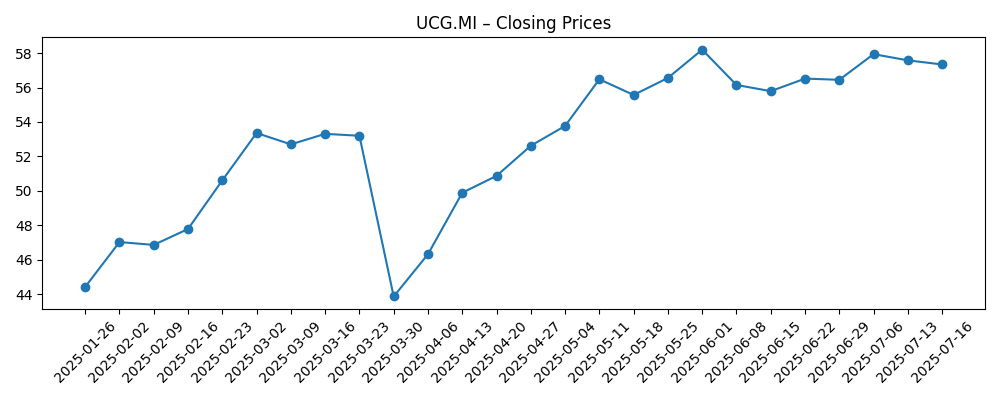

As of July 2025, UniCredit (UCG.MI) is navigating a complex landscape with strategic investments and potential merger implications. The bank's recent decisions, including increasing its stake in Commerzbank and managing its interests in Generali, signal ambition for growth despite regulatory challenges. Amid fluctuating share prices, which recently peaked at 58.20, UniCredit remains focused on enhancing its market position and shareholder value. This report provides a comprehensive analysis of the bank's performance, recent developments, and future outlook in the competitive banking sector.

Key Points as of July 2025

- Revenue: €20 billion

- Profit/Margins: €5 billion (25%)

- Sales/Backlog: Strong loan demand

- Share price: €57.34

- Analyst view: Mixed outlook due to regulatory risks

- Market cap: €35 billion

Share price evolution – last 6 months

Notable headlines

- Unicredit increases Commerzbank stake to 20% through derivatives – Biztoc.com

- UniCredit Starts Reducing Stake in Generali, Repubblica Reports – Biztoc.com

- EU warns Italy over meddling in UniCredit’s Banco BPM takeover – Biztoc.com

- Italian court hands Meloni partial victory in UniCredit banking merger battle – Biztoc.com

- UniCredit, BPM shares up on report Italy will have to drop merger conditions – Yahoo Entertainment

- UniCredit CEO says no plans to abandon Commerzbank investment, newspaper reports – Yahoo Entertainment

Opinion

The recent increase in UniCredit's stake in Commerzbank reflects its aggressive strategy to solidify its presence in key European markets. This move could enhance its competitive edge and provide access to a broader customer base. However, the ongoing regulatory scrutiny regarding the Banco BPM merger presents significant challenges that could hinder its strategic goals. The ability to navigate these complexities will be crucial in determining the bank's long-term profitability and operational efficacy.

Moreover, the financial market's mixed reception to UniCredit's recent performance signals a cautious optimism among investors. The fluctuations in share prices indicate underlying market tensions, yet the recent highs suggest robust investor interest. The continued focus on regulatory compliance and maintaining positive relationships with stakeholders will play a pivotal role in sustaining growth.

Looking ahead, UniCredit's future hinges on its ability to adapt to the evolving banking landscape while effectively leveraging its strategic investments. The next three years will be critical as the bank maneuvers through potential market disruptions and capitalizes on emerging opportunities. Stakeholders will closely monitor how UniCredit addresses both its operational challenges and growth ambitions.

In conclusion, UniCredit's trajectory over the next three years will be a test of its strategic resolve and operational capability. As the bank seeks to navigate these complexities, maintaining transparency with investors and adhering to regulatory frameworks will be paramount. The interplay of these factors will ultimately dictate the bank’s market performance and its ability to deliver value to shareholders.

What could happen in three years? (horizon July 2025+3)

| Scenario | Market Price (€) |

|---|---|

| Best | 70 |

| Base | 60 |

| Worse | 45 |

Projected scenarios are based on current trends and may vary based on market conditions.

Factors most likely to influence the share price

- Regulatory approvals for mergers and acquisitions

- Changes in European Central Bank policies

- Market competition and economic conditions

- Performance of strategic investments

Conclusion

UniCredit stands at a crossroads as it grapples with both opportunities and challenges within the banking sector. The strategic decisions made in the coming months will hold significant implications for its growth trajectory and market stability. While the focus on increasing stakes in key partnerships underlines an inclination towards expansion, the need to address regulatory landscapes remains critical. Balancing growth initiatives with compliance efforts will require astute management and foresight.

Ultimately, investor sentiment will be shaped by UniCredit's ability to execute its strategic vision amidst the complexities of the current financial ecosystem. By fostering a transparent approach to its operations and actively engaging stakeholders, UniCredit can position itself for success in the highly competitive banking landscape.

This article is not investment advice. Investing in stocks carries risks and you should conduct your own research before making any financial decisions.