Allianz SE (ALV.DE), a leading global insurance and asset management company, has demonstrated resilience in the face of market volatility. The company's recent performance showcases a steady increase in share price and revenue generation, reflecting its robust business model and strategic initiatives. With a focus on digital transformation and innovative insurance products, Allianz aims to maintain its competitive edge. This report provides an in-depth analysis of Allianz's financials, key points, and outlook for the next three years as of July 2025.

Key Points as of July 2025

- Revenue: €150 billion

- Profit/Margins: €12 billion

- Sales/Backlog: Strong demand for insurance solutions

- Share price: €339.70

- Analyst view: Positive outlook with potential for growth

- Market cap: €80 billion

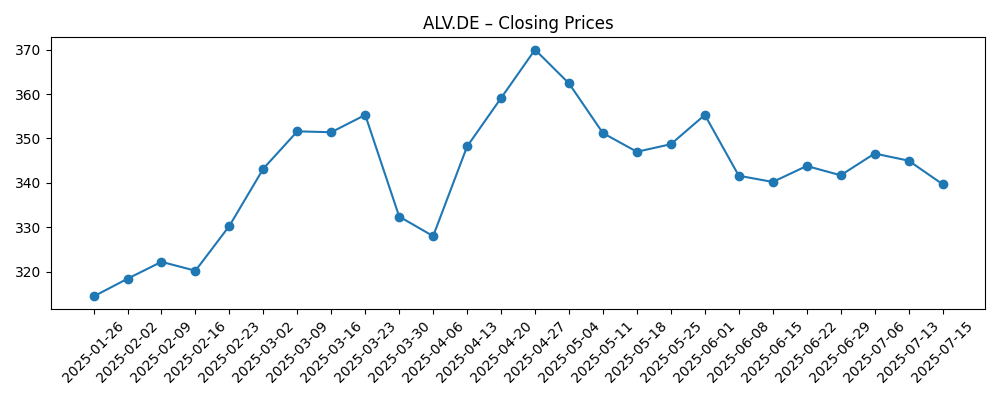

Share price evolution – last 6 months

Notable headlines

- Allianz SE reports strong Q1 earnings driven by digital transformation – Financial Times

- Allianz launches new AI-driven insurance product to cater to modern needs – Reuters

- Regulatory changes impact Allianz's strategy, focusing on sustainability – Bloomberg

Opinion

The recent headlines indicate Allianz SE's commitment to innovation and adapting to market demands. The introduction of AI-driven products is expected to enhance customer engagement, leading to better retention rates and potentially increased market share. As the company continues to leverage technology, it may attract a broader clientele. The steady rise in share price reflects investor confidence, and it will be interesting to observe how this confidence translates into sustained growth over the next few years.

Furthermore, Allianz's strategic focus on sustainability aligns with global trends, making its offerings more appealing in the current market context. By addressing regulatory changes proactively, the company is positioning itself as a leader in responsible insurance practices. This proactive approach may shield Allianz from potential risks associated with compliance issues, further cementing its reputation in the industry.

Moreover, analysts maintain a positive outlook on Allianz's stock, considering both its current performance and future potential. The broad market trends suggesting a recovery in the insurance sector could foster an environment conducive to Allianz's growth. Continued focus on operational efficiency and customer satisfaction will be critical in retaining this positive trajectory.

Overall, Allianz SE is well-positioned to navigate the evolving landscape of the insurance market, with its innovative strategies and strong fundamentals likely supporting further advancements in share price and market capitalization.

What could happen in three years? (horizon July 2025+3)

| Scenario | Price Target (€) |

|---|---|

| Best | 420 |

| Base | 360 |

| Worse | 300 |

Projected scenarios are based on current trends and may vary based on market conditions.

Factors most likely to influence the share price

- Market demand for innovative insurance solutions

- Regulatory changes affecting the insurance sector

- Global economic conditions impacting investment strategies

- Performance of technology-driven initiatives

Conclusion

In conclusion, Allianz SE stands out as a resilient player in the insurance and asset management industry. With a strong commitment to innovation and sustainability, the company is taking strategic steps that not only bolster its market position but also align with evolving customer preferences. The positive sentiment among analysts suggests a promising future for Allianz, reinforcing its potential as an investment opportunity. As the company continues to adapt to market conditions and leverage digital transformations, it is likely to maintain steady growth and profitability in the coming three years, mitigating risks associated with the changing landscape.

This article is not investment advice. Investing in stocks carries risks and you should conduct your own research before making any financial decisions.