Volkswagen AG’s preferred shares (VOW3.DE) sit near 99.02 as of

Key Points as of September 2025

- Revenue: 324.22B (ttm) with revenue per share of 646.77; quarterly revenue growth (YoY) at -3.00%.

- Profit/Margins: Profit margin 2.79%; operating margin 4.75%; gross profit 52.94B; EBITDA 26.63B; diluted EPS 16.76; quarterly earnings growth (YoY) -27.90%.

- Balance sheet/liquidity: Total cash 58.46B; total debt 255.92B; debt/equity 129.24%; current ratio 1.09.

- Cash generation: Operating cash flow 15.98B; levered free cash flow -86.36B.

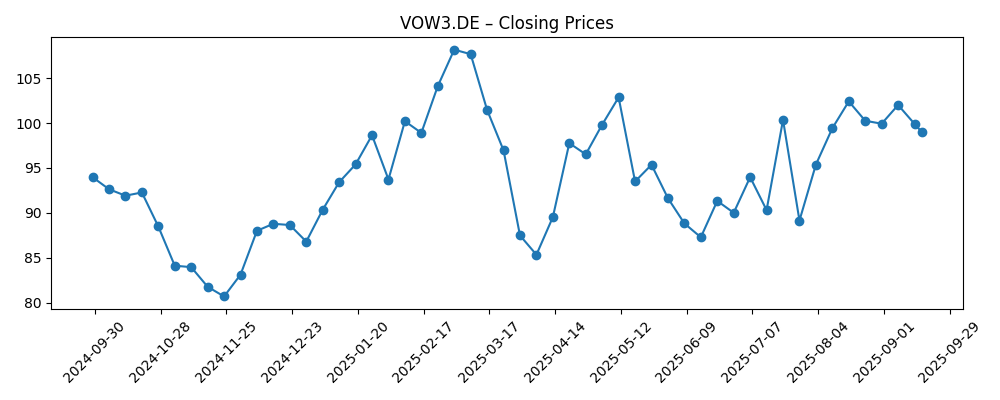

- Share price: ~99.02; 52‑week range 78.86–114.20; 50‑day MA 96.82; 200‑day MA 95.19; beta 1.04.

- Dividend: Forward rate 6.36 (yield 6.37%); payout ratio 37.95%; ex‑dividend date 5/19/2025.

- Ownership/trading: Shares outstanding 206.2M; implied shares outstanding 505.43M; float 234.68M; avg volume (3m) 950.03k; avg volume (10d) 797.7k.

- Analyst view: Not provided in this dataset; investor focus likely on margin trajectory, EV execution and capital discipline.

Share price evolution – last 12 months

Notable headlines

Opinion

The valuation debate around Volkswagen often starts with income support versus execution risk. A 6.37% forward yield and a sub‑beta profile offer defensive appeal, particularly after a year in which the shares rose 9.48% but trailed broader equities. Yet the payout sits atop thin reported profitability (2.79% profit margin, 4.75% operating margin) and negative levered free cash flow, signaling that near‑term cash returns depend on disciplined capital allocation and stabilizing operations. Over the next three years, investors will likely reward credible roadmaps that tighten cost structures, simplify model complexity, and prioritize margin‑accretive trims. If management sustains the dividend while improving earnings quality, the stock could re‑rate toward its historical ranges without requiring outsized top‑line growth.

The comparison with European peers, highlighted by recent investor coverage juxtaposing Volkswagen and Renault, frames the core question: can legacy scale translate into competitive EV profitability? Volkswagen’s breadth across brands and regions provides volume leverage, but it also adds organizational complexity at a time when speed matters. Quarterly revenue contraction (-3.0% YoY) and a sharp decline in quarterly earnings growth (-27.9% YoY) hint at pricing pressure and product‑mix normalization. A credible cadence of EV launches, disciplined incentives, and cost take‑outs in procurement and manufacturing could rebuild operating margin headroom. Conversely, delays in software or platform rollouts would likely cap valuation even if unit volumes stabilize.

Balance sheet optics are a second fulcrum. With 58.46B in cash against 255.92B in total debt and a current ratio of 1.09, liquidity appears adequate but not ample if macro demand weakens. Operating cash flow of 15.98B shows the franchise still generates cash, yet negative levered free cash flow underscores the importance of pacing capex and working capital. Over the outlook period, investors may prioritize self‑funded investments, targeted disposals, or partnership structures that reduce cash burn while preserving strategic options. Any signs of improving cash conversion, even without major revenue acceleration, could support a multiple reset.

Finally, share‑price behavior provides context for expectations. The stock has oscillated within a 78.86–114.20 band across 52 weeks, with 50‑ and 200‑day averages clustering near the current price, suggesting the market awaits clearer direction. If execution milestones accumulate—stable margins through mix management, improved software reliability, and measured EV growth—the shares could grind higher, aided by the dividend. If pricing pressure intensifies or execution stumbles, the yield may not fully offset drawdowns. Against this backdrop, a patient, risk‑aware stance seems appropriate, with an eye on quarterly margin trajectory and cash‑flow inflections as the primary signals.

What could happen in three years? (horizon September 2025+3)

| Scenario | Implication by September 2028 |

|---|---|

| Best | Cost reductions and platform simplification lift margins; EV programs hit scale with steady pricing; software reliability improves, reducing warranty/recall costs; dividend is sustained and perceived as safer, supporting a valuation re‑rating. |

| Base | Mixed EV adoption and selective price competition; incremental efficiency gains offset input costs; margins stabilize around recent levels; dividend remains intact; shares track fundamentals with range‑bound returns and modest volatility. |

| Worse | Persistent pricing pressure, execution delays in software/EV launches, and weaker macro demand constrain margins; cash conversion disappoints, forcing tougher capital‑allocation choices; dividend credibility comes into question, weighing on valuation. |

Projected scenarios are based on current trends and may vary based on market conditions.

Factors most likely to influence the share price

- Margin trajectory versus guidance (manufacturing efficiency, mix, incentives) and progress from current 2.79% profit and 4.75% operating margins.

- Cash‑flow discipline (capex pacing, working‑capital management) relative to 15.98B operating cash flow and negative levered free cash flow.

- EV and software execution milestones that affect pricing power, warranty costs, and launch cadence.

- Regional demand and competition dynamics, especially Europe and China, impacting volumes and pricing.

- Capital allocation and shareholder returns (dividend sustainability at a 6.37% yield and any portfolio actions).

Conclusion

Volkswagen enters the next three years balancing income appeal with execution risk. The dividend yield of 6.37% provides near‑term support, but thin reported margins and negative levered free cash flow underscore the need for consistent delivery on cost, product, and software targets. Revenue has softened (-3.0% YoY in the latest quarter) and earnings are under pressure, yet scale, brand breadth, and operational levers remain meaningful. If management can stabilize margins, improve cash conversion, and pace investments with clearer returns, the shares could shift from range‑bound trading toward a gradual re‑rating. Should pricing pressure or program delays persist, the stock may continue to lag broader indices despite its income profile. For investors, monitoring quarterly margin progression and cash‑flow inflections is paramount; those signals will likely dictate whether today’s valuation and yield translate into stronger total returns by 2028.

This article is not investment advice. Investing in stocks carries risks and you should conduct your own research before making any financial decisions.