As of July 2025, Meta Platforms, Inc. continues to show resilience and growth potential driven by its strategic investments in AI and virtual reality (VR). The company's recent financial results and innovative product offerings position it well for the future while navigating challenges in the tech landscape. Recent court rulings and developments in AI frameworks further underscore Meta's role in shaping the tech industry's future. Investors are closely watching Meta's strategies to enhance revenue streams and adapt to regulatory environments, making it a focal point for market observers.

Key Points as of July 2025

- Revenue: $170.36B

- Profit Margin: 39.11%

- Quarterly Revenue Growth (yoy): 16.10%

- Share price: $714.80

- Analyst view: Positive outlook driven by AI and VR investments

- Market cap: Approx. $1.55T

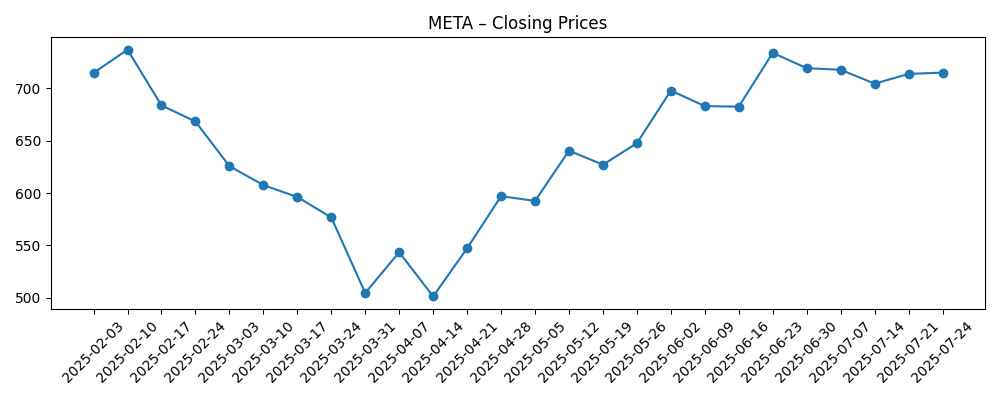

Share price evolution – last 6 months

Notable headlines

- Meta snubs the EU’s voluntary AI guidelines

- What Meta and Anthropic really won in court

- Zoom’s new Meta Quest app encourages taking video calls in VR

- OpenAI Leadership Responds to Meta Offers: 'Someone Has Broken Into Our Home'

- Facebook is starting to feed its AI with private, unpublished photos

- Meta investors settle $8bn lawsuit with Zuckerberg over Facebook privacy

Opinion

Meta Platforms, Inc. has been navigating a rapidly evolving tech landscape, making strategic moves that invigorate investor interest. The recent focus on AI has brought both opportunities and scrutiny, particularly as regulatory frameworks tighten globally. The company's decision to snub the EU's voluntary AI guidelines reflects a bold stance that could either enhance its innovation trajectory or invite further scrutiny from regulators. This balancing act is critical as Meta seeks to position itself as a leader in emerging technologies.

Furthermore, the expansion of VR capabilities through products like the Meta Quest app illustrates how the company is diversifying its revenue streams beyond traditional advertising. This innovation could yield significant growth potential, especially as more users adopt VR technologies for communication and entertainment. As digital landscapes continue to shift, maintaining a competitive edge through advanced technology will be key for Meta's continued success.

Share price fluctuations have mirrored these developments, with the stock currently trading at $714.80. Observers will want to see if the price stabilizes or experiences volatility based on Meta's ability to execute its plans effectively. Market sentiment appears cautiously optimistic about the company's trajectory, but new legal and regulatory challenges could dampen this outlook.

Looking ahead, investors must weigh the potential for growth against the backdrop of market volatility and regulatory pressures. Meta's adaptability in responding to these challenges will be a significant factor influencing its share price over the next few years, making it a critical watchpoint for equity analysts.

What could happen in three years? (horizon July 2025+3)

| Scenario | Expected Revenue | Expected Share Price |

|---|---|---|

| Best | $250B | $900 |

| Base | $220B | $800 |

| Worse | $180B | $600 |

Projected scenarios are based on current trends and may vary based on market conditions.

Factors most likely to influence the share price

- Regulatory environment impact on operations

- Success of AI and VR product launches

- Market competition from other tech firms

- Investor sentiment towards tech stocks

Conclusion

In conclusion, Meta Platforms, Inc. stands at a critical juncture as it embraces innovation while navigating regulatory landscapes. The company's investment in AI and VR technologies positions it favorably for future growth, although potential pitfalls exist. With a solid financial foundation supported by strong profit margins and cash flow, Meta is poised to capitalize on market opportunities. However, external pressures such as regulatory scrutiny and competition could impact its growth trajectory. Keeping a close watch on the company's strategic initiatives and market responses over the next few years will be essential for stakeholders as they make informed decisions about their investments.

This article is not investment advice. Investing in stocks carries risks and you should conduct your own research before making any financial decisions.