ING Groep N.V. (INGA.AS) continues to navigate a complex financial landscape with varying investor sentiment as of May 2025. After a slight decline in net income in the first quarter, the bank demonstrates resilience with a strategic share buyback program and positive developments in customer balances and fee income. As the company embraces growth opportunities, the market closely monitors its stock activity, current share price trends, and analyst sentiment. This report provides insights into key financial metrics and evaluates potential future scenarios for ING Groep over the next three years.

Key Points as of May 2025

- Revenue: Q1 2025 posted €1.45B, down 7.8% YoY

- Profit/Margins: Continued focus on cost control amidst revenue decline

- Sales/Backlog: Growth in customer balances and fee income

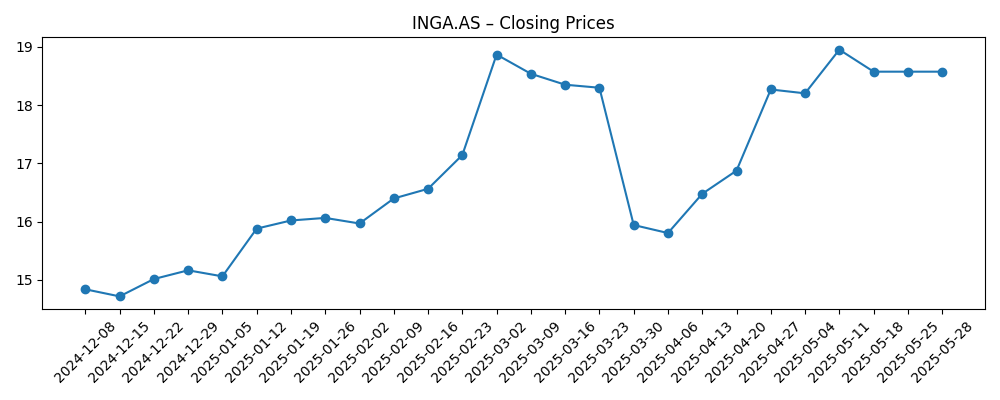

- Share price: Currently trading at €18.58

- Analyst view: Consensus rating of 'Moderate Buy'

- Market cap: Approximately €75 billion

Share price evolution – last 6 months

Notable headlines from the past 6 months:

- ING's Q1 net income down 7.8% to €1.45B – Biztoc.com

- ING completes share buyback and announces new programme of up to €2.0 billion – GlobeNewswire

- Progress on share buyback programme – GlobeNewswire

- Cetera Investment Advisers purchases 10,471 shares of ING Groep – ETF Daily News

- Ameriprise Financial Inc. cuts stake in ING Groep – ETF Daily News

- ING Groep receives consensus rating of 'Moderate Buy' from Brokerages – ETF Daily News

Opinion

The recent decline in net income has raised concerns among investors, particularly as it follows a period of strong growth. However, the share buyback program is a positive indicator of management's confidence in the company's long-term prospects. By allocating resources to repurchase shares, ING signals its commitment to enhancing shareholder value. Furthermore, the significant growth in customer balances and fee income showcases the bank's operational strength and potential for recovery.

Market reactions have been mixed, reflected in the varying trading patterns observed in the share price, which has fluctuated around €18.58. Investor sentiment may largely depend on ING's ability to maintain operational efficiency while navigating external headwinds like interest rate changes and economic fluctuations.

As ING continues to implement its strategic initiatives, such as the recent buyback plan, it is crucial to monitor how these actions translate into tangible financial results. Analysts remain optimistic, noting the moderate buy consensus, suggesting that the stock has the potential for upward movement if the company can stabilize its profitability.

Moving forward, ING's management faces the challenge of restoring growth momentum while addressing investor concerns about profitability. Success in adapting to market dynamics could further bolster confidence in the bank's strategic direction.

What could happen in three years? (horizon May 2028)

| Scenario | Outlook |

|---|---|

| Best | Strong recovery in net income, share price rises above €25 due to robust growth strategies. |

| Base | Moderate growth, net income stabilizes, share price ranges from €20–€25. |

| Worse | Continued pressure on profitability, share price declines below €18. |

*Scenario outcomes are speculative and may vary based on broader market conditions and company performance.

Factors most likely to influence the share price

- Regulatory changes impacting banking operations

- Economic growth in key markets

- Successful execution of strategic initiatives

- Investor sentiment and market trends

Conclusion

In conclusion, ING Groep N.V. finds itself at a pivotal moment, balancing challenges and opportunities within the financial landscape. The recent decline in net income amid efforts to enhance shareholder value through buybacks reflects the complexity of the current environment. While analysts maintain a moderately positive outlook, meticulous execution of strategic initiatives will be vital for restoring investor confidence. Over the next three years, ING must navigate external and internal dynamics to unlock growth potential and stabilize its financial performance. As the company progresses, continuous assessment of market conditions and adaptive strategies will prove crucial for success.

This article is not investment advice. Investing in stocks carries risks and you should conduct your own research before making any financial decisions.