Mobileye’s setup has shifted over the past few quarters: revenue is rebuilding while GAAP profitability remains under pressure, and the stock has settled into a lower, more volatile trading range. Investors are refocusing on the balance between growth and investment, with revenue (ttm) at 1.92B and operating cash flow at 652M signaling the business can fund R&D and program launches without leaning on debt. What changed is a mix of uneven auto production, changing content per vehicle for driver‑assistance features, and a sentiment reset reflected in a consensus “Hold” stance from brokerages. Why it matters is that ADAS—advanced driver‑assistance systems—continues to expand as a safety feature across mass‑market platforms, but timing of model cycles and price competition can swing quarterly results. The three‑year question is whether design wins and software‑rich feature sets can compound into durable margins as programs ramp. In a consolidating auto‑tech supply chain, Mobileye’s liquidity and customer footprint give it options, but execution will set the pace.

Key Points as of October 2025

- Revenue – Revenue (ttm) is 1.92B, with the most recent quarterly revenue growth at 15.30% year over year.

- Profit/Margins – Profit margin is -153.91% and operating margin (ttm) is -14.62%; EBITDA is -248.4M, with net income (ttm) at -2.96B.

- Cash & Liquidity – Total cash (mrq) is 1.71B; current ratio is 6.91; total debt is 56M, indicating low leverage.

- Cash Generation – Operating cash flow (ttm) is 652M and levered free cash flow (ttm) is 616.75M, providing funding capacity for R&D and launches.

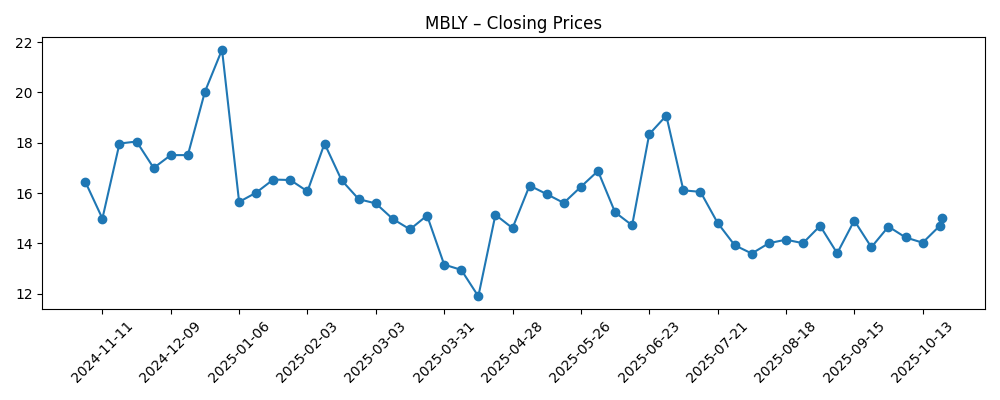

- Share price & trading – Last weekly close on 2025-10-21: 15.02; 52‑week range 11.58–22.51; 50‑day MA 14.31; 200‑day MA 15.44; beta (5Y) 0.51.

- Analyst view – Brokerages’ consensus rating is “Hold,” reflecting balanced expectations (ETF Daily News).

- Share structure & short interest – Shares outstanding 216.01M vs implied shares outstanding 841.04M; short interest 29.78M (16.14% of float) as of 2025-09-30.

- Sales/Backlog – Backlog details and order book metrics not disclosed in the provided snapshot.

- Market cap – Data not disclosed in the provided snapshot.

- Qualitative – Positioned as a key ADAS supplier to global automakers; product mix, tariffs, and FX can influence margins and pricing power.

Share price evolution – last 12 months

Notable headlines

- Mobileye Global Inc. (NASDAQ:MBLY) Receives Consensus Rating of “Hold” from Brokerages [ETF Daily News]

- PFG Investments LLC Sells 8,290 Shares of Mobileye Global Inc. $MBLY [ETF Daily News]

- Mobileye Stock Sees High Volatility Amid Market Shifts [WSJ]

- Mobileye's New Technology Wins Major Automotive Contract [Reuters]

- Mobileye Reports Robust Q3 Earnings Exceeding Projections [Bloomberg]

- Mobileye to Expand R&D Efforts to Accelerate Innovation [Financial Times]

Opinion

The figures point to a business balancing scale and investment. Top line growth re‑accelerated on a year‑over‑year basis, while GAAP margins remain deeply negative. The coexistence of sizable losses and positive operating and free cash flow suggests non‑cash items and working capital dynamics are meaningful to the reported line. Liquidity is ample and leverage is minimal, giving the company flexibility to absorb program timing swings and to continue funding software and silicon roadmaps. The share price has been choppy, but the 52‑week range indicates investors are already discounting execution risk while leaving room for upside if margin quality improves.

Sustainability hinges on the mix and cadence of design wins converting into volume shipments. Backlog data are not disclosed here, so investors must triangulate using contract announcements and production trends at OEMs. A recent contract win and a consensus “Hold” stance point to expectations that are neither euphoric nor distressed. The near‑term swing factors are gross margin trajectory as higher‑content ADAS systems scale, and whether operating expense growth stays aligned with revenue. Consistency across two to three quarters would likely matter more than a single print, given recent volatility.

Within autos, safety content is becoming standard even as broader car demand runs hot‑and‑cold and tariffs complicate sourcing and pricing. ADAS penetration tends to rise with new model launches and regulatory nudges, but price competition among Tier‑1 suppliers and chip platforms can compress margins. For Mobileye, the strategic question is whether its stack can command premium average selling prices versus alternatives while maintaining broad OEM compatibility. A lean balance sheet provides staying power, yet competitive announcements or regulatory shifts can quickly change adoption curves.

These dynamics feed into the valuation narrative. A path toward improving operating margins and sustained cash generation could support multiple expansion as execution risk recedes. Conversely, an extended period of price pressure or slower take‑rates could anchor the multiple near current levels despite revenue growth. Share structure and short interest introduce additional technicals: the gap between implied and basic shares highlights potential supply overhang, and a meaningful short base can amplify moves around news flow. In short, fundamentals must do the work to reshape the story.

What could happen in three years? (horizon October 2025+3)

| Scenario | Narrative |

|---|---|

| Best | Design wins convert smoothly into high‑content ADAS shipments across multiple OEMs and regions. Software features deepen monetization, operating discipline lifts margins, and positive free cash flow remains durable. Consistent delivery reduces perceived risk, attracts broader institutional ownership, and the stock rerates as the story shifts from cyclical supplier to software‑enabled safety platform. |

| Base | ADAS penetration rises steadily with new model cycles, but pricing remains competitive and regional demand is uneven. Revenue grows, gross margins inch higher with scale, and operating losses narrow as opex growth moderates. The market maintains a balanced view, awaiting proof of multi‑quarter consistency before materially changing the valuation framework. |

| Worse | Auto production stays choppy, take‑rates on advanced features lag expectations, and competitive pressure from alternative stacks erodes pricing. Mix shifts and tariffs weigh on margins, cash is used to sustain R&D, and investor focus turns to balance‑sheet durability and potential share overhang. The equity narrative centers on preservation and optionality rather than growth. |

Projected scenarios are based on current trends and may vary based on market conditions.

Factors most likely to influence the share price

- Conversion of announced design wins into production volume and associated gross margin trajectory.

- Automaker production levels, ADAS take‑rates, and regulatory mandates affecting safety features.

- Competitive developments from alternative ADAS/autonomy suppliers and chip platforms impacting pricing power.

- Operating expense discipline versus revenue growth, affecting path toward improved operating margins.

- Tariffs, FX, and supply‑chain costs that could alter unit economics by region.

- Share supply dynamics and short interest changes relative to news flow and liquidity conditions.

Conclusion

Mobileye enters the next three years with a mixed scorecard: revenue growth has resumed, cash generation and liquidity are strong, but GAAP profitability is still a drag on sentiment. The investment debate turns on execution—turning design wins into sustained shipments at improving unit economics—against a backdrop of uneven auto production and active competition for ADAS sockets. A consensus “Hold” view reflects that balance: the upside case requires visible margin progress and steady cash generation; the downside centers on pricing pressure and program timing risk. Watch next 1–2 quarters: backlog conversion signals (via contract and launch updates); gross margin trajectory as higher‑content systems scale; operating expense discipline; cash flow consistency; and any shifts in short interest or share supply. If the company strings together consistent quarters, the narrative can pivot from volatility to delivery; if not, the stock may continue to trade on headlines and macro auto swings.

This article is not investment advice. Investing in stocks carries risks and you should conduct your own research before making any financial decisions.