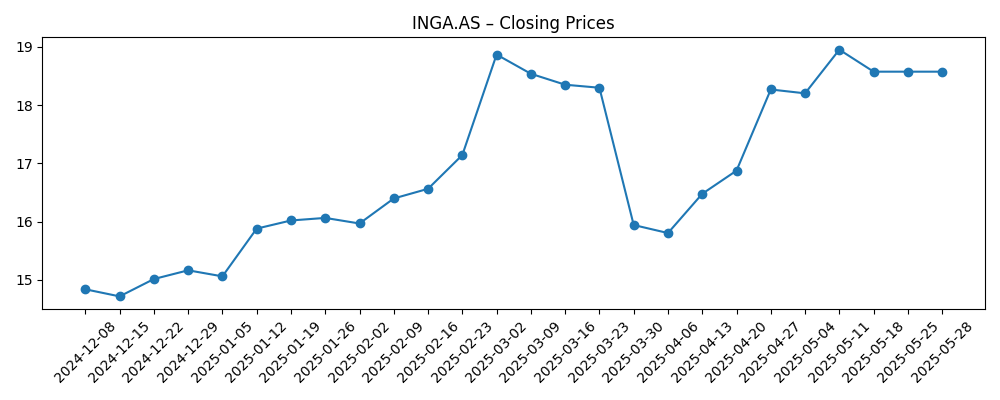

ING Group’s share price has rallied toward its 52‑week high, supported by robust profitability and steady capital returns. As of late August 2025, the stock sits near the top of its 14.24–21.52 range, with a 52‑week change of 33.33% and moving averages trending higher. Fundamentals show revenue (ttm) of 19.59B, profit margin of 24.46% and return on equity of 9.30%, while the forward annual dividend rate is 1.06 (yield 4.97%) with an 8/4/2025 ex‑dividend date. Headlines underscore resilience (EBA stress test), ongoing share buybacks, and a “Moderate Buy” consensus from brokerages, though quarterly revenue and earnings growth are negative year over year. Over a three‑year horizon, dividend durability, the pace of buybacks, and macro‑driven credit trends will likely steer total returns, with capital strength a buffer against volatility.

Key Points as of August 2025

- Revenue (ttm): 19.59B; quarterly revenue growth (yoy): -6.60%.

- Profitability: profit margin 24.46%; operating margin 53.08%; ROE 9.30%; ROA 0.47%.

- Capital & liquidity: total cash 237.14B vs total debt 234.72B; operating cash flow (ttm): -68.64B.

- Share price: last close 21.135; 52‑week range 14.24–21.52; 50‑day MA 19.66; 200‑day MA 17.44; 52‑week change 33.33%.

- Market cap (est.): approximately 62.35B based on 2.95B shares outstanding and a 21.135 price.

- Dividends: forward annual rate 1.06; yield 4.97%; payout ratio 53.27%; 5‑year average yield 5.63; ex‑dividend date 8/4/2025.

- Analyst view: consensus rating “Moderate Buy”; ownership by institutions 49.72%.

- Corporate actions: progress on share buyback programme; EBA stress test confirmed resilient capital position.

- Trading activity: average volume (3M) 7.8M; average volume (10D) 5.7M.

Share price evolution – last 12 months

Notable headlines

- EBA stress test confirms ING’s resilient capital position

- Progress on share buyback programme

- ING Group, N.V. (NYSE:ING) Receives Consensus Rating of “Moderate Buy” from Brokerages

- Citigroup Inc. Reduces Holdings in ING Group, N.V. (NYSE:ING)

- American Century Companies Inc. Buys 35,382 Shares of ING Group, N.V. $ING

- JP Morgan, Commerzbank and ING to Support European Defense Bank

- Transatlantic Financial Leaders Back Creation of New Defence Bank

Opinion

ING Group’s price momentum into late August 2025 reflects improving sentiment toward European banks and company‑specific supports. The stock’s climb toward its 52‑week high of 21.52 and above both its 50‑day and 200‑day moving averages suggests buyers are rewarding visibility on capital returns and resilience. Book value per share of 17.36 provides a reference point for value‑oriented investors assessing downside buffers, while the 52‑week change of 33.33% highlights how quickly sentiment has turned from late‑2024 levels. Still, the most recent quarter shows revenue and earnings headwinds on a year‑over‑year basis, urging selectivity and attention to credit quality. Over a three‑year horizon, sustaining the rally likely hinges on stable net interest income, fee growth, and controlled provisions rather than one‑off factors.

Capital return remains central to the equity story. The forward dividend rate of 1.06, implying a 4.97% yield at current levels, and a payout ratio of 53.27% offer income support, while the disclosed progress on the share buyback programme adds a second lever for total return and per‑share metrics. The early‑August ex‑dividend date underscores a predictable cadence of distributions that many European bank investors prioritize. If buybacks continue alongside a stable dividend, and if management can hold profitability near the current 24.46% margin with ROE around existing levels, investors may accept modest top‑line variability. Conversely, any pause in buybacks or a reset of the distribution framework would likely weigh on the multiple and temper the post‑2024 rerating.

Resilience validated by the EBA stress test matters because it underwrites flexibility during macro shocks. ING’s large cash position (237.14B) versus total debt (234.72B) provides confidence in liquidity management, even as operating cash flow (ttm) is negative, which is not unusual for banks due to balance‑sheet dynamics. Offsetting that, quarterly revenue growth of -6.60% and quarterly earnings growth of -14.50% (yoy) caution that earnings normalization is still in progress. Over the next three years, credit cycle developments, loan demand, and deposit beta dynamics will be pivotal for margins. A benign path could keep the share price near or above the current band’s upper end, while a tougher cycle could push the stock back toward the lower end of its recent range.

Strategically, participation alongside global peers in initiatives such as the prospective European Defence Bank could incrementally expand corporate banking opportunities and fee pools, though execution and regulatory oversight will be key. Flows from institutional investors appear mixed—some reductions (Citigroup) offset by additions (American Century)—while the brokerage “Moderate Buy” consensus points to a cautiously constructive stance. With average trading volumes of 7.8M over three months and 5.7M over ten days, liquidity supports active capital management. Over a three‑year horizon, a combination of resilient capital, predictable dividends, and selective growth in fee businesses could underpin mid‑cycle valuation, provided macro conditions do not erode asset quality. Monitoring updates on buybacks, dividend policy, and stress‑test outcomes remains essential for gauging sustainability.

What could happen in three years? (horizon August 2025+3)

| Scenario | What it looks like by August 2028 |

|---|---|

| Best | Momentum persists and the share price sustains above the recent 52‑week high of 21.52. Revenue trends improve from the current -6.60% yoy patch, while profitability stays close to recent margins. The forward dividend rate of 1.06 is maintained or better, buybacks continue, and ROE trends higher than the present 9.30%. |

| Base | Shares oscillate around medium‑term averages (50‑day 19.66; 200‑day 17.44). Revenue stabilizes, cost discipline protects margins, and the dividend is maintained near the current framework (rate 1.06; yield dependent on price). Buybacks are paced with earnings and regulatory headroom. |

| Worse | A weaker credit cycle drives elevated provisions and slower activity. The stock re‑tests the 52‑week low of 14.24. Management prioritizes balance‑sheet resilience; the dividend framework (1.06 forward rate) is reviewed, and buybacks are deferred until conditions normalize, despite prior stress‑test reassurance. |

Projected scenarios are based on current trends and may vary based on market conditions.

Factors most likely to influence the share price

- Interest‑rate path and deposit pricing dynamics affecting net interest margins.

- Credit quality and provisions through the cycle, especially in corporate and mortgage books.

- Capital return policy execution (dividends and buybacks) versus regulatory constraints.

- Regulatory developments and stress‑test outcomes shaping capital buffers and lending capacity.

- Fee income traction in payments, wealth and corporate banking, including new initiatives (e.g., defence‑related financing).

- Market sentiment toward European banks and flows from institutional investors.

Conclusion

ING Group enters the next three years with supportive technicals and solid—if not flawless—fundamentals. The stock’s move toward its 52‑week high, with a 33.33% gain over the past year and supportive 50‑day and 200‑day averages, signals improving confidence. Profitability metrics (24.46% profit margin, ROE 9.30%) and a forward dividend rate of 1.06 at a 4.97% yield set a constructive baseline for total return, bolstered by buyback progress and a “Moderate Buy” consensus. Counterpoints include negative year‑over‑year revenue and earnings growth and the usual late‑cycle risks to credit, which argue for a measured stance. On balance, capital strength, liquidity (237.14B cash versus 234.72B debt) and disciplined capital returns provide levers to navigate macro volatility. For investors, monitoring dividend continuity, buyback pacing and credit trends will be central to assessing whether current momentum can extend into 2028.

This article is not investment advice. Investing in stocks carries risks and you should conduct your own research before making any financial decisions.