As of August 2025, Suncor Energy Inc. (SU.TO) finds itself in a fluctuating market characterized by recent analyst upgrades, a diverse performance in share price, and ongoing scrutiny over its operational efficiency. The company's latest fiscal figures reflect a modest growth trajectory in earnings, though revenue growth is under pressure. Investors remain cautiously optimistic due to Suncor's strategic positioning in the energy sector and its commitment to dividends, which continues to attract institutional interest. Amidst a backdrop of fluctuating oil prices, Suncor's stock performance will hinge on its ability to navigate operational challenges and capitalize on market opportunities in the coming years.

Key Points as of August 2025

- Revenue: C$50.63B

- Profit Margin: 12.04%

- Sales/Backlog: Quarterly Revenue Growth (yoy): -0.50%

- Share Price: Recent average of C$53.86

- Analyst View: Moderate Buy

- Market Cap: C$66.1B

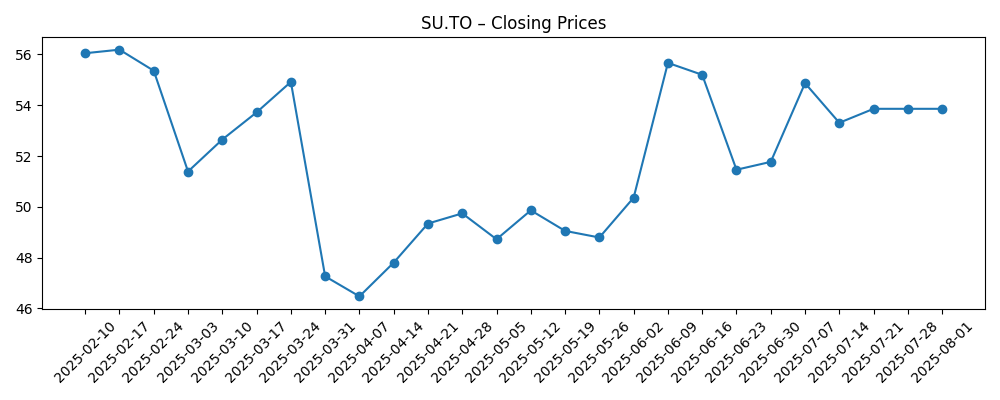

Share price evolution – last 6 months

Notable headlines

- Scotiabank Raises PT on Suncor Energy (SU) to C$60 From C$57, Keeps Sector Perform Rating

- Suncor Energy Inc. (NYSE:SU) Receives $67.00 Consensus PT from Analysts

- Suncor Energy Inc. (TSE:SU) Receives Average Recommendation of “Moderate Buy” from Analysts

Opinion

Recent analyst revisions signal a cautious optimism for Suncor Energy as the company's stock price fluctuates within a tight range. The average share price has remained relatively stable around C$53.86, showcasing resilience amid external market pressures. Analysts are optimistic about the potential for Suncor to leverage its diversified operations in a recovering economic climate. However, the challenges of lowering production costs and enhancing operational efficiency remain paramount. The consensus target price increase by Scotiabank suggests expected performance improvement, further encouraging investor interest.

Moreover, Suncor's commitment to maintaining a competitive dividend yield remains a cornerstone of its investment strategy, effectively appealing to income-focused investors. The dividend payout ratio of approximately 46% indicates a sustainable approach to returning value to shareholders, even amidst volatility in crude oil prices. This strategy not only solidifies investor confidence but also positions Suncor favorably against competitors aiming for similar market shares.

Considering the complexities surrounding global energy demand, Suncor Energy's ability to adapt and innovate in its operational practices will be crucial. The oil and gas industry faces increasing environmental scrutiny, and Suncor’s roadmap towards sustainable practices could enhance its long-term valuation. Strategic shifts towards renewables, if integrated effectively, could also provide a hedge against potential shifts in market demand.

In summary, while short-term challenges persist, the outlook for Suncor Energy appears cautiously optimistic. Its operational adjustments, solid dividend policies, and analyst support could pave the way for gradual recovery. However, ongoing monitoring of operational efficiency will be essential to ensure it capitalizes on potential market opportunities.

What could happen in three years? (horizon August 2025+3)

| Scenario | Outcome |

|---|---|

| Best | Stock price rises to C$70.00 as oil prices stabilize and operational efficiency improves. |

| Base | Stock price remains around C$60.00, driven by steady demand and efficient operations. |

| Worse | Stock price falls to C$45.00 due to external market pressures and underperformance in operational metrics. |

Projected scenarios are based on current trends and may vary based on market conditions.

Factors most likely to influence the share price

- Fluctuations in global oil prices

- Operational efficiency and cost management strategies

- Changes in regulatory policies affecting the energy sector

- Shifts towards renewable energy and sustainability initiatives

Conclusion

In conclusion, Suncor Energy Inc. presents a complex investment landscape as of August 2025. The recent analyst upgrades and a stable dividend strategy position Suncor favorably within the energy market; however, challenges pertaining to revenue growth and operational efficiency need addressing. The company’s ability to adapt to changing energy demands, particularly in a climate increasingly focused on sustainability, will likely dictate its future performance. Investors should keep an eye on market conditions and operational metrics as these factors will influence stock performance in the coming years. With cautious optimism, Suncor could navigate its challenges while capitalizing on new opportunities in a shifting energy landscape.

This article is not investment advice. Investing in stocks carries risks and you should conduct your own research before making any financial decisions.