JD.com enters the next three years balancing growth and discipline. Trailing-12-month revenue is 1.27T with quarterly revenue growth of 22.40%, yet profitability remains thin (profit margin 3.06% and operating margin -0.30%). EBITDA of 40.02B and net income of 38.65B sit alongside negative levered free cash flow of -14.16B, underscoring investment intensity. The balance sheet is a support: total cash 213.84B versus debt of 100.79B, and a newly established forward dividend rate of 1 implies a 3.29% yield. Shares have eased toward the 50-day average of 32.07, below the 200-day at 35.89, after a volatile year between the 52-week low of 25.61 and high of 47.82. A reported plan to list a Singapore REIT could unlock capital from logistics real estate and act as a catalyst if execution is timely.

Key Points as of August 2025

- Revenue: ttm 1.27T; quarterly revenue growth (yoy) 22.40%.

- Profit/Margins: profit margin 3.06%; operating margin (ttm) -0.30%; gross profit 124.37B.

- Cash and leverage: total cash 213.84B; total debt 100.79B; debt/equity 33.90%; current ratio 1.22.

- Cash flows: operating cash flow 24.82B; levered free cash flow -14.16B.

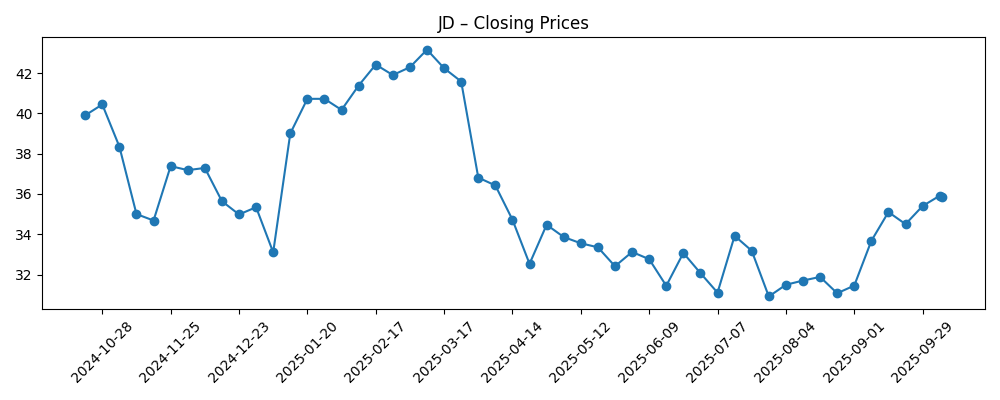

- Share price: last weekly close ~31.07 (Aug 29, 2025); 50-day MA 32.07; 200-day MA 35.89; 52-week range 25.61–47.82; beta 0.47.

- Dividend: forward annual dividend rate 1; yield 3.29%; payout ratio 28.47%; ex-div 4/8/2025; dividend date 4/29/2025.

- Ownership/short interest: insiders 0.79%; institutions 15.37%; short interest 26.71M (7/15: 22.12M); short ratio 2.53; short % of float 1.90%.

- Analyst view: consensus not provided here; market caution reflected in quarterly earnings growth (yoy) of -51.10%.

- Market cap: not provided in this snapshot; valuation likely to hinge on margin normalization and asset monetization progress.

Share price evolution – last 12 months

Notable headlines

Opinion

The reported plan to list a Singapore REIT could be a strategically important turn for JD.com. Logistics and real-estate assets have historically tied up capital while enabling fast delivery and service differentiation. Externalizing part of that portfolio into a REIT may surface asset values, recycle capital into core retail and technology, and potentially reduce balance-sheet intensity without sacrificing operational control if structured with anchor stakes and long-term leases. For equity holders, the read-through is twofold: first, a clearer split between operating earnings and property income; second, a potential boost to return on equity as the company pivots from owning to orchestrating assets. The risks are timing, valuation, and regulatory approvals. If execution slips or pricing is conservative, the immediate benefit could be muted, but the strategic direction still signals a focus on efficiency and optionality over the next three years.

Under the hood, JD.com’s fundamentals present a mixed picture. Top-line momentum is solid with 22.40% quarterly revenue growth year over year, yet profitability remains tight: profit margin is 3.06% and the operating margin (ttm) sits at -0.30%. EBITDA of 40.02B and net income of 38.65B indicate earnings power, but negative levered free cash flow of -14.16B points to investment needs and financing outflows. The dividend—forward rate 1 with a 3.29% yield and a 28.47% payout ratio—adds a shareholder-return pillar but also raises the bar for consistent cash generation. The company’s 213.84B cash and 100.79B debt provide flexibility to bridge a period of margin repair. Over 2025–2028, investors will likely prize evidence of cost discipline in fulfillment, growth in higher-margin services, and operating leverage that can translate revenue strength into sustainable free cash flow.

On the tape, the stock reflects this push-pull. Shares trade near the 50-day moving average of 32.07 and below the 200-day at 35.89, signaling a cautious trend. The 52-week range of 25.61–47.82 highlights how sensitive sentiment has been to policy signals, competitive intensity, and earnings updates. A beta of 0.47 suggests relatively lower market correlation, yet the rise in short interest to 26.71M (from 22.12M a month earlier) indicates skepticism about near-term margin stabilization. In our view, a credible roadmap to improve profitability—alongside milestones on asset monetization—would prompt a rerating, while setbacks around regulatory approvals or competitive pricing could keep the shares range-bound. Watch the slope of the 200-day average for confirmation that the market is willing to discount a steadier 2026–2027 earnings trajectory.

Looking three years out, the investment debate hinges on execution versus headwinds. If JD.com can monetize logistics real estate prudently, prioritize returns on capital, and show a pattern of operating margin improvement, the stock’s valuation should respond even in a moderate growth environment. The balance sheet can underwrite this transition, while the dividend may support total return and attract income-oriented holders if covered by cash flows. Conversely, competitive subsidy cycles, macro variability, or regulatory friction could cap margins and delay monetization benefits, leaving free cash flow under pressure. In that scenario, the current defensive attributes—cash reserves, low beta, and a dividend—provide some cushion but not a thesis. For now, the burden of proof is on turning revenue momentum into cumulative cash generation through 2028.

What could happen in three years? (horizon August 2028)

| Scenario | Business outcomes (2025–2028) | Stock view |

|---|---|---|

| Best | Singapore REIT listing completes smoothly; capital recycling funds technology and services; fulfillment efficiency lifts margins from today’s thin levels; revenue momentum holds; free cash flow turns resilient; dividend grows within a disciplined payout framework. | Valuation re-rates as profitability visibility improves; shares challenge the upper end of prior ranges and establish a higher base. |

| Base | Gradual asset monetization; steady but modest margin improvement; revenue growth normalizes; cash generation stabilizes; dividend maintained with opportunistic capital returns as conditions allow. | Range-bound trading around long-term averages; catalysts (asset sales, profit beats) drive episodic outperformance. |

| Worse | Pricing pressure and regulation keep operating margin near breakeven; REIT timing slips; consumer demand softens; free cash flow remains negative, forcing tighter capital allocation. | Multiple compresses toward cycle lows; investors prioritize balance-sheet strength over growth until execution improves. |

Projected scenarios are based on current trends and may vary based on market conditions.

Factors most likely to influence the share price

- Execution on logistics asset monetization (including the reported Singapore REIT) and capital allocation discipline.

- Margin trajectory relative to competitive intensity in Chinese e-commerce and services.

- Free cash flow sustainability versus dividend commitments and investment needs.

- Regulatory environment and ADR-related risks affecting investor access and sentiment.

- Consumer demand trends and macro conditions impacting discretionary spending and order volumes.

Conclusion

JD.com’s three-year setup is a balance of credible catalysts and execution risk. Revenue momentum is intact, but the task is to convert growth into durable cash generation. Today’s metrics—thin operating margin, negative levered free cash flow, and rising short interest—explain why the market remains guarded, even as cash on hand and a modest beta offer downside buffers. The reported plan to list a Singapore REIT is strategically coherent: it could recycle capital, sharpen returns on equity, and clarify the economics of logistics. To earn a higher valuation by 2028, JD.com will likely need sequential improvement in profitability, visible free cash flow coverage of its dividend, and steady progress on asset monetization. In the absence of those milestones, shares may remain range-bound. For now, this is a show-me story with optionality—supported by liquidity, disciplined payouts, and identifiable catalysts that could shift sentiment if delivered.

This article is not investment advice. Investing in stocks carries risks and you should conduct your own research before making any financial decisions.