KOC Holding faces a challenging financial landscape with a significant decline in quarterly revenue growth and profit margins currently resting at -0.13%. Despite ongoing operational hurdles, the company is actively engaging in strategies to improve its financial health and investor outlook. The share price has experienced notable fluctuations in recent months, affecting investor sentiment. With a strong focus on managing debts and leveraging cash flow, KOC Holding aims to stabilize and enhance its market performance in the upcoming periods. Stakeholders remain attentive to the company’s ability to execute its recovery plans effectively.

Key Points as of July 2025

- Revenue: 2.23T

- Profit Margin: -0.13%

- Operating Margin: 3.27%

- Share price: 173.0

- Analyst view: Cautiously optimistic

- Market cap: 440.56B

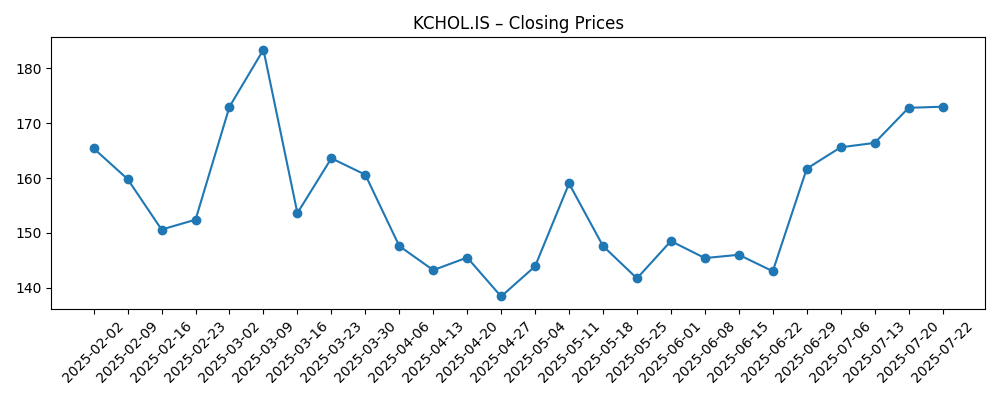

Share price evolution – last 6 months

Notable headlines

- KOC Holding's revenue declines by 13% in latest quarter

- Management outlines debt reduction strategy amid financial turbulence

- KOC Holding reports negative earnings for Q1 2025

Opinion

The recent decline in quarterly revenue by 13.50% has raised concerns among investors regarding KOC Holding's operational efficiency. This downward trend indicates potential challenges in navigating the competitive landscape. However, with its strong cash reserves of 365.57B and a focus on restructuring debt amounting to 944.37B, there might be a pathway to recovery if managed prudently. The share price has fluctuated significantly, suggesting a volatile investor sentiment but also providing potential buying opportunities for long-term investors.

As the management has indicated a proactive approach towards improving profit margins and reducing debt, market observers remain cautiously optimistic about KOC Holding's future performance. The company's ability to execute its strategies effectively will be crucial in influencing both short-term and long-term stock performance. The fluctuations in share prices observed recently may provide an essential insight into investor expectations, which could play a role in shaping future investment decisions.

In conclusion, the mixed signals from recent earnings calls and market performance could lead to further volatility in KOC Holding's share price. For investors, monitoring the company's operational adjustments and strategic decisions will be key to assessing future stock valuations. With the right measures in place, KOC Holding could potentially turn challenges into growth opportunities, thus restoring investor confidence.

What could happen in three years? (horizon July 2025+3)

| Scenario | Share Price | Market Cap |

|---|---|---|

| Best | 250.00 | 640.00B |

| Base | 200.00 | 512.00B |

| Worse | 150.00 | 384.00B |

Projected scenarios are based on current trends and may vary based on market conditions.

Factors most likely to influence the share price

- Debt reduction effectiveness

- Quarterly revenue growth trends

- Investor sentiment and market conditions

- Operational efficiency improvements

Conclusion

KOC Holding stands at a critical juncture as it attempts to navigate through financial difficulties while maintaining investor confidence. The company’s recent performance has undoubtedly raised concerns, but its plans to address operational issues and reduce debt could be pivotal in the coming years. Stakeholders must pay close attention to the company’s execution of these strategies, as they are likely to heavily influence future share price movements.

This article is not investment advice. Investing in stocks carries risks and you should conduct your own research before making any financial decisions.