PDD Holdings enters the next three years with a powerful mix of scale, profitability, and cash reserves, offset by guidance caution and competitive intensity. The company reports trailing-12-month revenue of 409.62B and a profit margin of 23.91%, supported by an operating margin of 24.80%. Cash of 387.13B versus 10.96B total debt and a 2.36 current ratio provide ample flexibility for marketing, logistics, and quality initiatives, such as Temu’s recent partnership with FITI. Shares are up 27.17% over 52 weeks, with a recent close near 120 and a 50-day average of 112.07. Headlines show Q2 beats alongside management’s tempered expectations and a recent analyst downgrade, underscoring a balanced risk-reward. With a five-year beta of 0.41 and no dividend, PDD’s appeal rests on sustained Temu growth, disciplined investment, and the durability of mid‑20s margins amid regulatory and competitive pressures.

Key Points as of August 2025

- Revenue: TTM revenue of 409.62B; quarterly revenue growth (yoy) at 7.10%.

- Profit/Margins: Profit margin 23.91%; operating margin 24.80%; TTM net income 97.92B.

- Sales/Backlog: Q2 results beat headlines, but management tempered expectations; quarterly earnings growth (yoy) -3.90%.

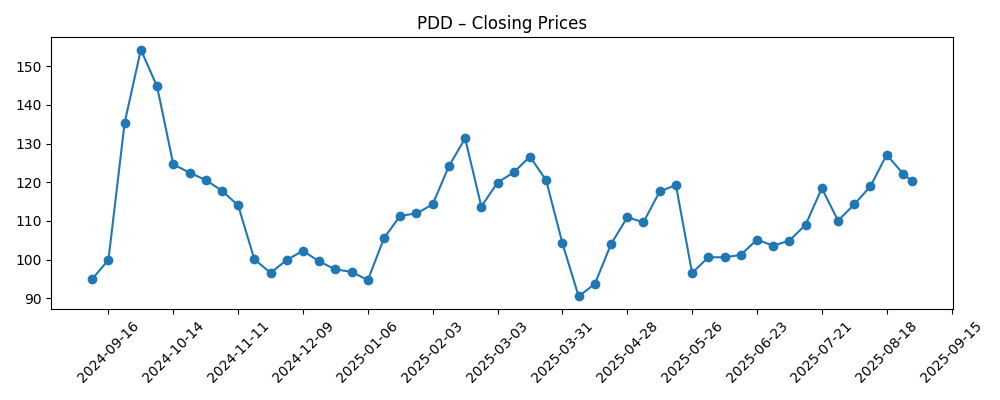

- Share price: Last weekly close 120.22 (Aug 29); 52-week range 87.11–155.67; 50-day MA 112.07; 200-day MA 109.55; beta 0.41.

- Analyst view: Mixed signals – recent downgrade amid strong prints; investor debate centered on sustainability of growth and subsidies.

- Market cap: Approx. $170B based on ~1.42B shares and a recent ~$120 share price.

- Balance sheet: Total cash 387.13B vs total debt 10.96B; current ratio 2.36; debt/equity 3.03%.

- Ownership & short interest: Institutions hold 31.76%; short interest 23.54M (1.66% of shares outstanding; short ratio 3.53).

- Capital returns: No dividend; payout ratio 0.00%.

Share price evolution – last 12 months

Notable headlines

- PDD Holdings soars as Q2 earnings smash expectations

- Temu-owner PDD tops quarterly revenue estimates

- PDD Beats In Q2 Earnings As Management Tempers Expectations

- AMD upgraded, PDD downgraded: Wall Street's top analyst calls

- PDD’s Temu Partners with FITI to Improve Product Quality

- PDD Holdings Inc. (PDD): A Bull Case Theory

Opinion

PDD’s latest quarter highlighted the duality defining its next stretch: an upside surprise on revenue yet cautious commentary about the runway. With TTM revenue at 409.62B and margins in the mid‑20s, the business has shown it can scale efficiently. Still, the dip in quarterly earnings growth (yoy) to -3.90% suggests reinvestment is sizable or mix is shifting toward lower-margin categories and subsidies to fuel Temu’s global reach. Management’s tempered tone, echoed in press coverage, implies a deliberate effort to balance growth and profitability as competitive responses intensify. The FITI partnership indicates a push to reinforce product quality, which could mitigate regulatory and reputational risk — critical for sustaining customer acquisition efficiency over time.

Shares have been volatile year-to-date, dipping to 90.50 in April before rebounding toward 127.11 in August and settling near 120. Technicals are constructive — the 50-day (112.07) above the 200-day (109.55) — but headlines are driving sentiment as much as fundamentals. A recent analyst downgrade counterbalances the “Q2 beat” narrative, focusing attention on sustainability rather than one-off upside. With a five-year beta of 0.41, PDD’s stock has shown relatively muted correlation to broader swings, yet China-sensitive risk remains idiosyncratic. If marketing ROI normalizes and logistics efficiencies hold, margins could stay resilient even as the company prioritizes growth, but the market may demand consistent execution to rerate the shares meaningfully above prior highs.

Balance-sheet strength is a distinguishing asset. Cash of 387.13B versus 10.96B of debt and a 2.36 current ratio gives PDD wide latitude to invest in cross-border logistics, merchant support, and compliance. That cushion also allows tactical pricing to defend share without compromising long-term ROI. However, ample cash can tempt overreach; the key is targeting initiatives that reinforce user trust and retention. The FITI tie-up is a constructive signal, but quality assurance requires ongoing investment and vendor discipline. Meanwhile, short interest remains modest (1.66% of shares outstanding), suggesting no crowded bearish stance; still, a flatlining earnings trajectory could embolden skeptics if growth decelerates further or if subsidy intensity rises.

Over a three-year horizon, we see three forces shaping outcomes: the durability of Temu’s customer acquisition funnel, the pace of regulatory adaptation across markets, and management’s willingness to trade growth for margin (or vice versa). Positive catalysts include continuous product-quality upgrades, improving unit economics, and further operational leverage from scale. Risks include tightening compliance regimes and more aggressive competition in discount e-commerce. With no dividend and significant liquidity (average 3-month volume 7.39M), PDD remains a growth-and-execution story. If the company sustains mid‑20s operating margins while maintaining at least mid-single-digit revenue growth, multiple expansion is plausible; if revenue momentum slows and earnings contract, the stock may reset toward longer-term averages.

What could happen in three years? (horizon August 2025+3)

| Scenario | Business setup | Share-price implication |

|---|---|---|

| Best | Temu sustains broad user growth with improved quality/compliance; marketing efficiency holds; margins stay in the mid‑20s with operating leverage. | Outperforms the market as investors reward durable growth and profitability; potential rerating toward premium e-commerce multiples. |

| Base | Growth moderates to steady levels; management balances promotions with profitability; quality initiatives reduce risk but add cost. | Tracks the market with periods of volatility; valuation stabilizes around historical ranges pending clearer long-term signals. |

| Worse | Competitive pressure and regulation raise costs; subsidies increase; earnings growth remains negative for multiple quarters. | Underperforms, with potential multiple compression until profitability trends re-accelerate or spending is recalibrated. |

Projected scenarios are based on current trends and may vary based on market conditions.

Factors most likely to influence the share price

- Regulatory scrutiny and compliance requirements in major markets, including cross-border trade and product quality enforcement.

- Competitive intensity in discount e-commerce and marketplace subsidies that affect take rates and margins.

- Marketing efficiency and logistics costs that drive unit economics and operating leverage.

- Macroeconomic conditions in China and key export markets impacting consumer demand and FX.

- Management guidance cadence and headline risk from earnings beats/misses or analyst rating changes.

Conclusion

PDD combines scale, cash, and mid‑20s margins with a headline cycle that swings between beats and caution. The company’s TTM revenue of 409.62B and strong balance sheet (387.13B cash vs 10.96B debt) provide room to invest in growth and compliance while absorbing volatility. The 7.10% revenue growth (yoy) alongside negative earnings growth (yoy) of -3.90% highlights a trade-off that will likely define the next three years: protecting share and user growth without eroding profitability. Quality initiatives like the FITI partnership address an important risk vector, and a five-year beta of 0.41 suggests less market sensitivity than many peers. If management can sustain operating discipline and demonstrate improving unit economics, the stock could outperform; if subsidy levels rise or regulation tightens materially, multiple compression is a risk. On balance, we see a credible path to compounding, but execution consistency will matter most.

This article is not investment advice. Investing in stocks carries risks and you should conduct your own research before making any financial decisions.