With shares of Tencent (0700.HK) up roughly 61% over the past 12 months and trading near HK$598.5, investors are asking what can drive the next leg higher. As of September 2025, Tencent combines mid‑teens top‑line momentum (ttm revenue 704.16B; quarterly revenue growth 14.5% y/y) with strong margins (operating 32.58%, net 29.54%) and ample cash generation (OCF 283.33B; LFCF 120.25B). Near‑term catalysts include improving gaming trends, a recovering ads business, and steady fintech engagement, while medium‑term upside hinges on AI infrastructure and overseas expansion. Key watch‑items are China’s regulatory cadence, GPU supply constraints—where Tencent signals flexibility—and the pace of shareholder returns via dividends and buybacks. This three‑year outlook weighs these drivers against risks, anchoring on recent results and the stock’s 52‑week range of 364.8–621.0.

Key Points as of September 2025

- Revenue – TTM revenue 704.16B; quarterly revenue growth 14.5% y/y; gross profit 385.04B; EBITDA 245.76B.

- Profit/Margins – Operating margin 32.58%; profit margin 29.54%; net income (ttm) 208B; diluted EPS 24.320.

- Sales/Backlog – Gaming momentum evident: Q2 gaming revenue up 17% y/y; overseas revenue up 35% y/y (per Reuters); ads and fintech steady.

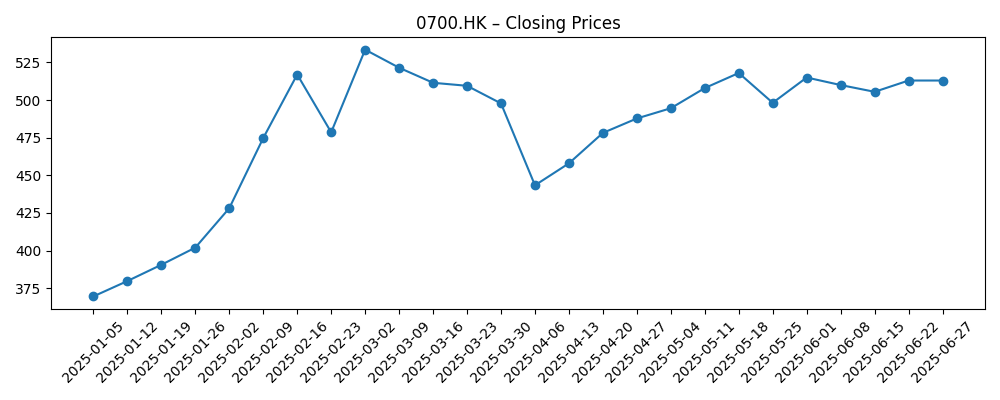

- Share price – Recent close ~598.5; 52‑week range 364.8–621.0; +61.08% over 12 months; beta 0.54; 50‑DMA 548.902 vs 200‑DMA 481.648.

- Balance sheet – Cash 380.44B; debt 412.49B; debt/equity 34.29%; current ratio 1.25.

- Cash returns – OCF 283.33B; levered FCF 120.25B; forward dividend rate 4.5 (0.75% yield); payout ratio 18.60%; ex‑div 5/16/2025.

- Market cap – Implied ≈HKD 5.43T (598.5 × 9.08B shares outstanding).

- Analyst view – Investor focus on sustained growth, margin discipline, capital returns, and regulatory visibility.

- Ownership – Insiders 31.73%; institutions 24.12%; float 6.26B.

Share price evolution – last 12 months

Notable headlines

- Tencent reports Q2 revenue up 15% YoY to ~$25.7B; gaming +17% YoY; global revenue +35% YoY; net profit ~$7.7B (Reuters via Techmeme)

- Tencent doesn’t care if it can buy American GPUs again (The Register)

- Abxylute will actually sell Intel and Tencent’s gigantic glasses‑free 3D handheld (The Verge)

Opinion

Tencent’s latest reported quarter showed broad‑based growth, with revenue and gaming outperformance against expectations. That, combined with improving macro sentiment around Chinese internet platforms, has underpinned a strong rerating over the last six months as the stock climbed from the low‑400s to just under 600. In our view, the mix is constructive: games provide high‑margin cash flow; ads benefit from product upgrades and AI targeting; and fintech offers steady engagement. The balance sheet and cash generation give Tencent optionality to invest in infrastructure and content while funding dividends and buybacks. Over a three‑year horizon, sustaining mid‑teens growth would likely require continued hit content, better overseas traction, and incremental monetization of AI across ads, cloud, and tools. Set against this, investors should watch for normalization after a strong run and sensitivity to macro news flow.

On AI infrastructure, management signaling that it “doesn’t care” about regaining access to U.S. GPUs suggests confidence in domestic or alternative accelerators and in optimizing software stacks. If that holds, Tencent could expand AI capabilities without the same capex bottlenecks faced by some peers, supporting both advertising relevance and developer services. The practical yardsticks will be model quality in production, latency and cost curves, and whether AI features lift time‑spent or ad pricing. A credible, cost‑effective AI stack would also strengthen Tencent Cloud’s enterprise pitch in regulated industries. Conversely, if non‑U.S. silicon underperforms at scale, the company might face performance gaps that cap product differentiation, creating medium‑term execution risk even with strong near‑term financials.

The handheld collaboration highlighted by The Verge is best seen as an ecosystem probe rather than a material P&L driver. Still, it signals Tencent’s ongoing push to influence hardware‑software interfaces, which could matter for distribution, payments, and cloud gaming hooks. If such experiments seed new content formats or leverage glasses‑free 3D to refresh user engagement, Tencent might extend the life of key franchises and open sponsorship or commerce inventory. However, hardware is competitive and cyclical; success likely depends on partnerships and developer adoption rather than unit economics alone. Over three years, we would treat these efforts as optionality rather than core valuation drivers, with the bigger levers remaining software IP, ad technology, and fintech services rooted in WeChat’s scale.

Technically, the share price sits above its 50‑ and 200‑day moving averages, reflecting improved sentiment and execution. The 52‑week range of 364.8–621.0 frames upside‑downside asymmetry tied to policy, macro, and earnings delivery. If earnings growth stays ahead of revenue growth—via operating leverage and mix—multiples can hold even as the stock consolidates. Capital returns help: a 0.75% forward yield and a sub‑20% payout leave room for increases if cash flows remain robust. Over three years, we see the path driven by: the cadence of hit games and overseas scaling; AI‑enabled ad monetization; prudent cloud investment; and transparent capital allocation. Disappointments on any of these could bring volatility, but the lower beta and stronger balance sheet versus many peers provide some cushion during market stress.

What could happen in three years? (horizon September 2028)

| Scenario | Growth and mix | Margins and cash | Capital returns and valuation |

|---|---|---|---|

| Best | Sustains growth momentum similar to recent trends, with multiple hit games, improving overseas mix and AI‑boosted ads/cloud. | Margins stable to higher vs current levels; strong OCF supports continued investment and rising FCF. | Higher dividends/buybacks; market awards a quality premium as visibility and regulatory clarity improve. |

| Base | Moderate growth with steady domestic engagement and selective overseas wins; AI features enhance monetization gradually. | Margins broadly steady; cash generation remains robust, funding organic capex and shareholder returns. | Valuation tracks earnings; total return driven by EPS compounding and incremental payouts. |

| Worse | Macro or policy headwinds slow growth; content pipeline underwhelms; AI impact limited by compute or ecosystem constraints. | Margins compress on mix and investment needs; cash flow covers core spend but limits flexibility. | Multiple de‑rates; returns rely on defensive balance sheet and cost control rather than growth. |

Projected scenarios are based on current trends and may vary based on market conditions.

Factors most likely to influence the share price

- Regulatory cadence in China affecting games approvals, fintech, data, and advertising products.

- Content pipeline quality and cadence of hit titles, plus overseas scaling and competition.

- AI infrastructure access and efficiency (GPU supply, local accelerators) and monetization across ads/cloud.

- China macro conditions influencing ad budgets, consumer spending, and SME activity.

- Capital allocation (buybacks/dividends) and visibility on reinvestment versus returns.

- Competitive dynamics from super‑app ecosystems and short‑video platforms impacting time‑spent and ad share.

Conclusion

Tencent enters the next three years with improving growth, solid profitability, and meaningful cash generation. The stock’s recovery reflects better execution and sentiment, but sustaining performance will require a steady cadence of compelling game releases, ongoing ad product upgrades, and disciplined expansion abroad. Management’s pragmatism around AI compute suggests a path to innovation without overreliance on any single supplier, which could support monetization across ads and cloud. Meanwhile, the balance sheet and cash flows provide capacity for both reinvestment and rising shareholder returns, with today’s payout ratio leaving headroom. Risks remain centered on policy, macro, and competition for user attention, any of which could temper multiples after a strong run. On balance, the base case is for earnings compounding to drive total returns, with upside if AI and overseas initiatives surprise positively and downside if regulatory or macro shocks slow execution.

This article is not investment advice. Investing in stocks carries risks and you should conduct your own research before making any financial decisions.