Samsung Electronics (005930.KS) enters late‑2025 with improving, but uneven, fundamentals. Trailing‑12‑month revenue stands at 308.59T with net income of 30.32T, implying a 9.83% profit margin and a 6.27% operating margin. Liquidity and balance‑sheet strength remain clear positives: cash of 100.73T versus 14.03T of debt and a 2.51 current ratio. The share price has rebounded toward the top of its 52‑week range, closing the week of August 29 at 69,700, compared with a 49,900–75,000 band and a 50‑day/200‑day moving average of 66,320/58,300.5. Yet growth is modest, with quarterly revenue up 0.70% year over year and quarterly earnings down 48.80%. With a forward dividend of 1,456 (2.09% yield) and beta of 0.75, investors face a classic mix: defensive cash generation, a cyclical memory upswing, and execution tests in foundry and devices.

Key Points as of August 2025

- Revenue and earnings: ttm revenue 308.59T; net income 30.32T; EBITDA 71.25T; profit margin 9.83%; operating margin 6.27%.

- Sales trajectory: quarterly revenue growth (yoy) 0.70% while quarterly earnings growth (yoy) is -48.80%.

- Share price: last weekly close 69,700; 52‑week range 49,900–75,000; 50‑day MA 66,320; 200‑day MA 58,300.5; beta 0.75.

- Dividend: forward annual dividend 1,456 (2.09% yield); payout ratio 32.46%; last ex‑dividend date 6/27/2025.

- Balance sheet: total cash 100.73T vs total debt 14.03T; current ratio 2.51.

- Cash generation: operating cash flow (ttm) 78.16T; levered free cash flow (ttm) 17.25T.

- Market cap (approx.): ~412.6T at 69,700 share price and 5.92B shares outstanding.

- Analyst focus: memory upcycle vs. SK hynix share gains; execution in advanced foundry nodes and device innovation (e.g., foldables/tri‑fold).

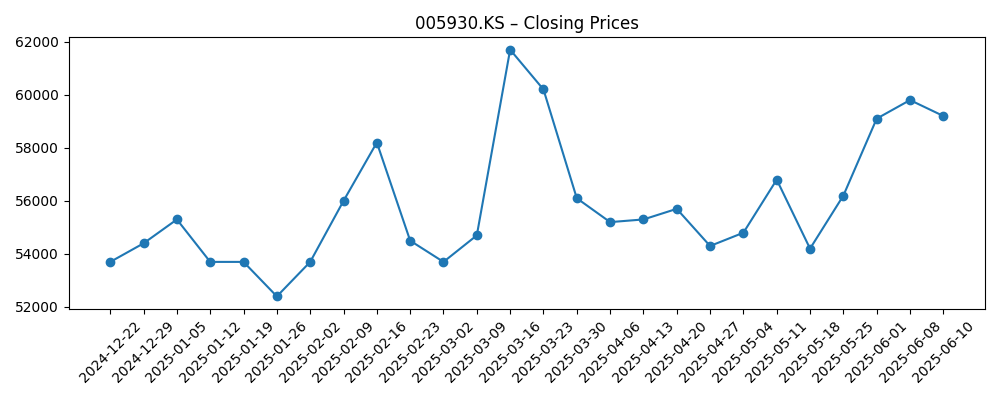

Share price evolution – last 12 months

Notable headlines

- SK hynix dethrones Samsung as top DRAM maker for first time in 30 years (Joins.com)

- Samsung acknowledges its upcoming tri‑fold phone on earnings call (CNET)

- Microsoft's Copilot AI debuts on Samsung's 2025 TVs and monitors (Windows Central)

- Around 12,000 Samsung Galaxy Z Fold 7 and Z Flip 7 swiped in London heist (Android Central)

- This Samsung manufacturing base has produced over 2 billion Galaxy phones (SamMobile)

- Samsung Galaxy S26 to gain new feature, report claims (Forbes)

Opinion

The headline that SK hynix briefly toppled Samsung in DRAM market share matters beyond bragging rights. Memory drives Samsung’s profitability cycles, and share slippage during an upswing can compress operating leverage. The company still brings scale, technology depth, and capital capacity, but the bar has risen: consistent high‑bandwidth memory supply, rapid node transitions, and disciplined capex are crucial to re‑assert leadership. Investors should watch whether gross profit (112.15T ttm) reconnects with rising revenue through better mix and pricing. If DRAM pricing tightens and Samsung regains bit share, the current 9.83% profit margin could normalize higher; if not, earnings sensitivity remains. The next few quarters will likely set the tone for a three‑year path, with memory execution the most material earnings swing factor.

On mobile devices, Samsung’s confirmation of an “upcoming” tri‑fold signals a push to defend/extend its premium leadership in foldables. Product novelty by itself is not a thesis, but it can lift average selling prices and brand heat if durability, weight, and app experiences meet expectations. The reported London theft of around 12,000 premium foldables is unlikely to be financially material for a group of this scale, but it highlights logistical risk and channel security. More importantly, rumors around the Galaxy S26 and a maturing foldable lineup suggest Samsung will lean on devices to showcase on‑device AI, further tying hardware upgrades to the AI cycle that is benefiting the broader semiconductor complex.

The TV and display franchise offers a quieter, but useful, pillar. Microsoft Copilot’s integration into 2025 Samsung TVs and monitors extends AI assistants from phones and PCs to living‑room screens. This can increase engagement and upsell higher‑margin SKUs without requiring heavy subsidies. While TVs are not the primary profit engine, software tie‑ins can steady earnings and improve ecosystem stickiness, complementing mobile and home appliances. If Samsung can cross‑sell services and leverage its installed base—including facilities that have produced billions of Galaxy devices—the contribution may show up in steadier operating cash flow (78.16T ttm) and reduced volatility across cycles.

The share price backdrop is constructive but not euphoric. From late‑2024 softness, the stock based in the low‑to‑mid‑50,000s, rallied through June–July, printed a recent high near 71,800 in early August, and settled at 69,700 by month‑end. It now trades above the 50‑day (66,320) and 200‑day (58,300.5) moving averages, with a 52‑week change of -6.33% despite the rebound. A 2.09% forward yield and a 32.46% payout ratio provide some downside cushion while leaving room for capex and R&D. Over a three‑year horizon, we think share performance will hinge on three levers: DRAM/HBM execution, advanced‑node foundry wins, and whether Samsung can turn device innovation (foldables/tri‑fold, AI features) into sustained margin lift.

What could happen in three years? (horizon August 2025+3)

| Scenario | Three‑year outlook |

|---|---|

| Best | Memory upcycle persists and Samsung regains share in high‑bandwidth products; foundry stabilizes yields at advanced nodes and secures marquee AI/edge wins; foldables and AI‑centric Galaxy models expand premium mix; operating margins trend higher and cash generation comfortably funds both capex and dividends, supporting sustained outperformance. |

| Base | Memory pricing normalizes after a cyclical rebound; share is stable; foundry progress is steady but second‑place to the leader; mobile growth is incremental with periodic flagships; margins improve modestly versus ttm while the dividend stays intact; total returns track broader Asian tech indices. |

| Worse | Competitive pressure from SK hynix in DRAM and from leading foundries at advanced nodes weighs on pricing and utilization; device innovation fails to lift mix; geopolitical or export controls disrupt demand; margins stall and free cash flow tightens, limiting buybacks/dividend growth; shares lag peers. |

Projected scenarios are based on current trends and may vary based on market conditions.

Factors most likely to influence the share price

- DRAM/HBM pricing and Samsung’s ability to regain/defend bit share against SK hynix.

- Foundry execution at advanced nodes (yield, customer wins) and utilization levels.

- Adoption of AI‑centric devices (foldables, on‑device AI features) and premium mix in Galaxy.

- Export controls, supply‑chain security, and geopolitical developments affecting semiconductor demand.

- FX and macro sensitivity of consumer electronics demand, particularly in key end markets.

Conclusion

Samsung’s investment case into 2028 centers on converting formidable assets—scale across memory, foundry, and devices; strong cash and low leverage—into consistent earnings power. The numbers today show resilience but not escape velocity: modest revenue growth, pressure on earnings, and improving technicals with the stock above its moving averages. Headlines underscore the stakes: a resurgent SK hynix in DRAM, a tri‑fold that could stretch the premium handset line, and AI experiences moving onto TVs. If memory execution improves and foundry narrows the gap at advanced nodes, operating leverage could lift margins and support both capex and dividends. If not, cash discipline and a 2.09% yield offer partial ballast. With beta at 0.75 and a diversified portfolio, the shares can serve as a core Asia tech holding, but three‑year upside will be decided by memory share and AI device monetization.

This article is not investment advice. Investing in stocks carries risks and you should conduct your own research before making any financial decisions.