenue growth (yoy): -11.00%.

- Profitability: profit margin 33.67%; operating margin 46.56%; return on equity 10.13%.

- Net income (ttm): 17.84B; diluted EPS (ttm): 0.76; operating cash flow (ttm): 7.55B.

- Sales/backlog: traditional backlog not applicable to banks; loan/deposit pipeline detail not disclosed; focus remains on net interest and fee income.

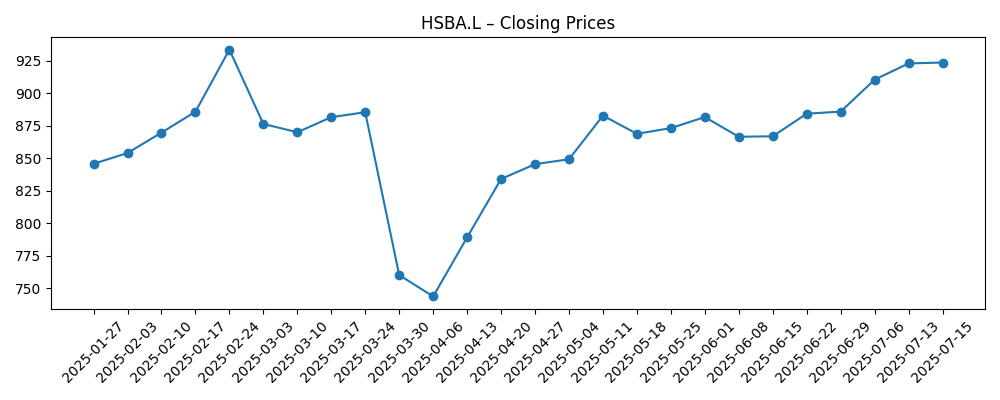

- Share price: 52‑week change 48.25%; 52‑week high 1,067.80; 50‑day moving average 989.03 vs 200‑day 895.25; beta 0.50.

- Dividend: forward annual dividend rate 0.5; forward yield 5.03%; payout ratio 63.79%.

- Balance sheet context: total cash 1.11T; total debt 746.42B; book value per share 9.88 (bank capital ratios not disclosed here).

- Market cap: data not disclosed in provided materials; shares outstanding 17.24B; insider ownership 0.25% and institutions 44.95%.

- Qualitative: Asia‑centric franchise and digital initiatives underpin fee growth; proposed Hang Seng Bank buyout raises exposure to Hong Kong/China alongside wealth inflow opportunities.

Share price evolution – last 12 months

Notable headlines

- HSBC to Buy Out Hang Seng Unit for $14 Billion in Hong Kong Bet (Bloomberg)

- HSBC offers $13.6bn for 100% control of Hong Kong lender Hang Seng (Financial Times)

- HSBC stock slumps after $14 billion bet on Hong Kong — at a hefty premium (MarketWatch)

- HSBC reports Q3 2025 financial results showing significant growth (HSBC)

- HSBC plans digital transformation to improve customer experience (Bloomberg)

- HSBC raises dividend amid strong performance in 2025 (Reuters)

- Singapore, the UK, and Switzerland top destinations for world’s super‑rich, HSBC says (Business Insider)

- HSBC collaborates with FinTech to enhance payment solutions (Wall Street Journal)

Opinion

HSBC’s latest prints show the rate cycle is turning from a tailwind to a normalizer. Revenue contracted year over year and earnings growth decelerated, consistent with industry‑wide margin compression as deposit costs catch up and trading/transaction income reverts. Yet headline margins remain robust, and return on equity sits in a double‑digit zone—evidence that cost discipline and mix still work. In that context, the proposed Hang Seng Bank buyout is a deliberate reweighting toward HSBC’s highest‑return franchise: Hong Kong and adjacent Greater Bay Area flows. The short‑term selloff reflects concern about price and concentration risk rather than a broken model. The crux is execution, credit quality, and whether fee‑rich wealth and payments can cushion net interest income as rates ease.

Income support looks credible for now: a forward yield above 5% and a payout ratio in the 60s signal commitment to shareholder returns, even as capital is earmarked for strategic moves. The cash and funding profile is large by design for a global bank, but reinvestment discipline will matter more than sheer balance‑sheet size. With quarterly revenue growth negative and earnings growth also down year over year, investors will scrutinize the quality of profits—how much stems from sustainable fees versus volatile markets—and the trajectory of loan‑loss provisions as credit normalizes. The digital program flagged in recent reports should, if executed well, lower cost‑to‑serve and deepen customer engagement without sacrificing risk controls.

The Hang Seng proposal is both offensive and defensive. Offensively, full control could unlock tighter coordination across retail, commercial, and private banking, improving cross‑sell into insurance, payments, FX and wealth—segments where HSBC’s Asia footprint and brand resonate. Defensively, it prevents strategic drift in a core earnings engine at a time when China’s growth mix is unsettled and local challengers are scaling. Integration will need to preserve Hang Seng’s strong franchise identity while harmonizing risk, compliance, and technology stacks. The benefit case hinges less on headline cost cuts and more on revenue synergies and balance‑sheet optimization.

These dynamics shape the multiple. If rate cuts are modest and fee momentum holds, HSBC’s lower beta profile could warrant a steadier premium versus European peers with narrower Asia access. Conversely, a sharper Hong Kong/China downturn or higher regulatory capital demands would compress the narrative toward capital preservation and dividend defensiveness, restraining re‑rating. In the middle ground, steady dividends, visible cost control, and proof that digital investments translate into better unit economics could keep the stock tracking book value progression while offering income. The next few quarters—especially signals on net interest margin, credit costs in Greater China, and steps toward the Hang Seng transaction—are likely to be the swing factors for sentiment.

What could happen in three years? (horizon October 2025+3)

| Best case | Rate cuts are shallow; Asia wealth inflows accelerate; Hang Seng integration proceeds smoothly with strong cross‑sell in wealth and payments; credit costs stay benign and digital programs lower the cost to serve. Investor narrative shifts toward durable fee growth and capital flexibility. |

| Base case | Moderate margin compression is offset by fees and operating efficiency; China/Hong Kong growth is uneven but manageable; dividend remains central to total return; the market values HSBC on steady book value progression with limited re‑rating. |

| Worse case | A sharper downturn in Hong Kong/China triggers higher impairments; integration complexities delay benefits; regulators tighten capital expectations; management prioritizes balance‑sheet resilience and trims capital returns, leading to de‑rating. |

Projected scenarios are based on current trends and may vary based on market conditions.

Factors most likely to influence the share price

- Path of policy rates and deposit competition affecting net interest margin.

- Credit trends in Hong Kong/China, especially commercial real estate and SME stress.

- Execution and regulatory milestones on the proposed Hang Seng Bank buyout.

- Regulatory capital and conduct requirements across the UK and Asia.

- Delivery of digital transformation and its impact on efficiency and fee growth.

- Wealth and cross‑border flows into Asia/UK hubs influencing fee income.

Conclusion

HSBC enters the next three years with two countervailing forces: cyclical normalization in net interest income and a strategic push deeper into its strongest geography. The data show revenue down year over year and earnings growth negative, yet margins and ROE remain solid—signs of an underlying franchise that can fund both dividends and reinvestment. The proposed acquisition of Hang Seng Bank reframes the risk‑reward: more concentrated exposure to Hong Kong and China, but also a clearer path to scale in wealth, payments, and FX where the bank competes best. If digital execution trims costs and fee income expands, the stock’s lower beta and income profile could keep it resilient even as rates ease. Near term, sentiment will track capital discipline and credit quality as much as growth. Watch next 1–2 quarters: regulatory milestones on the Hang Seng bid; net interest margin trajectory as rates ease; loan‑loss provisions in Greater China.

This article is not investment advice. Investing in stocks carries risks and you should conduct your own research before making any financial decisions.