XPeng’s investment narrative has pivoted from survival to scale in the past year: the stock has climbed 88.61% while quarterly revenue growth accelerated to 125.30% year over year. The change reflects improving product mix, expanding international distribution, and renewed investor interest in Chinese EV makers with credible export strategies. Two recent developments stand out: a manufacturing collaboration with Magna in Austria that could reduce capital intensity and speed European localization, and announcements of entry into additional EU markets that broaden demand optionality. At the same time, XPeng remains loss‑making, so the core question is whether rapid top‑line growth can translate into sustainable margins as price competition persists. For sector investors, the setup parallels the broader EV transition: scale and software differentiation are rewarded, while balance-sheet discipline and flexible manufacturing are becoming prerequisites. What matters next is the quality of growth—model mix, after‑sales and software monetization, and geographic execution—because those levers will determine if XPeng can compress losses and re‑rate closer to profitable peers.

Key Points as of October 2025

- Revenue: trailing 12‑month revenue of 60.29B with quarterly revenue growth (yoy) at 125.30%, signaling rapid scale-up.

- Profit/Margins: operating margin (ttm) -5.30% and profit margin -7.10%; diluted EPS (ttm) -0.63—losses persist despite growth.

- Sales/Backlog: backlog data not disclosed; growth appears volume-led. Watch order intake and EU launch pipeline for demand visibility.

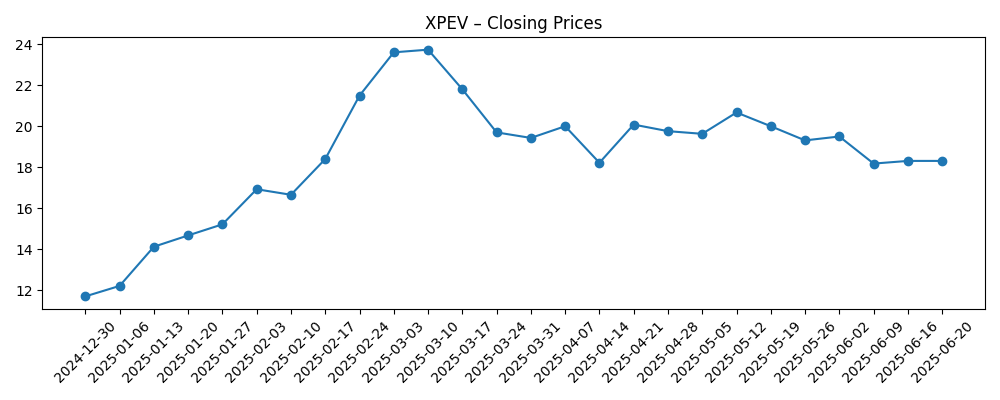

- Share price: ADR last closed near 24.19 (Oct 8), up 88.61% over the past year; 52‑week high 27.16; beta 2.53 implies elevated volatility.

- Analyst view: recent reports cite a 23.85 consensus target; options activity and short interest of 37.26M (down from 41.57M; short ratio 3.56) show active positioning.

- Market cap: data not disclosed in the provided dataset.

- Balance sheet: total cash 34.95B vs total debt 16.95B; current ratio 1.14—liquidity adequate but needs disciplined cash use.

- Competitive position: expansion into five additional EU markets and a Magna production tie‑up in Austria indicate an asset‑lighter European strategy.

- Ownership: institutions hold 14.03%; incremental purchases by public funds reported, but ownership base remains relatively shallow.

Share price evolution – last 12 months

Notable headlines

- XPeng Joins Forces With Magna To Build EVs In Austria

- XPeng (XPEV) continues global expansion, announcing entry into five additional EU markets

- XPeng Inc. Sponsored ADR (NYSE:XPEV) Receives $23.85 Consensus Target Price from Analysts

- Investors Buy Large Volume of Call Options on XPeng (NYSE:XPEV)

- Public Employees Retirement System of Ohio Increases Holdings in XPeng Inc. Sponsored ADR $XPEV

Opinion

XPeng’s reported revenue trajectory looks robust, with quarterly revenue growth outpacing the sector backdrop. Yet margins remain negative: the company’s operating margin (ttm) at -5.30% and profit margin at -7.10% suggest scale benefits are not fully flowing through. Gross profit exists but EBITDA is still negative, pointing to ongoing expense intensity in R&D, sales, and international rollout. The quality of the growth will be key: if gains are driven by price-led volume, the incremental margin will stay thin; if mix shifts toward higher-spec trims and software features, contribution margins can improve. The near-term test is whether XPeng can translate delivery momentum into sequential gross margin expansion while keeping customer acquisition costs in check.

Liquidity provides room to execute. Total cash of 34.95B versus total debt of 16.95B and a current ratio of 1.14 indicate a balanced but not slack balance sheet. The announced production collaboration with Magna in Austria is strategically notable because it offers an avenue to localize and de-risk European capacity without front-loading heavy capital expenditure. That can moderate cash burn versus a greenfield approach. However, sustained losses (EPS at -0.63) underline that execution needs to tighten. Investors should track whether operating leverage appears in the next phases of expansion and if the company can keep working capital needs from swelling as it enters more markets.

Industry dynamics are a double-edged sword. The China EV market remains intensely competitive, with ongoing price promotions compressing margins for many OEMs. XPeng’s expansion into additional EU markets and a local manufacturing partner could diversify revenue and reduce tariff/logistics friction, but it also introduces new regulatory, marketing, and service-network challenges. Differentiation via driver-assist software and connected services may become a more material profit lever abroad, though regulatory scrutiny on autonomous features and data privacy remains a moving target across jurisdictions.

The equity narrative is shifting from domestic share gains to export-led scale. If European execution validates, investors could reward XPeng with a higher multiple for perceived durability of growth and optionality in software monetization. Conversely, high beta (2.53) and visible short interest signal a market quick to reprice on misses. The current consensus target near the trading range implies a “show-me” phase: consistent gross margin improvement, credible localization via Magna, and steady international ramp would support a more constructive stance, while slip-ups could re-anchor the stock to volatility driven by macro and policy headlines.

What could happen in three years? (horizon October 2025+3)

| Scenario | Narrative |

|---|---|

| Best case | European launch milestones hit on time; Magna-enabled localization accelerates time-to-market and stabilizes costs. Mix shifts toward higher-margin trims and software features, driving visible operating leverage. Regulatory environment remains manageable, and XPeng carves out a differentiated brand position, narrowing losses materially and reframing the stock as a durable growth platform. |

| Base case | Growth remains solid but uneven as price competition persists. Europe becomes a meaningful, though still developing, revenue stream; margins improve gradually through scale and cost controls. Cash discipline keeps leverage contained, with the market valuing XPeng as a growth name with improving but not yet fully proven profitability. |

| Worse case | Price wars intensify and EU execution slips due to regulatory or localization setbacks. Mix deteriorates, software monetization lags, and cash burn forces tough trade-offs or financing on unattractive terms. The equity narrative reverts to volume without profits, and volatility remains elevated. |

Projected scenarios are based on current trends and may vary based on market conditions.

Factors most likely to influence the share price

- Execution of EU expansion and the pace/quality of Magna-enabled localization.

- Gross margin trajectory amid ongoing EV price competition in China and Europe.

- Software and driver-assist monetization rates versus hardware-led volume growth.

- Regulatory developments affecting exports, data/privacy rules, and advanced driver-assistance systems.

- Battery/raw material cost trends and supply-chain reliability.

- Financing conditions and any equity or debt actions to fund growth.

Conclusion

XPeng enters the next three years with momentum in top-line growth and a clearer path to geographic diversification, but the investment case hinges on converting scale into sustainable margins. The financials show rapid revenue expansion alongside negative profitability, offset by a liquidity position that can support execution if disciplined. Strategically, the Magna tie-up and EU rollout aim to reduce capital intensity and open higher-priced markets, potentially improving mix and stabilizing unit economics. Sector-wide price pressure and regulatory complexity, however, argue for cautious expectations on the speed of margin recovery. Watch next 1–2 quarters: gross margin progression; order intake and conversion in new EU markets; evidence of software/ADAS revenue contribution; milestones on Magna-enabled localization; working-capital discipline and cash use. Consistency on these fronts would strengthen the narrative from “growth with losses” toward “scalable growth,” while setbacks would likely reintroduce volatility given active derivatives positioning and a still-limited institutional base.

This article is not investment advice. Investing in stocks carries risks and you should conduct your own research before making any financial decisions.